Instructions For Schedule F - Profit Or Loss From Farming - 2004

ADVERTISEMENT

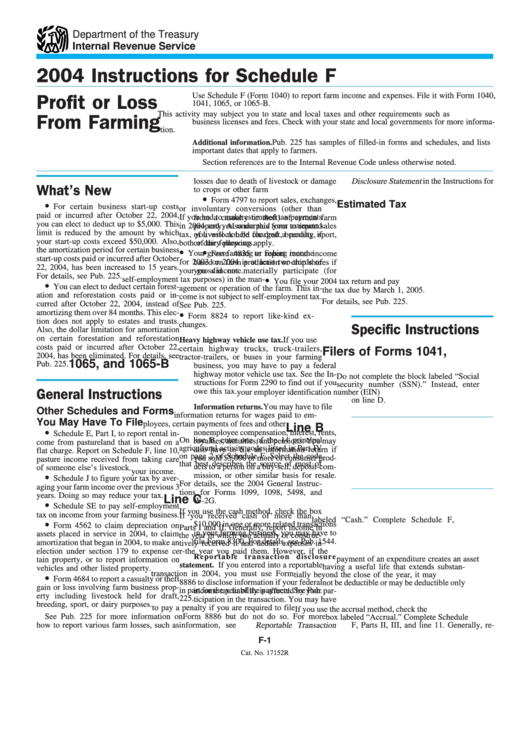

Department of the Treasury

Internal Revenue Service

2004 Instructions for Schedule F

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040,

Profit or Loss

1041, 1065, or 1065-B.

This activity may subject you to state and local taxes and other requirements such as

From Farming

business licenses and fees. Check with your state and local governments for more informa-

tion.

Additional information.

Pub. 225 has samples of filled-in forms and schedules, and lists

important dates that apply to farmers.

Section references are to the Internal Revenue Code unless otherwise noted.

losses due to death of livestock or damage

Disclosure Statement in the Instructions for

What’s New

to crops or other farm property.

Schedule C on page C-1.

•

Form 4797 to report sales, exchanges,

•

Estimated Tax

For certain business start-up costs

or involuntary conversions (other than

paid or incurred after October 22, 2004,

from a casualty or theft) of certain farm

If you had to make estimated tax payments

you can elect to deduct up to $5,000. This

in 2004 and you underpaid your estimated

property. Also use this form to report sales

limit is reduced by the amount by which

of livestock held for draft, breeding, sport,

tax, you will not be charged a penalty if

your start-up costs exceed $50,000. Also,

or dairy purposes.

both of the following apply.

•

•

the amortization period for certain business

Your gross farming or fishing income

Form 4835 to report rental income

start-up costs paid or incurred after October

for 2003 or 2004 is at least two-thirds of

based on farm production or crop shares if

22, 2004, has been increased to 15 years.

you did not materially participate (for

your gross income.

For details, see Pub. 225.

•

self-employment tax purposes) in the man-

You file your 2004 tax return and pay

•

You can elect to deduct certain forest-

agement or operation of the farm. This in-

the tax due by March 1, 2005.

ation and reforestation costs paid or in-

come is not subject to self-employment tax.

For details, see Pub. 225.

curred after October 22, 2004, instead of

See Pub. 225.

•

amortizing them over 84 months. This elec-

Form 8824 to report like-kind ex-

tion does not apply to estates and trusts.

changes.

Specific Instructions

Also, the dollar limitation for amortization

on certain forestation and reforestation

If you use

Heavy highway vehicle use tax.

costs paid or incurred after October 22,

certain highway trucks, truck-trailers,

Filers of Forms 1041,

2004, has been eliminated. For details, see

tractor-trailers, or buses in your farming

1065, and 1065-B

Pub. 225.

business, you may have to pay a federal

highway motor vehicle use tax. See the In-

Do not complete the block labeled “Social

structions for Form 2290 to find out if you

security number (SSN).” Instead, enter

owe this tax.

General Instructions

your employer identification number (EIN)

on line D.

Information returns.

You may have to file

Other Schedules and Forms

information returns for wages paid to em-

You May Have To File

ployees, certain payments of fees and other

Line B

•

nonemployee compensation, interest, rents,

Schedule E, Part I, to report rental in-

On line B, enter one of the 14 principal

royalties, annuities, and pensions. You may

come from pastureland that is based on a

agricultural activity codes listed in Part IV

also have to file an information return if

flat charge. Report on Schedule F, line 10,

on page 2 of Schedule F. Select the code

you sold $5,000 or more of consumer prod-

pasture income received from taking care

that best describes the source of most of

ucts to a person on a buy-sell, deposit-com-

of someone else’s livestock.

your income.

•

mission, or other similar basis for resale.

Schedule J to figure your tax by aver-

For details, see the 2004 General Instruc-

aging your farm income over the previous 3

tions for Forms 1099, 1098, 5498, and

years. Doing so may reduce your tax.

Line C

W-2G.

•

Schedule SE to pay self-employment

If you use the cash method, check the box

tax on income from your farming business.

If you received cash of more than

labeled “Cash.” Complete Schedule F,

•

$10,000 in one or more related transactions

Form 4562 to claim depreciation on

Parts I and II. Generally, report income in

in your farming business, you may have to

assets placed in service in 2004, to claim

the year in which you actually or construc-

file Form 8300. For details, see Pub. 1544.

amortization that began in 2004, to make an

tively received it and deduct expenses in

election under section 179 to expense cer-

the year you paid them. However, if the

Reportable transaction disclosure

payment of an expenditure creates an asset

tain property, or to report information on

If you entered into a reportable

statement.

having a useful life that extends substan-

vehicles and other listed property.

transaction in 2004, you must use Form

•

tially beyond the close of the year, it may

Form 4684 to report a casualty or theft

8886 to disclose information if your federal

not be deductible or may be deductible only

gain or loss involving farm business prop-

in part for the year of the payment. See Pub.

income tax liability is affected by your par-

erty including livestock held for draft,

225.

ticipation in the transaction. You may have

breeding, sport, or dairy purposes.

to pay a penalty if you are required to file

If you use the accrual method, check the

See Pub. 225 for more information on

Form 8886 but do not do so. For more

box labeled “Accrual.” Complete Schedule

how to report various farm losses, such as

information, see Reportable Transaction

F, Parts II, III, and line 11. Generally, re-

F-1

Cat. No. 17152R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6