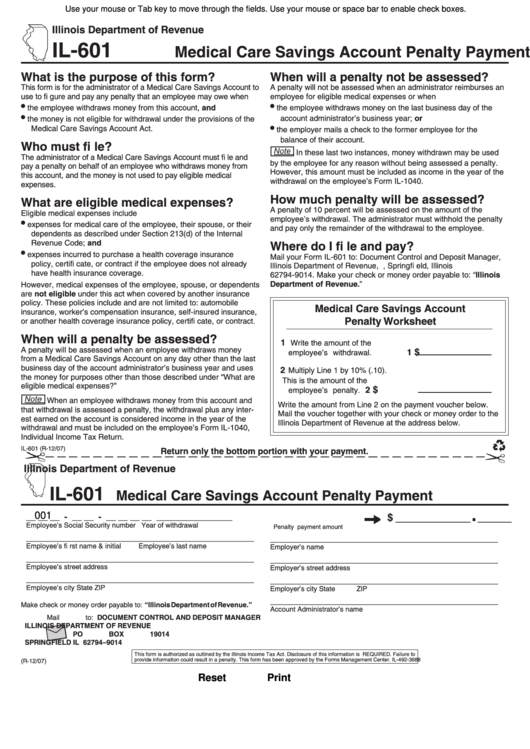

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-601

Medical Care Savings Account Penalty Payment

What is the purpose of this form?

When will a penalty not be assessed?

This form is for the administrator of a Medical Care Savings Account to

A penalty will not be assessed when an administrator reimburses an

use to fi gure and pay any penalty that an employee may owe when

employee for eligible medical expenses or when

•

•

the employee withdraws money from this account, and

the employee withdraws money on the last business day of the

•

account administrator’s business year; or

the money is not eligible for withdrawal under the provisions of the

•

Medical Care Savings Account Act.

the employer mails a check to the former employee for the

balance of their account.

Who must fi le?

In these last two instances, money withdrawn may be used

The administrator of a Medical Care Savings Account must fi le and

by the employee for any reason without being assessed a penalty.

pay a penalty on behalf of an employee who withdraws money from

However, this amount must be included as income in the year of the

this account, and the money is not used to pay eligible medical

withdrawal on the employee’s Form IL-1040.

expenses.

How much penalty will be assessed?

What are eligible medical expenses?

A penalty of 10 percent will be assessed on the amount of the

Eligible medical expenses include

employee’s withdrawal. The administrator must withhold the penalty

•

expenses for medical care of the employee, their spouse, or their

and pay only the remainder of the withdrawal to the employee.

dependents as described under Section 213(d) of the Internal

Revenue Code; and

Where do I fi le and pay?

•

expenses incurred to purchase a health coverage insurance

Mail your Form IL-601 to: Document Control and Deposit Manager,

policy, certifi cate, or contract if the employee does not already

Illinois Department of Revenue, P.O. Box 19014, Springfi eld, Illinois

have health insurance coverage.

62794-9014. Make your check or money order payable to: “Illinois

Department of Revenue.”

However, medical expenses of the employee, spouse, or dependents

are not eligible under this act when covered by another insurance

policy. These policies include and are not limited to: automobile

Medical Care Savings Account

insurance, worker’s compensation insurance, self-insured insurance,

Penalty Worksheet

or another health coverage insurance policy, certifi cate, or contract.

When will a penalty be assessed?

1

Write the amount of the

A penalty will be assessed when an employee withdraws money

$

1

employee’s withdrawal.

from a Medical Care Savings Account on any day other than the last

business day of the account administrator’s business year and uses

2

Multiply Line 1 by 10% (.10).

the money for purposes other than those described under “What are

This is the amount of the

eligible medical expenses?”

$

2

employee’s penalty.

When an employee withdraws money from this account and

Write the amount from Line 2 on the payment voucher below.

that withdrawal is assessed a penalty, the withdrawal plus any inter-

Mail the voucher together with your check or money order to the

est earned on the account is considered income in the year of the

Illinois Department of Revenue at the address below.

withdrawal and must be included on the employee’s Form IL-1040,

Individual Income Tax Return.

IL-601 (R-12/07)

Return only the bottom portion with your payment.

Illinois Department of Revenue

IL-601

Medical Care Savings Account Penalty Payment

.

001

___________

_____

__ __ __ - __ __ - __ __ __ __

________________

$

Employee’s Social Security number

Year of withdrawal

Penalty payment amount

________________________________________________

________________________________________________

Employee’s fi rst name & initial

Employee’s last name

Employer’s name

________________________________________________

________________________________________________

Employee’s street address

Employer’s street address

________________________________________________

________________________________________________

Employee’s city

State

ZIP

Employer’s city

State

ZIP

________________________________________________

Make check or money order payable to: “Illinois Department of Revenue.”

Account Administrator’s name

Mail to: DOCUMENT CONTROL AND DEPOSIT MANAGER

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19014

SPRINGFIELD IL 62794–9014

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3688

(R-12/07)

Reset

Print

1

1