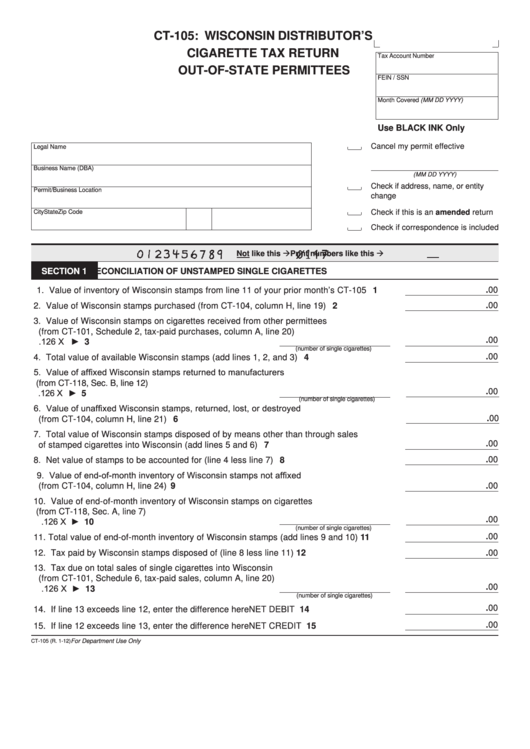

CT-105: WISCONSIN DISTRIBUTOR’S

CIGARETTE TAX RETURN

Tax Account Number

OUT-OF-STATE PERMITTEES

FEIN / SSN

Month Covered (MM DD YYYY)

Use BLACK INK Only

Cancel my permit effective

Legal Name

Business Name (DBA)

(MM DD YYYY)

Check if address, name, or entity

Permit/Business Location

change

City

State

Zip Code

Check if this is an amended return

Check if correspondence is included

Print numbers like this

Not like this

NO COMMAS

SECTION 1

RECONCILIATION OF UNSTAMPED SINGLE CIGARETTES

.00

1. Value of inventory of Wisconsin stamps from line 11 of your prior month’s CT-105 . . . . . 1

.00

2. Value of Wisconsin stamps purchased (from CT-104, column H, line 19) . . . . . . . . . . . . 2

3. Value of Wisconsin stamps on cigarettes received from other permittees

(from CT-101, Schedule 2, tax-paid purchases, column A, line 20)

.126 X ►

3

.00

(number of single cigarettes)

.00

4. Total value of available Wisconsin stamps (add lines 1, 2, and 3) . . . . . . . . . . . . . . . . . . 4

5. Value of affixed Wisconsin stamps returned to manufacturers

(from CT-118, Sec. B, line 12)

.126 X ►

5

.00

(number of single cigarettes)

6. Value of unaffixed Wisconsin stamps, returned, lost, or destroyed

.00

(from CT-104, column H, line 21). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7. Total value of Wisconsin stamps disposed of by means other than through sales

.00

of stamped cigarettes into Wisconsin (add lines 5 and 6) . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

8. Net value of stamps to be accounted for (line 4 less line 7). . . . . . . . . . . . . . . . . . . . . . . 8

9. Value of end-of-month inventory of Wisconsin stamps not affixed

(from CT-104, column H, line 24). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.00

10. Value of end-of-month inventory of Wisconsin stamps on cigarettes

(from CT-118, Sec. A, line 7)

.126 X ►

10

.00

(number of single cigarettes)

.00

11. Total value of end-of-month inventory of Wisconsin stamps (add lines 9 and 10) . . . . . . 11

12. Tax paid by Wisconsin stamps disposed of (line 8 less line 11) . . . . . . . . . . . . . . . . . . . . 12

.00

13. Tax due on total sales of single cigarettes into Wisconsin

(from CT-101, Schedule 6, tax-paid sales, column A, line 20)

.126 X ►

.00

13

(number of single cigarettes)

.00

14. If line 13 exceeds line 12, enter the difference here . . . . . . . . . . . . . . . NET DEBIT

14

.00

15. If line 12 exceeds line 13, enter the difference here . . . . . . . . . . . . . . . NET CREDIT

15

CT-105 (R. 1-12)

For Department Use Only

1

1 2

2