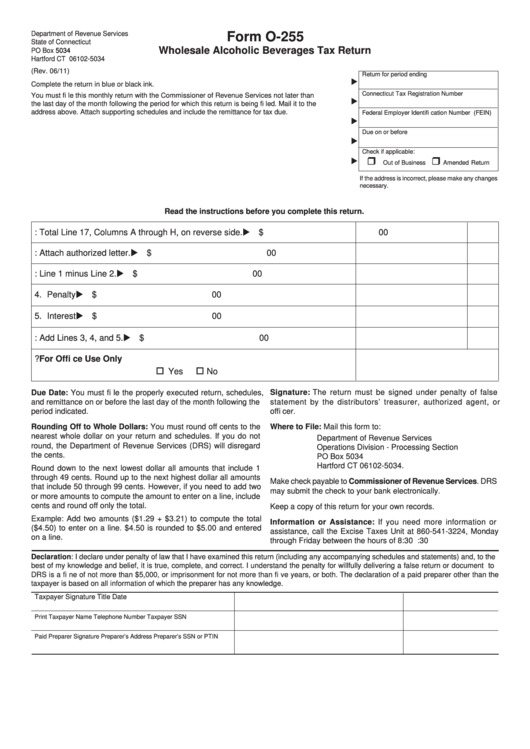

Department of Revenue Services

Form O-255

State of Connecticut

Wholesale Alcoholic Beverages Tax Return

PO Box

5034

Hartford CT 06102-5034

(Rev. 06/11)

(Rev. 06/11)

Return for period ending

Complete the return in blue or black ink.

Connecticut Tax Registration Number

You must fi le this monthly return with the Commissioner of Revenue Services not later than

the last day of the month following the period for which this return is being fi led. Mail it to the

address above. Attach supporting schedules and include the remittance for tax due.

Federal Employer Identifi cation Number (FEIN)

Due on or before

:

Check if applicable

Out of Business

Amended Return

If the address is incorrect, please make any changes

necessary.

Read the instructions before you complete this return.

$

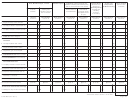

1. Amount of tax: Total Line 17, Columns A through H, on reverse side.

00

$

2. Tax credits: Attach authorized letter.

00

$

3. Adjusted tax: Line 1 minus Line 2.

00

$

4. Penalty

00

$

5. Interest

00

$

6. Total amount due: Add Lines 3, 4, and 5.

00

7. Are any of your inventories or accounts receivable pledged at this time?

For Offi ce Use Only

Yes

No

Due Date: You must fi le the properly executed return, schedules,

Signature: The return must be signed under penalty of false

and remittance on or before the last day of the month following the

statement by the distributors’ treasurer, authorized agent, or

period indicated.

offi cer.

Where to File: Mail this form to:

Rounding Off to Whole Dollars: You must round off cents to the

nearest whole dollar on your return and schedules. If you do not

Department of Revenue Services

round, the Department of Revenue Services (DRS) will disregard

Operations Division - Processing Section

the cents.

PO Box 5034

Hartford CT 06102-5034.

Round down to the next lowest dollar all amounts that include 1

through 49 cents. Round up to the next highest dollar all amounts

Make check payable to Commissioner of Revenue Services. DRS

that include 50 through 99 cents. However, if you need to add two

may submit the check to your bank electronically.

or more amounts to compute the amount to enter on a line, include

cents and round off only the total.

Keep a copy of this return for your own records.

Example: Add two amounts ($1.29 + $3.21) to compute the total

Information or Assistance: If you need more information or

($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered

assistance, call the Excise Taxes Unit at 860-541-3224, Monday

on a line.

through Friday between the hours of 8:30 a.m. and 4:30 p.m.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the

best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to

DRS is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the

taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer SSN

Paid Preparer Signature

Preparer’s Address

Preparer’s SSN or PTIN

1

1 2

2 3

3 4

4