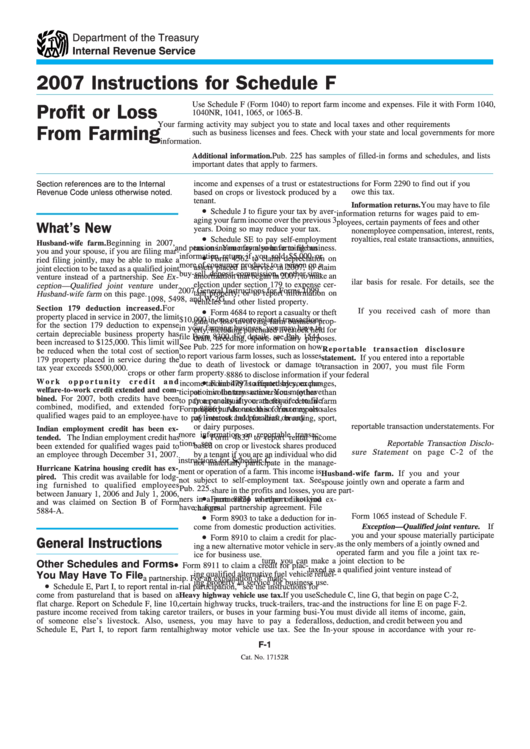

Instructions For Schedule F - Profit Or Loss From Farming- 2007

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

2007 Instructions for Schedule F

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040,

Profit or Loss

1040NR, 1041, 1065, or 1065-B.

Your farming activity may subject you to state and local taxes and other requirements

From Farming

such as business licenses and fees. Check with your state and local governments for more

information.

Pub. 225 has samples of filled-in forms and schedules, and lists

Additional information.

important dates that apply to farmers.

income and expenses of a trust or estate

structions for Form 2290 to find out if you

Section references are to the Internal

based on crops or livestock produced by a

owe this tax.

Revenue Code unless otherwise noted.

tenant.

Information returns.

You may have to file

•

Schedule J to figure your tax by aver-

information returns for wages paid to em-

aging your farm income over the previous 3

ployees, certain payments of fees and other

What’s New

years. Doing so may reduce your tax.

nonemployee compensation, interest, rents,

•

royalties, real estate transactions, annuities,

Schedule SE to pay self-employment

Beginning in 2007,

Husband-wife farm.

tax on income from your farming business.

and pensions. You may also have to file an

you and your spouse, if you are filing mar-

•

information return if you sold $5,000 or

Form 4562 to claim depreciation on

ried filing jointly, may be able to make a

more of consumer products to a person on a

assets placed in service in 2007, to claim

joint election to be taxed as a qualified joint

buy-sell, deposit-commission, or other sim-

amortization that began in 2007, to make an

venture instead of a partnership. See Ex-

ilar basis for resale. For details, see the

election under section 179 to expense cer-

ception — Qualified joint venture under

2007 General Instructions for Forms 1099,

tain property, or to report information on

Husband-wife farm on this page.

1098, 5498, and W-2G.

vehicles and other listed property.

Section 179 deduction increased.

For

•

If you received cash of more than

Form 4684 to report a casualty or theft

property placed in service in 2007, the limit

$10,000 in one or more related transactions

gain or loss involving farm business prop-

for the section 179 deduction to expense

in your farming business, you may have to

erty, including purchased livestock held for

certain depreciable business property has

file Form 8300. For details, see Pub. 1544.

draft, breeding, sport, or dairy purposes.

been increased to $125,000. This limit will

See Pub. 225 for more information on how

Reportable transaction disclosure

be reduced when the total cost of section

to report various farm losses, such as losses

statement.

If you entered into a reportable

179 property placed in service during the

due to death of livestock or damage to

transaction in 2007, you must file Form

tax year exceeds $500,000.

crops or other farm property.

8886 to disclose information if your federal

•

W o r k

o p p o r t u n i t y

c r e d i t

a n d

Form 4797 to report sales, exchanges,

income tax liability is affected by your par-

welfare-to-work credit extended and com-

or involuntary conversions (other than

ticipation in the transaction. You may have

bined.

For 2007, both credits have been

to pay a penalty if you are required to file

from a casualty or theft) of certain farm

combined, modified, and extended for

Form 8886 but do not do so. You may also

property. Also use this form to report sales

qualified wages paid to an employee.

of livestock held for draft, breeding, sport,

have to pay interest and penalties on any

reportable transaction understatements. For

or dairy purposes.

Indian employment credit has been ex-

•

more information on reportable transac-

The Indian employment credit has

Form 4835 to report rental income

tended.

tions, see Reportable Transaction Disclo-

based on crop or livestock shares produced

been extended for qualified wages paid to

sure Statement on page C-2 of the

by a tenant if you are an individual who did

an employee through December 31, 2007.

instructions for Schedule C.

not materially participate in the manage-

Hurricane Katrina housing credit has ex-

ment or operation of a farm. This income is

If you and your

Husband-wife farm.

pired.

This credit was available for lodg-

not subject to self-employment tax. See

spouse jointly own and operate a farm and

ing furnished to qualified employees

Pub. 225.

share in the profits and losses, you are part-

between January 1, 2006 and July 1, 2006,

•

ners in a partnership whether or not you

Form 8824 to report like-kind ex-

and was claimed on Section B of Form

changes.

have a formal partnership agreement. File

5884-A.

•

Form 1065 instead of Schedule F.

Form 8903 to take a deduction for in-

Exception — Qualified joint venture. If

come from domestic production activities.

•

you and your spouse materially participate

Form 8910 to claim a credit for plac-

General Instructions

as the only members of a jointly owned and

ing a new alternative motor vehicle in serv-

operated farm and you file a joint tax re-

ice for business use.

turn, you can make a joint election to be

•

Other Schedules and Forms

Form 8911 to claim a credit for plac-

taxed as a qualified joint venture instead of

You May Have To File

ing qualified alternative fuel vehicle refuel-

a partnership. For an explanation of “mate-

ing property in service for business use.

•

Schedule E, Part I, to report rental in-

rial participation,” see the instructions for

come from pastureland that is based on a

Heavy highway vehicle use tax.

If you use

Schedule C, line G, that begin on page C-2,

flat charge. Report on Schedule F, line 10,

certain highway trucks, truck-trailers, trac-

and the instructions for line E on page F-2.

pasture income received from taking care

tor trailers, or buses in your farming busi-

You must divide all items of income, gain,

of someone else’s livestock. Also, use

ness, you may have to pay a federal

loss, deduction, and credit between you and

Schedule E, Part I, to report farm rental

highway motor vehicle use tax. See the In-

your spouse in accordance with your re-

F-1

Cat. No. 17152R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7