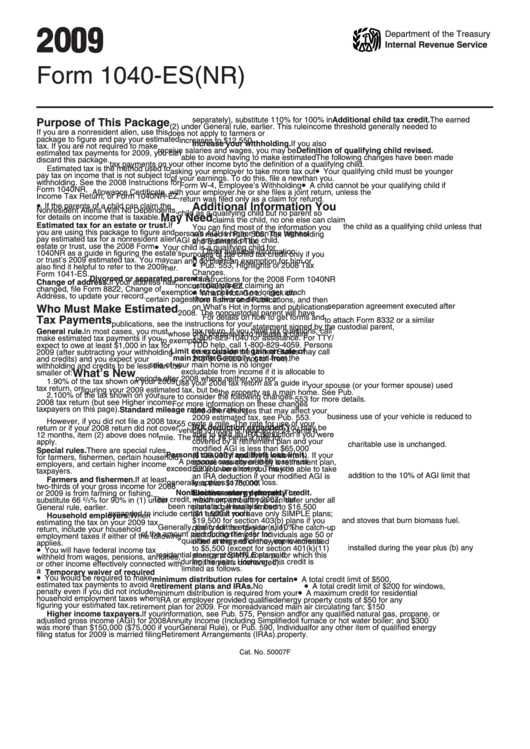

Form 1040-Es(Nr) - U.s. Estimated Tax For Nonresident Alien Individuals - 2009

ADVERTISEMENT

2 0 09

Department of the Treasury

Internal Revenue Service

Form 1040-ES(NR)

U.S. Estimated Tax for Nonresident Alien Individuals

separately), substitute 110% for 100% in

Additional child tax credit. The earned

Purpose of This Package

(2) under General rule, earlier. This rule

income threshold generally needed to

If you are a nonresident alien, use this

does not apply to farmers or fishermen.

qualify for the additional child tax credit

package to figure and pay your estimated

increases to $12,550.

Increase your withholding. If you also

tax. If you are not required to make

receive salaries and wages, you may be

Definition of qualifying child revised.

estimated tax payments for 2009, you can

able to avoid having to make estimated

The following changes have been made

discard this package.

tax payments on your other income by

to the definition of a qualifying child.

•

Estimated tax is the method used to

asking your employer to take more tax out

Your qualifying child must be younger

pay tax on income that is not subject to

of your earnings. To do this, file a new

than you.

•

withholding. See the 2008 Instructions for

Form W-4, Employee’s Withholding

A child cannot be your qualifying child if

Form 1040NR, U.S. Nonresident Alien

Allowance Certificate, with your employer.

he or she files a joint return, unless the

Income Tax Return, or Form 1040NR-EZ,

return was filed only as a claim for refund.

•

U.S. Income Tax Return for Certain

Additional Information You

If the parents of a child can claim the

Nonresident Aliens With No Dependents,

child as a qualifying child but no parent so

May Need

for details on income that is taxable.

claims the child, no one else can claim

Estimated tax for an estate or trust. If

the child as a qualifying child unless that

You can find most of the information you

you are using this package to figure and

person’s AGI is higher than the highest

will need in Pub. 505, Tax Withholding

pay estimated tax for a nonresident alien

AGI of any parent of the child.

and Estimated Tax.

•

estate or trust, use the 2008 Form

Your child is a qualifying child for

Other available information:

1040NR as a guide in figuring the estate’s

purposes of the child tax credit only if you

•

Pub. 519, U.S. Tax Guide for Aliens.

or trust’s 2009 estimated tax. You may

can and do claim an exemption for him or

•

Pub. 553, Highlights of 2008 Tax

also find it helpful to refer to the 2009

her.

Changes.

Form 1041-ES.

•

Divorced or separated parents. A

Instructions for the 2008 Form 1040NR

Change of address. If your address has

noncustodial parent claiming an

or 1040NR-EZ.

changed, file Form 8822, Change of

•

exemption for a child can no longer attach

What’s Hot. Go to , click on

Address, to update your record.

certain pages from a divorce decree or

More Forms and Publications, and then

separation agreement executed after

on What’s Hot in forms and publications.

Who Must Make Estimated

2008. The noncustodial parent will have

For details on how to get forms and

Tax Payments

to attach Form 8332 or a similar

publications, see the instructions for your

statement signed by the custodial parent,

tax return. If you have tax questions, call

General rule. In most cases, you must

whose only purpose is to release a claim

1-800-829-1040 for assistance. For TTY/

make estimated tax payments if you

to exemption.

TDD help, call 1-800-829-4059. Persons

expect to owe at least $1,000 in tax for

Limit on exclusion of gain on sale of

living outside the United States may call

2009 (after subtracting your withholding

main home. Generally, gain from the

215-516-2000 (not toll-free).

and credits) and you expect your

sale of your main home is no longer

withholding and credits to be less than the

excludable from income if it is allocable to

What’s New

smaller of:

periods after 2008 where neither you nor

1. 90% of the tax shown on your 2009

Use your 2008 tax return as a guide in

your spouse (or your former spouse) used

tax return, or

figuring your 2009 estimated tax, but be

the property as a main home. See Pub.

2. 100% of the tax shown on your

sure to consider the following changes.

553 for more details.

2008 tax return (but see Higher income

For more information on these changes

taxpayers on this page).

Standard mileage rates. The rate for

and other changes that may affect your

business use of your vehicle is reduced to

2009 estimated tax, see Pub. 553.

However, if you did not file a 2008 tax

55 cents a mile. The rate for use of your

IRA deduction expanded. You may be

return or if your 2008 return did not cover

vehicle to move is reduced to 24 cents a

able to take an IRA deduction if you were

12 months, item (2) above does not

mile. The rate of 14 cents a mile for

covered by a retirement plan and your

apply.

charitable use is unchanged.

modified AGI is less than $65,000

Special rules. There are special rules

Personal casualty and theft loss limit.

($109,000 if qualifying widow(er)). If your

for farmers, fishermen, certain household

A personal casualty or theft loss must

spouse was covered by a retirement plan,

employers, and certain higher income

exceed $500 to be allowed. This is in

but you were not, you may be able to take

taxpayers.

addition to the 10% of AGI limit that

an IRA deduction if your modified AGI is

Farmers and fishermen. If at least

generally applies to the net loss.

less than $176,000.

two-thirds of your gross income for 2008

Nonbusiness energy property credit.

Elective salary deferrals. The

or 2009 is from farming or fishing,

This credit, which expired after 2007, has

substitute 66

2

/

% for 90% in (1) under

maximum amount you can defer under all

3

been reinstated. It has also been

plans is generally limited to $16,500

General rule, earlier.

expanded to include certain asphalt roofs

($11,500 if you have only SIMPLE plans;

Household employers. When

and stoves that burn biomass fuel.

$19,500 for section 403(b) plans if you

estimating the tax on your 2009 tax

Generally, the credit is equal to (a) 10%

qualify for the 15-year rule). The catch-up

return, include your household

of the amount paid during the year for

contribution limit for individuals age 50 or

employment taxes if either of the following

qualified energy efficiency improvements

older at the end of the year is increased

applies.

•

installed during the year plus (b) any

to $5,500 (except for section 401(k)(11)

You will have federal income tax

residential energy property costs paid

plans and SIMPLE plans, for which this

withheld from wages, pensions, annuities,

during the year. However, this credit is

limit remains unchanged).

or other income effectively connected with

limited as follows.

a U.S. trade or business.

Temporary waiver of required

•

•

You would be required to make

minimum distribution rules for certain

A total credit limit of $500,

•

estimated tax payments to avoid a

retirement plans and IRAs. No

A total credit limit of $200 for windows,

•

penalty even if you did not include

minimum distribution is required from your

A maximum credit for residential

household employment taxes when

IRA or employer provided qualified

energy property costs of $50 for any

figuring your estimated tax.

retirement plan for 2009. For more

advanced main air circulating fan; $150

Higher income taxpayers. If your

information, see Pub. 575, Pension and

for any qualified natural gas, propane, or

adjusted gross income (AGI) for 2008

Annuity Income (Including Simplified

oil furnace or hot water boiler; and $300

was more than $150,000 ($75,000 if your

General Rule), or Pub. 590, Individual

for any other item of qualified energy

filing status for 2009 is married filing

Retirement Arrangements (IRAs).

property.

Cat. No. 50007F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6