Clean Energy Technology Exclusion Worksheet For Payroll Tax

ADVERTISEMENT

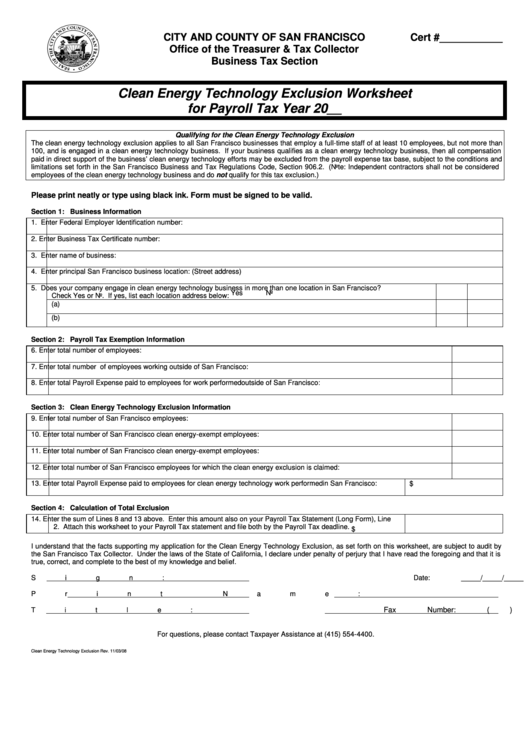

CITY AND COUNTY OF SAN FRANCISCO

Cert #___________

Office of the Treasurer & Tax Collector

Business Tax Section

Clean Energy Technology Exclusion Worksheet

for Payroll Tax Year 20__

Qualifying for the Clean Energy Technology Exclusion

The clean energy technology exclusion applies to all San Francisco businesses that employ a full-time staff of at least 10 employees, but not more than

100, and is engaged in a clean energy technology business. If your business qualifies as a clean energy technology business, then all compensation

paid in direct support of the business’ clean energy technology efforts may be excluded from the payroll expense tax base, subject to the conditions and

limitations set forth in the San Francisco Business and Tax Regulations Code, Section 906.2. (Note: Independent contractors shall not be considered

employees of the clean energy technology business and do not qualify for this tax exclusion.)

Please print neatly or type using black ink. Form must be signed to be valid.

Section 1: Business Information

1.

Enter Federal Employer Identification number:

2.

Enter Business Tax Certificate number:

3.

Enter name of business:

4.

Enter principal San Francisco business location: (Street address)

5.

Does your company engage in clean energy technology business in more than one location in San Francisco?

Yes

No

Check Yes or No. If yes, list each location address below:

(a)

(b)

Section 2: Payroll Tax Exemption Information

6.

Enter total number of employees:

7.

Enter total number of employees working outside of San Francisco:

8.

Enter total Payroll Expense paid to employees for work performed outside of San Francisco:

Section 3: Clean Energy Technology Exclusion Information

9.

Enter total number of San Francisco employees:

10.

Enter total number of San Francisco clean energy-exempt employees:

11.

Enter total number of San Francisco clean energy-exempt employees:

12.

Enter total number of San Francisco employees for which the clean energy exclusion is claimed:

13.

Enter total Payroll Expense paid to employees for clean energy technology work performed in San Francisco:

$

Section 4: Calculation of Total Exclusion

14.

Enter the sum of Lines 8 and 13 above. Enter this amount also on your Payroll Tax Statement (Long Form), Line

2. Attach this worksheet to your Payroll Tax statement and file both by the Payroll Tax deadline.

$

I understand that the facts supporting my application for the Clean Energy Technology Exclusion, as set forth on this worksheet, are subject to audit by

the San Francisco Tax Collector. Under the laws of the State of California, I declare under penalty of perjury that I have read the foregoing and that it is

true, correct, and complete to the best of my knowledge and belief.

Sign:

Date: _____/_____/_____

Print Name:

Contact Number: (

)

Fax Number: (

)

Title:

For questions, please contact Taxpayer Assistance at (415) 554-4400.

Clean Energy Technology Exclusion

Rev. 11/03/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1