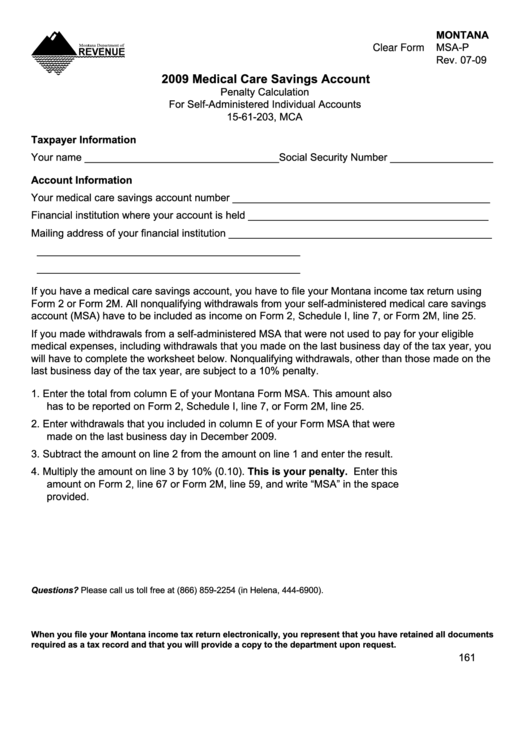

MONTANA

MSA-P

Clear Form

Rev. 07-09

2009 Medical Care Savings Account

Penalty Calculation

For Self-Administered Individual Accounts

15-61-203, MCA

Taxpayer Information

Your name __________________________________Social Security Number __________________

Account Information

Your medical care savings account number _____________________________________________

Financial institution where your account is held __________________________________________

Mailing address of your financial institution ______________________________________________

______________________________________________

______________________________________________

If you have a medical care savings account, you have to file your Montana income tax return using

Form 2 or Form 2M. All nonqualifying withdrawals from your self-administered medical care savings

account (MSA) have to be included as income on Form 2, Schedule I, line 7, or Form 2M, line 25.

If you made withdrawals from a self-administered MSA that were not used to pay for your eligible

medical expenses, including withdrawals that you made on the last business day of the tax year, you

will have to complete the worksheet below. Nonqualifying withdrawals, other than those made on the

last business day of the tax year, are subject to a 10% penalty.

1. Enter the total from column E of your Montana Form MSA. This amount also

has to be reported on Form 2, Schedule I, line 7, or Form 2M, line 25. .....................1. _________

2. Enter withdrawals that you included in column E of your Form MSA that were

made on the last business day in December 2009. ...................................................2. _________

3. Subtract the amount on line 2 from the amount on line 1 and enter the result. ......... 3. _________

4. Multiply the amount on line 3 by 10% (0.10). This is your penalty. Enter this

amount on Form 2, line 67 or Form 2M, line 59, and write “MSA” in the space

provided. ....................................................................................................................4. _________

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

When you file your Montana income tax return electronically, you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

161

1

1