Form 40v - Individual Income Tax Payment Voucher - 2003

ADVERTISEMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FORM

I

C

T

D

2003

NDIVIDUAL AND

ORPORATE

AX

IVISION

40V

Individual Income Tax Payment Voucher

For the year January 1 – December 31, 2003

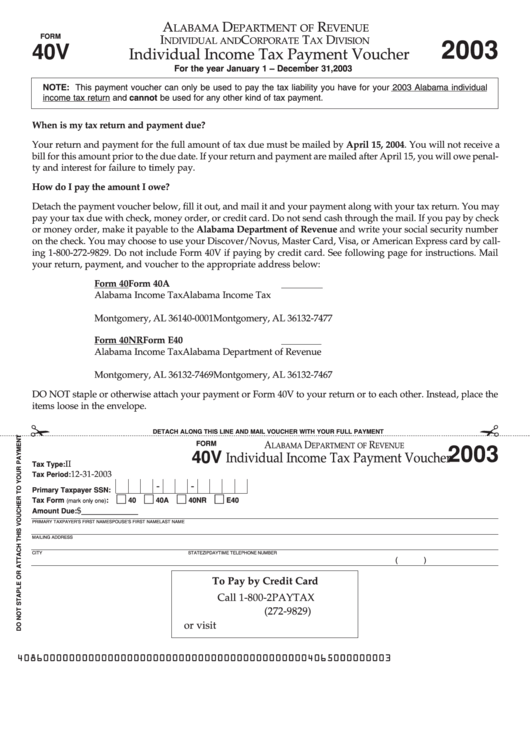

NOTE: This payment voucher can only be used to pay the tax liability you have for your 2003 Alabama individual

income tax return and cannot be used for any other kind of tax payment.

When is my tax return and payment due?

Your return and payment for the full amount of tax due must be mailed by April 15, 2004. You will not receive a

bill for this amount prior to the due date. If your return and payment are mailed after April 15, you will owe penal-

ty and interest for failure to timely pay.

How do I pay the amount I owe?

Detach the payment voucher below, fill it out, and mail it and your payment along with your tax return. You may

pay your tax due with check, money order, or credit card. Do not send cash through the mail. If you pay by check

or money order, make it payable to the Alabama Department of Revenue and write your social security number

on the check. You may choose to use your Discover/Novus, Master Card, Visa, or American Express card by call-

ing 1-800-272-9829. Do not include Form 40V if paying by credit card. See following page for instructions. Mail

your return, payment, and voucher to the appropriate address below:

Form 40

Form 40A

Alabama Income Tax

Alabama Income Tax

P.O. Box 2401

P.O. Box 327477

Montgomery, AL 36140-0001

Montgomery, AL 36132-7477

Form 40NR

Form E40

Alabama Income Tax

Alabama Department of Revenue

P.O. Box 327469

P.O. Box 327467

Montgomery, AL 36132-7469

Montgomery, AL 36132-7467

DO NOT staple or otherwise attach your payment or Form 40V to your return or to each other. Instead, place the

items loose in the envelope.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

FORM

A

D

R

2003

LABAMA

EPARTMENT OF

EVENUE

40V

Individual Income Tax Payment Voucher

Tax Type:

II

Tax Period:

12-31-2003

-

-

Primary Taxpayer SSN:

Tax Form

:

40

40A

40NR

E40

(mark only one)

Amount Due: $_____________

PRIMARY TAXPAYER’S FIRST NAME

SPOUSE’S FIRST NAME

LAST NAME

MAILING ADDRESS

CITY

STATE

ZIP

DAYTIME TELEPHONE NUMBER

(

)

To Pay by Credit Card

Call 1-800-2PAYTAX

(272-9829)

or visit

4086000000000000000000000000000000000000000004065000000003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2