DUALTT-AONM-YRXY-MOHJ-EUJY

A

D

R

LABAMA

EPARTMENT OF

EVENUE

I

C

T

D

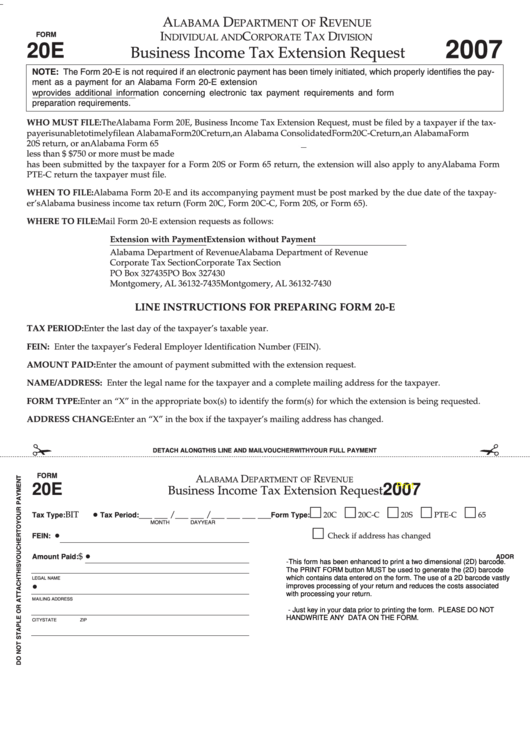

FORM

NDIVIDUAL AND

ORPORATE

AX

IVISION

2007

20E

Business Income Tax Extension Request

NOTE: The Form 20-E is not required if an electronic payment has been timely initiated, which properly identifies the pay-

ment as a payment for an Alabama Form 20-E extension request. The Alabama Department of Revenue Web site at

provides additional information concerning electronic tax payment requirements and form

preparation requirements.

WHO MUST FILE: The Alabama Form 20E, Business Income Tax Extension Request, must be filed by a taxpayer if the tax-

payer is unable to timely file an Alabama Form 20C return, an Alabama Consolidated Form 20C-C return, an Alabama Form

20S return, or an Alabama Form 65 return. The Form 20E must be filed if the required payment accompanying the request is

less than $750. Payments of $750 or more must be made electronically. If a timely-filed Alabama Form 20E extension request

has been submitted by the taxpayer for a Form 20S or Form 65 return, the extension will also apply to any Alabama Form

PTE-C return the taxpayer must file.

WHEN TO FILE: Alabama Form 20-E and its accompanying payment must be post marked by the due date of the taxpay-

er’s Alabama business income tax return (Form 20C, Form 20C-C, Form 20S, or Form 65).

WHERE TO FILE: Mail Form 20-E extension requests as follows:

Extension with Payment

Extension without Payment

Alabama Department of Revenue

Alabama Department of Revenue

Corporate Tax Section

Corporate Tax Section

PO Box 327435

PO Box 327430

Montgomery, AL 36132-7435

Montgomery, AL 36132-7430

LINE INSTRUCTIONS FOR PREPARING FORM 20-E

TAX PERIOD: Enter the last day of the taxpayer’s taxable year.

FEIN: Enter the taxpayer’s Federal Employer Identification Number (FEIN).

AMOUNT PAID: Enter the amount of payment submitted with the extension request.

NAME/ADDRESS: Enter the legal name for the taxpayer and a complete mailing address for the taxpayer.

FORM TYPE: Enter an “X” in the appropriate box(s) to identify the form(s) for which the extension is being requested.

ADDRESS CHANGE: Enter an “X” in the box if the taxpayer’s mailing address has changed.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

20E

2007

Reset

Print

Business Income Tax Extension Request

•

Tax Type: BIT

Tax Period: ___ ___ /___ ___ /___ ___ ___ ___

Form Type:

20C

20C-C

20S

PTE-C

65

MONTH

DAY

YEAR

•

FEIN:

Check if address has changed

•

Amount Paid: $

ADOR

-This form has been enhanced to print a two dimensional (2D) barcode.

The PRINT FORM button MUST be used to generate the (2D) barcode

which contains data entered on the form. The use of a 2D barcode vastly

LEGAL NAME

•

improves processing of your return and reduces the costs associated

with processing your return.

MAILING ADDRESS

- Just key in your data prior to printing the form. PLEASE DO NOT

HANDWRITE ANY DATA ON THE FORM.

CITY

STATE

ZIP

1

1