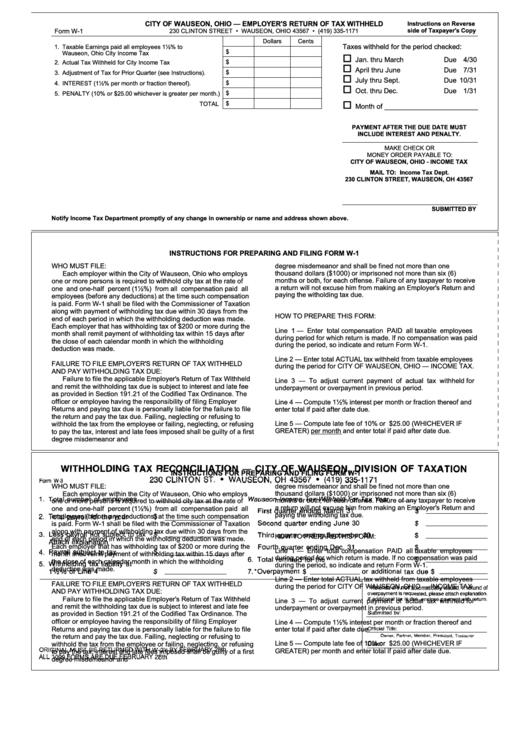

CITY OF WAUSEON, OHIO — EMPLOYER'S RETURN OF TAX WITHHELD

Instructions on Reverse

side of Taxpayer's Copy

Form W-1

230 CLINTON STREET • WAUSEON, OHIO 43567 • (419) 335-1171

Dollars

Cents

Taxes withheld for the period checked:

1. Taxable Earnings paid all employees 1½% to

$

Wauseon, Ohio City Income Tax

Jan. thru March

Due

4/30

$

2.

Actual Tax Withheld for City Income Tax

April thru June

Due

7/31

3.

Adjustment of Tax for Prior Quarter (see Instructions).

$

July thru Sept.

Due

10/31

$

4.

INTEREST (1½% per month or fraction thereof).

Oct. thru Dec.

Due

1/31

$

5.

PENALTY (10% or $25.00 whichever is greater per month.)

$

TOTAL

Month of ________________________

PAYMENT AFTER THE DUE DATE MUST

INCLUDE INTEREST AND PENALTY.

MAKE CHECK OR

MONEY ORDER PAYABLE TO:

CITY OF WAUSEON, OHIO - INCOME TAX

MAIL TO: Income Tax Dept.

230 CLINTON STREET, WAUSEON, OH 43567

SUBMITTED BY

Notify Income Tax Department promptly of any change in ownership or name and address shown above.

INSTRUCTIONS FOR PREPARING AND FILING FORM W-1

WHO MUST FILE:

degree misdemeanor and shall be fined not more than one

thousand dollars ($1000) or imprisoned not more than six (6)

Each employer within the City of Wauseon, Ohio who employs

months or both, for each offense. Failure of any taxpayer to receive

one or more persons is required to withhold city tax at the rate of

a return will not excuse him from making an Employer's Return and

one and one-half percent (1½%) from all compensation paid all

paying the witholding tax due.

employees (before any deductions) at the time such compensation

is paid. Form W-1 shall be filed with the Commissioner of Taxation

along with payment of withholding tax due within 30 days from the

HOW TO PREPARE THIS FORM:

end of each period in which the withholding deduction was made.

Each employer that has withholding tax of $200 or more during the

Line 1 — Enter total compensation PAID all taxable employees

month shall remit payment of withholding tax within 15 days after

during period for which return is made. If no compensation was paid

the close of each calendar month in which the withholding

during the period, so indicate and return Form W-1.

deduction was made.

Line 2 — Enter total ACTUAL tax withheld from taxable employees

FAILURE TO FILE EMPLOYER'S RETURN OF TAX WITHHELD

during the period for CITY OF WAUSEON, OHIO — INCOME TAX.

AND PAY WITHHOLDING TAX DUE:

Failure to file the applicable Employer's Return of Tax Withheld

Line 3 — To adjust current payment of actual tax withheld for

and remit the withholding tax due is subject to interest and late fee

underpayment or overpayment in previous period.

as provided in Section 191.21 of the Codified Tax Ordinance. The

officer or employee having the responsibility of filing Employer

Line 4 — Compute 1½% interest per month or fraction thereof and

Returns and paying tax due is personally liable for the failure to file

enter total if paid after date due.

the return and pay the tax due. Failing, neglecting or refusing to

Line 5 — Compute late fee of 10% or $25.00 (WHICHEVER IF

withhold the tax from the employee or failing, neglecting, or refusing

GREATER) per month and enter total if paid after date due.

to pay the tax, interest and late fees imposed shall be guilty of a first

degree misdemeanor and

INSTRUCTIONS FOR PREPARING AND FILING FORM W-1

WHO MUST FILE:

degree misdemeanor and shall be fined not more than one

thousand dollars ($1000) or imprisoned not more than six (6)

Each employer within the City of Wauseon, Ohio who employs

months or both, for each offense. Failure of any taxpayer to receive

one or more persons is required to withhold city tax at the rate of

a return will not excuse him from making an Employer's Return and

one and one-half percent (1½%) from all compensation paid all

paying the witholding tax due.

employees (before any deductions) at the time such compensation

is paid. Form W-1 shall be filed with the Commissioner of Taxation

along with payment of withholding tax due within 30 days from the

HOW TO PREPARE THIS FORM:

end of each period in which the withholding deduction was made.

Each employer that has withholding tax of $200 or more during the

Line 1 — Enter total compensation PAID all taxable employees

month shall remit payment of withholding tax within 15 days after

during period for which return is made. If no compensation was paid

the close of each calendar month in which the withholding

during the period, so indicate and return Form W-1.

deduction was made.

Line 2 — Enter total ACTUAL tax withheld from taxable employees

FAILURE TO FILE EMPLOYER'S RETURN OF TAX WITHHELD

during the period for CITY OF WAUSEON, OHIO — INCOME TAX.

AND PAY WITHHOLDING TAX DUE:

Failure to file the applicable Employer's Return of Tax Withheld

Line 3 — To adjust current payment of actual tax withheld for

and remit the withholding tax due is subject to interest and late fee

underpayment or overpayment in previous period.

as provided in Section 191.21 of the Codified Tax Ordinance. The

officer or employee having the responsibility of filing Employer

Line 4 — Compute 1½% interest per month or fraction thereof and

Returns and paying tax due is personally liable for the failure to file

enter total if paid after date due.

the return and pay the tax due. Failing, neglecting or refusing to

Line 5 — Compute late fee of 10% or $25.00 (WHICHEVER IF

withhold the tax from the employee or failing, neglecting, or refusing

GREATER) per month and enter total if paid after date due.

to pay the tax, interest and late fees imposed shall be guilty of a first

degree misdemeanor and

1

1