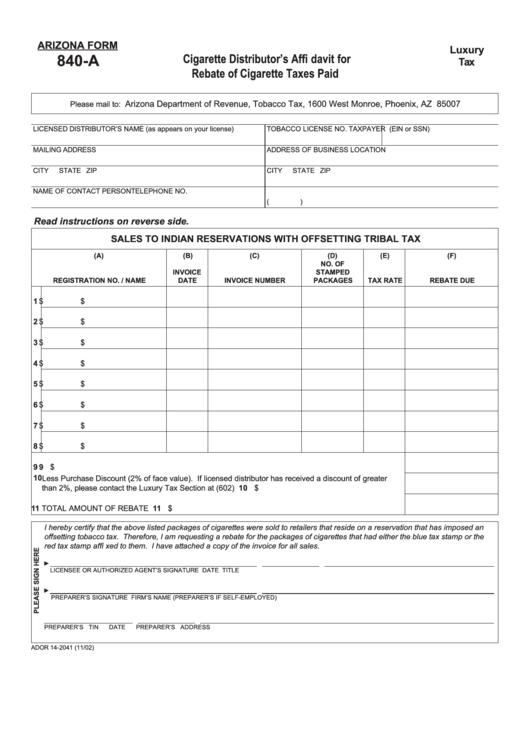

ARIZONA FORM

Luxury

840-A

Cigarette Distributor’s Affi davit for

Tax

Rebate of Cigarette Taxes Paid

Arizona Department of Revenue, Tobacco Tax, 1600 West Monroe, Phoenix, AZ 85007

Please mail to:

LICENSED DISTRIBUTOR’S NAME (as appears on your license)

TOBACCO LICENSE NO.

TAXPAYER I.D. (EIN or SSN)

MAILING ADDRESS

ADDRESS OF BUSINESS LOCATION

CITY

STATE

ZIP

CITY

STATE

ZIP

NAME OF CONTACT PERSON

TELEPHONE NO.

(

)

Read instructions on reverse side.

SALES TO INDIAN RESERVATIONS WITH OFFSETTING TRIBAL TAX

(A)

(B)

(C)

(D)

(E)

(F)

NO. OF

INVOICE

STAMPED

REGISTRATION NO. / NAME

DATE

INVOICE NUMBER

PACKAGES

TAX RATE

REBATE DUE

1

$

$

2

$

$

3

$

$

4

$

$

5

$

$

6

$

$

7

$

$

8

$

$

9 Total ........................................................................................................................................................ 9 $

10 Less Purchase Discount (2% of face value). If licensed distributor has received a discount of greater

than 2%, please contact the Luxury Tax Section at (602) 542-4643....................................................... 10 $

11 TOTAL AMOUNT OF REBATE DUE....................................................................................................... 11 $

I hereby certify that the above listed packages of cigarettes were sold to retailers that reside on a reservation that has imposed an

offsetting tobacco tax. Therefore, I am requesting a rebate for the packages of cigarettes that had either the blue tax stamp or the

red tax stamp affi xed to them. I have attached a copy of the invoice for all sales.

►

LICENSEE OR AUTHORIZED AGENT’S SIGNATURE

DATE

TITLE

►

PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PREPARER’S TIN

DATE

PREPARER’S ADDRESS

ADOR 14-2041 (11/02)

1

1