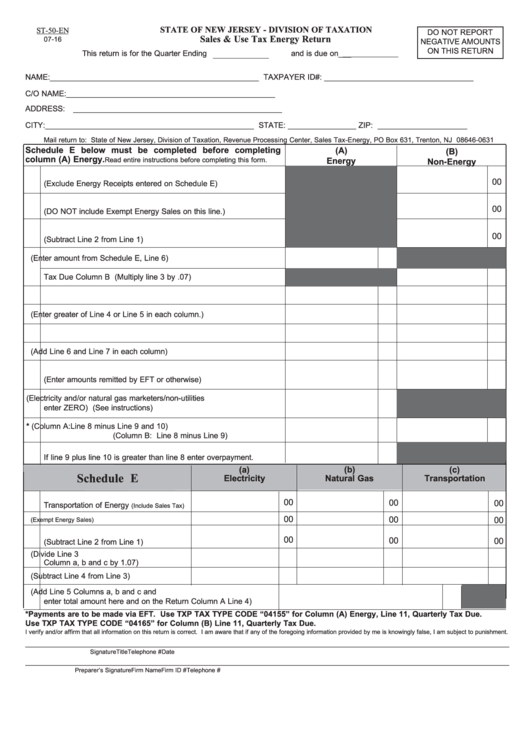

ST-50-EN

STATE OF NEW JERSEY - DIVISION OF TAXATION

DO NOT REPORT

Sales & Use Tax Energy Return

07-16

NEGATIVE AMOUNTS

ON THIS RETURN

This return is for the Quarter Ending

and is due on___

NAME:

_________________________________________________ TAXPAYER ID#: ___________________________________

C/O NAME: _________________________________________________

ADDRESS:

_________________________________________________

CITY:

_________________________________________________ STATE: ________________ ZIP: _____________________

Mail return to: State of New Jersey, Division of Taxation, Revenue Processing Center, Sales Tax-Energy, PO Box 631, Trenton, NJ 08646-0631

Schedule E below must be completed before completing

(A)

(B)

column (A) Energy.

Read entire instructions before completing this form.

Energy

Non-Energy

1. Total Non-Energy Gross Receipts for Quarter

00

(Exclude Energy Receipts entered on Schedule E)

2. Less Deductions

00

(DO NOT include Exempt Energy Sales on this line.)

3. Non-Energy Gross Receipts Subject to Tax

00

(Subtract Line 2 from Line 1)

4. Tax Due Column A (Enter amount from Schedule E, Line 6)

Tax Due Column B (Multiply line 3 by .07)

5. Sales Tax Collected

6. Sales Tax Due (Enter greater of Line 4 or Line 5 in each column.)

7. Use Tax Due

8. Total Tax Due (Add Line 6 and Line 7 in each column)

9. Total Monthly Payments

(Enter amounts remitted by EFT or otherwise)

10. UTUA Credit (Electricity and/or natural gas marketers/non-utilities

enter ZERO) (See instructions)

11. Quarterly Tax Due* (Column A: Line 8 minus Line 9 and 10)

(Column B: Line 8 minus Line 9)

12. Overpayment Credit

If line 9 plus line 10 is greater than line 8 enter overpayment.

(b)

(a)

(c)

Electricity

Natural Gas

Transportation

1. Total Gross Receipts for Sales and

00

00

00

Transportation of Energy

(Include Sales Tax)

00

2. Less Deductions

00

00

(Exempt Energy Sales)

3. Energy Gross Receipts Subject to Tax

00

00

00

(Subtract Line 2 from Line 1)

4. Adjusted Gross Receipts (Divide Line 3

Column a, b and c by 1.07)

5. Tax Due (Subtract Line 4 from Line 3)

6. Total Combined Tax Due (Add Line 5 Columns a, b and c and

enter total amount here and on the Return Column A Line 4)

*Payments are to be made via EFT. Use TXP TAX TYPE CODE “04155” for Column (A) Energy, Line 11, Quarterly Tax Due.

Use TXP TAX TYPE CODE “04165” for Column (B) Line 11, Quarterly Tax Due.

I verify and/or affirm that all information on this return is correct. I am aware that if any of the foregoing information provided by me is knowingly false, I am subject to punishment.

______________________________________________________________________________________________________________________________________________

Signature

Title

Telephone #

Date

______________________________________________________________________________________________________________________________________________

Preparer’s Signature

Firm Name

Firm ID #

Telephone #

1

1 2

2