Form Pet 368 - Blender'S Return

ADVERTISEMENT

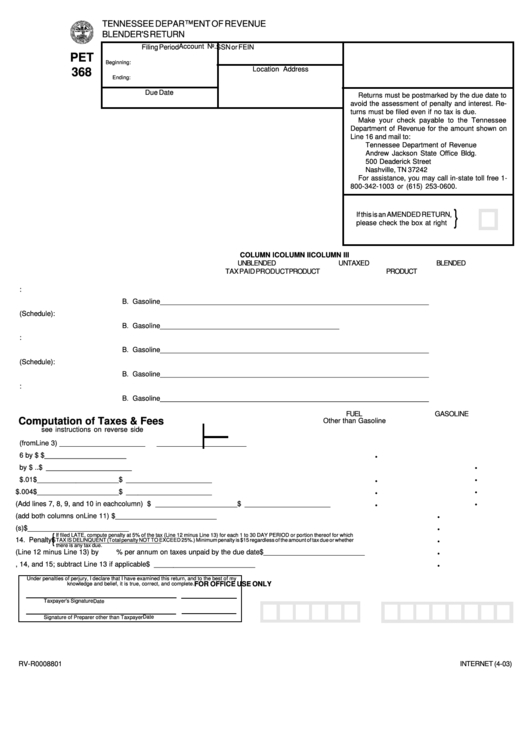

TENNESSEE DEPARTMENT OF REVENUE

BLENDER'S RETURN

Account No.

Filing Period

SSN or FEIN

PET

Beginning:

Location Address

368

Ending:

Due Date

Returns must be postmarked by the due date to

avoid the assessment of penalty and interest. Re-

turns must be filed even if no tax is due.

Make your check payable to the Tennessee

Department of Revenue for the amount shown on

Line 16 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

For assistance, you may call in-state toll free 1-

800-342-1003 or (615) 253-0600.

}

If this is an AMENDED RETURN,

please check the box at right

COLUMN I

COLUMN II

COLUMN III

UNBLENDED

UNTAXED

BLENDED

TAX PAID PRODUCT

PRODUCT

PRODUCT

1. Beginning Inventory:

A. Fuel other than gasoline ________________________

______________________

_______________________

B. Gasoline

________________________

______________________

_______________________

2. Purchases (Schedule):

A. Fuel other than gasoline ________________________

______________________

B. Gasoline

________________________

______________________

3. Used in blending:

A. Fuel other than gasoline ________________________

______________________

_______________________

B. Gasoline

________________________

______________________

_______________________

4. Other use or sale (Schedule):A. Fuel other than gasoline ________________________

______________________

_______________________

B. Gasoline

________________________

______________________

_______________________

5. Ending inventory:

A. Fuel other than gasoline ________________________

______________________

_______________________

B. Gasoline

________________________

______________________

_______________________

FUEL

GASOLINE

Computation of Taxes & Fees

Other than Gasoline

see instructions on reverse side

6. Gallons Subject to Tax (from Line 3) ..................

..........................

______________________

_______________________

.

7. Diesel Tax - multiply gallons on Line 6 by $.17 ...

.......................... $ _____________________

.

8. Gasoline Tax - multiply gallons on Line 6 by $.20

.............................................................................. $ ______________________

.

.

9. Special Tax - multiply gallons on Line 6 by $.01 .................................................................. $ _____________________

$ ______________________

.

.

10. Environmental Assurance Fee - multiply gallons on Line 6 by $.004 ................................. $ _____________________

$ ______________________

.

.

11. Total Tax Due (Add lines 7, 8, 9, and 10 in each column) .................................................. $ _____________________

$ ______________________

.

12. Total taxes and fees (add both columns on Line 11) .................................................................................... $ __________________________

.

13. Enter outstanding credit amount from previous Department of Revenue notice(s) ...................................... $ __________________________

.

If filed LATE, compute penalty at 5% of the tax (Line 12 minus Line 13) for each 1 to 30 DAY PERIOD or portion thereof for which

{

14. Penalty

$ __________________________

TAX IS DELINQUENT (Total penalty NOT TO EXCEED 25%.) Minimum penalty is $15 regardless of the amount of tax due or whether

there is any tax due.

.

15. Interest - Multiply the tax (Line 12 minus Line 13) by

% per annum on taxes unpaid by the due date $ __________________________

.

16. Total Remittance Amount - Add lines 12, 14, and 15; subtract Line 13 if applicable .................................... $ __________________________

Under penalties of perjury, I declare that I have examined this return, and to the best of my

FOR OFFICE USE ONLY

knowledge and belief, it is true, correct, and complete.

Taxpayer's Signature

Date

Date

Signature of Preparer other than Taxpayer

RV-R0008801

INTERNET (4-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1