Record Of Municipal Taxes Withheld - Village Of Malinta

ADVERTISEMENT

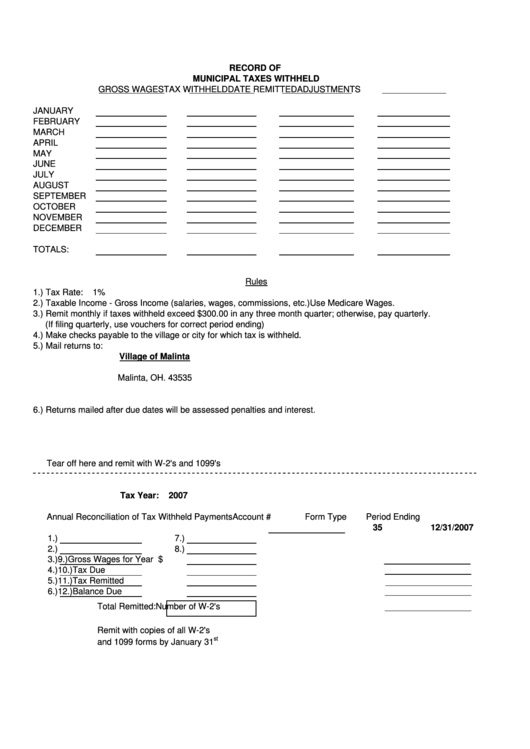

RECORD OF

MUNICIPAL TAXES WITHHELD

GROSS WAGES

TAX WITHHELD

DATE REMITTED

ADJUSTMENTS

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

TOTALS:

Rules

1.) Tax Rate:

1%

2.) Taxable Income - Gross Income (salaries, wages, commissions, etc.)

Use Medicare Wages.

3.) Remit monthly if taxes withheld exceed $300.00 in any three month quarter; otherwise, pay quarterly.

(If filing quarterly, use vouchers for correct period ending)

4.) Make checks payable to the village or city for which tax is withheld.

5.) Mail returns to:

Village of Malinta

P.O. Box 69

Malinta, OH. 43535

6.) Returns mailed after due dates will be assessed penalties and interest.

Tear off here and remit with W-2's and 1099's

Tax Year:

2007

Annual Reconciliation of Tax Withheld Payments

Account #

Form Type

Period Ending

35

12/31/2007

1.)

7.)

2.)

8.)

3.)

9.)

Gross Wages for Year $

4.)

10.)

Tax Due

5.)

11.)

Tax Remitted

6.)

12.)

Balance Due

Total Remitted:

Number of W-2's

Remit with copies of all W-2's

st

and 1099 forms by January 31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1