DUALTT-AONM-YRXY-MOHJ-EUJY

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

40V

I

C

T

D

NDIVIDUAL AND

ORPORATE

AX

IVISION

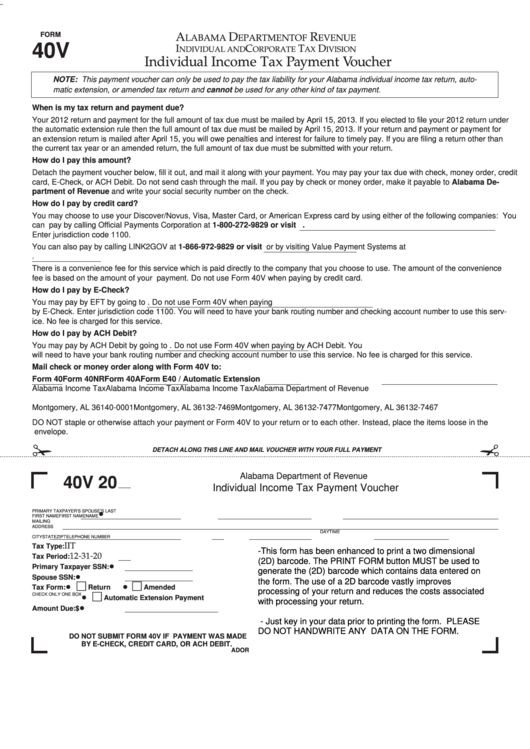

Individual Income Tax Payment Voucher

NOTE: This payment voucher can only be used to pay the tax liability for your Alabama individual income tax return, auto-

matic extension, or amended tax return and cannot be used for any other kind of tax payment.

When is my tax return and payment due?

Your 2012 return and payment for the full amount of tax due must be mailed by April 15, 2013. If you elected to file your 2012 return under

the automatic extension rule then the full amount of tax due must be mailed by April 15, 2013. If your return and payment or payment for

an extension return is mailed after April 15, you will owe penalties and interest for failure to timely pay. If you are filing a return other than

the current tax year or an amended return, the full amount of tax due must be submitted with your return.

How do I pay this amount?

Detach the payment voucher below, fill it out, and mail it along with your payment.You may pay your tax due with check, money order, credit

card, E-Check, or ACH Debit. Do not send cash through the mail. If you pay by check or money order, make it payable to Alabama De-

partment of Revenue and write your social security number on the check.

How do I pay by credit card?

You may choose to use your Discover/Novus, Visa, Master Card, or American Express card by using either of the following companies: You

can pay by calling Official Payments Corporation at 1-800-272-9829 or visit

Enter jurisdiction code 1100.

You can also pay by calling LINK2GOV at 1-866-972-9829 or visit or by visiting Value Payment Systems at

There is a convenience fee for this service which is paid directly to the company that you choose to use. The amount of the convenience

fee is based on the amount of your payment. Do not use Form 40V when paying by credit card.

How do I pay by E-Check?

You may pay by EFT by going to Do not use Form 40V when paying

by E-Check. Enter jurisdiction code 1100. You will need to have your bank routing number and checking account number to use this serv-

ice. No fee is charged for this service.

How do I pay by ACH Debit?

You may pay by ACH Debit by going to Do not use Form 40V when paying by ACH Debit. You

will need to have your bank routing number and checking account number to use this service. No fee is charged for this service.

Mail check or money order along with Form 40V to:

Form 40

Form 40NR

Form 40A

Form E40 / Automatic Extension

Alabama Income Tax

Alabama Income Tax

Alabama Income Tax

Alabama Department of Revenue

P.O. Box 2401

P.O. Box 327469

P.O. Box 327477

P.O. Box 327467

Montgomery, AL 36140-0001

Montgomery, AL 36132-7469

Montgomery, AL 36132-7477

Montgomery, AL 36132-7467

DO NOT staple or otherwise attach your payment or Form 40V to your return or to each other. Instead, place the items loose in the

envelope.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

40V 20

Alabama Department of Revenue

Individual Income Tax Payment Voucher

Print

Reset

PRIMARY TAXPAYER’S

SPOUSE’S

LAST

•

FIRST NAME

FIRST NAME

NAME

MAILING

ADDRESS

DAYTIME

CITY

STATE

ZIP

TELEPHONE NUMBER

IIT

Tax Type:

-This form has been enhanced to print a two dimensional

12-31-20

Tax Period:

(2D) barcode. The PRINT FORM button MUST be used to

•

Primary Taxpayer SSN:

generate the (2D) barcode which contains data entered on

•

Spouse SSN:

the form. The use of a 2D barcode vastly improves

•

•

Tax Form:

Return

Amended

processing of your return and reduces the costs associated

CHECK ONLY ONE BOX

•

Automatic Extension Payment

with processing your return.

•

Amount Due:

$

- Just key in your data prior to printing the form. PLEASE

DO NOT HANDWRITE ANY DATA ON THE FORM.

DO NOT SUBMIT FORM 40V IF PAYMENT WAS MADE

BY E-CHECK, CREDIT CARD, OR ACH DEBIT.

ADOR

1

1