Reset Form

Print Form

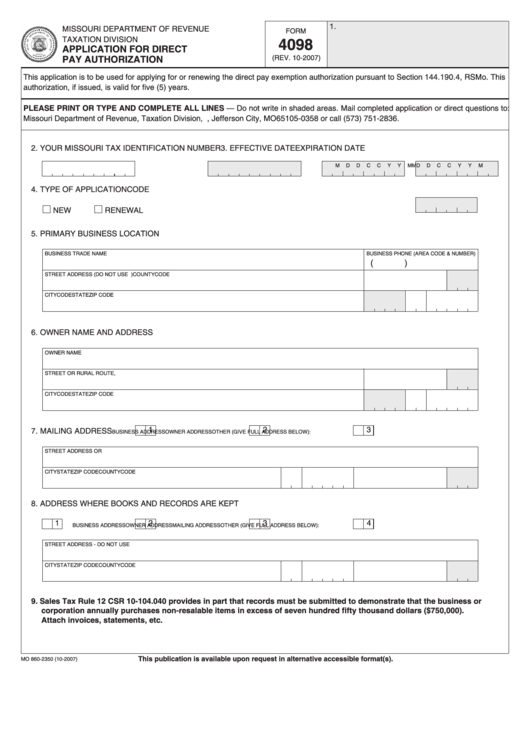

1.

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

4098

APPLICATION FOR DIRECT

(REV. 10-2007)

PAY AUTHORIZATION

This application is to be used for applying for or renewing the direct pay exemption authorization pursuant to Section 144.190.4, RSMo. This

authorization, if issued, is valid for five (5) years.

PLEASE PRINT OR TYPE AND COMPLETE ALL LINES — Do not write in shaded areas. Mail completed application or direct questions to:

Missouri Department of Revenue, Taxation Division, P.O. Box 358, Jefferson City, MO 65105-0358 or call (573) 751-2836.

2. YOUR MISSOURI TAX IDENTIFICATION NUMBER

3. EFFECTIVE DATE

EXPIRATION DATE

M

M

D

D

C

C

Y

Y

M

M

D

D

C

C

Y

Y

4. TYPE OF APPLICATION

CODE

NEW

RENEWAL

5. PRIMARY BUSINESS LOCATION

BUSINESS TRADE NAME

BUSINESS PHONE (AREA CODE & NUMBER)

(

)

STREET ADDRESS (DO NOT USE P.O. BOX OR RURAL ROUTE)

COUNTY

CODE

CITY

CODE

STATE ZIP CODE

6. OWNER NAME AND ADDRESS

OWNER NAME

STREET OR RURAL ROUTE, P.O. BOX NUMBER

COUNTY

CODE

CITY

CODE

STATE ZIP CODE

1

2

3

7. MAILING ADDRESS

BUSINESS ADDRESS

OWNER ADDRESS

OTHER (GIVE FULL ADDRESS BELOW):

STREET ADDRESS OR P.O. BOX

CITY

STATE ZIP CODE

COUNTY

CODE

8. ADDRESS WHERE BOOKS AND RECORDS ARE KEPT

1

2

3

4

BUSINESS ADDRESS

OWNER ADDRESS

MAILING ADDRESS

OTHER (GIVE FULL ADDRESS BELOW):

STREET ADDRESS - DO NOT USE P.O. BOX OR RURAL ROUTE

CITY

STATE ZIP CODE

COUNTY

CODE

9. Sales Tax Rule 12 CSR 10-104.040 provides in part that records must be submitted to demonstrate that the business or

corporation annually purchases non-resalable items in excess of seven hundred fifty thousand dollars ($750,000).

Attach invoices, statements, etc.

This publication is available upon request in alternative accessible format(s).

MO 860-2350 (10-2007)

1

1 2

2