Form O-255 - Wholesale Alcoholic Beverage Tax Return - 2001

ADVERTISEMENT

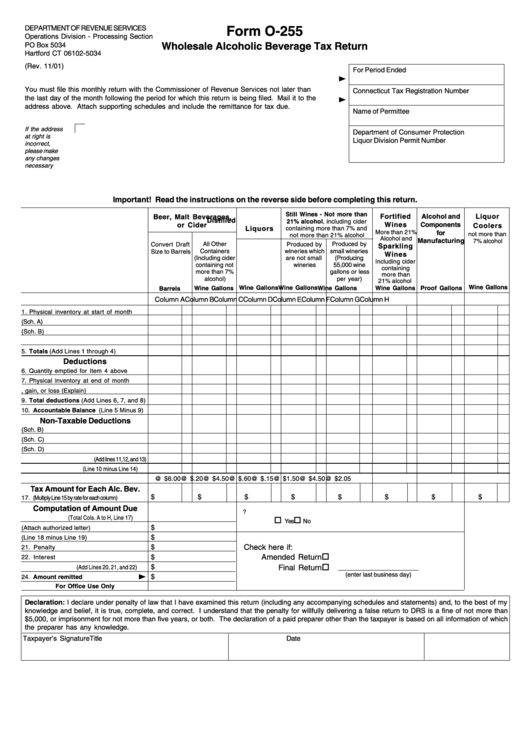

DEPARTMENT OF REVENUE SERVICES

Form O-255

Operations Division - Processing Section

Wholesale Alcoholic Beverage Tax Return

PO Box 5034

Hartford CT 06102-5034

(Rev. 11/01)

For Period Ended

You must file this monthly return with the Commissioner of Revenue Services not later than

Connecticut Tax Registration Number

the last day of the month following the period for which this return is being filed. Mail it to the

address above. Attach supporting schedules and include the remittance for tax due.

Name of Permittee

If the address

Department of Consumer Protection

at right is

Liquor Division Permit Number

incorrect,

please make

any changes

necessary

Important! Read the instructions on the reverse side before completing this return.

Still Wines - Not more than

Fortified

Alcohol and

Liquor

Beer, Malt Beverages,

Distilled

21% alcohol, including cider

or Cider

Wines

Components

Coolers

Liquors

containing more than 7% and

More than 21%

for

not more than

not more than 21% alcohol

Alcohol and

Manufacturing

7% alcohol

Convert Draft

All Other

Produced by

Produced by

Sparkling

Containers

wineries which

small wineries

Size to Barrels

Wines

(Including cider

are not small

(Producing

Including cider

containing not

wineries

55,000 wine

containing

gallons or less

more than 7%

more than

alcohol)

per year)

21% alcohol

Wine Gallons

Wine Gallons Wine Gallons

Wine Gallons

Barrels

Wine Gallons

Wine Gallons

Proof Gallons

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

1. Physical inventory at start of month

2. Quantity purchased or acquired (Sch. A)

3. Tax-paid purchases and returns (Sch. B)

4. Produced by manufacturing process

5. Totals (Add Lines 1 through 4)

Deductions

6. Quantity emptied for Item 4 above

7. Physical inventory at end of month

8. Adjustments, gain, or loss (Explain)

9. Total deductions (Add Lines 6, 7, and 8)

10. Accountable Balance (Line 5 Minus 9)

Non-Taxable Deductions

11. Tax-paid purchases and returns (Sch. B)

12. Shipments outside Connecticut (Sch. C)

13. Shipments within Connecticut (Sch. D)

14. Total non-tax deductions (Add lines 11,12, and 13)

15. Taxable net quantity (Line 10 minus Line 14)

@ $6.00

@ $.20

@ $4.50

@ $.60

@ $.15

@ $1.50

@ $4.50

@ $2.05

16. Tax rate for each of the columns

Tax Amount for Each Alc. Bev.

$

$

$

$

$

$

$

$

17. (Multiply Line 15 by rate for each column)

Computation of Amount Due

25. Are any of your inventories or accounts receivable pledged at this time?

18. Amount of tax (Total Cols. A to H, Line 17)

Yes

No

$

19. Tax credits (Attach authorized letter)

$

20. Adjusted tax (Line 18 minus Line 19)

Check here if:

$

21. Penalty

Amended Return

$

22. Interest

$

Final Return

23. Total amount due (Add Lines 20, 21, and 22)

(enter last business day)

$

24. Amount remitted

For Office Use Only

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which

the preparer has any knowledge.

Taxpayer’s Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2