Form Ir-Ez For The City Of Eaton

ADVERTISEMENT

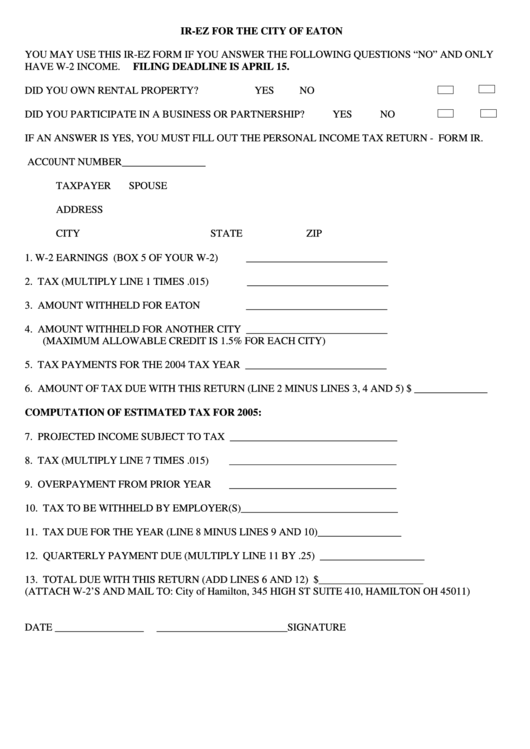

IR-EZ FOR THE CITY OF EATON

YOU MAY USE THIS IR-EZ FORM IF YOU ANSWER THE FOLLOWING QUESTIONS “NO” AND ONLY

HAVE W-2 INCOME.

FILING DEADLINE IS APRIL 15.

DID YOU OWN RENTAL PROPERTY?

YES

NO

DID YOU PARTICIPATE IN A BUSINESS OR PARTNERSHIP?

YES

NO

IF AN ANSWER IS YES, YOU MUST FILL OUT THE PERSONAL INCOME TAX RETURN - FORM IR.

ACC0UNT NUMBER________________

TAXPAYER

SPOUSE

ADDRESS

CITY

STATE

ZIP

1. W-2 EARNINGS (BOX 5 OF YOUR W-2)

___________________________

2. TAX (MULTIPLY LINE 1 TIMES .015)

___________________________

3. AMOUNT WITHHELD FOR EATON

___________________________

4. AMOUNT WITHHELD FOR ANOTHER CITY ___________________________

(MAXIMUM ALLOWABLE CREDIT IS 1.5% FOR EACH CITY)

5. TAX PAYMENTS FOR THE 2004 TAX YEAR ___________________________

6. AMOUNT OF TAX DUE WITH THIS RETURN (LINE 2 MINUS LINES 3, 4 AND 5) $ ______________

COMPUTATION OF ESTIMATED TAX FOR 2005:

7. PROJECTED INCOME SUBJECT TO TAX ________________________________

8. TAX (MULTIPLY LINE 7 TIMES .015)

________________________________

9. OVERPAYMENT FROM PRIOR YEAR

________________________________

10. TAX TO BE WITHHELD BY EMPLOYER(S)______________________________

11. TAX DUE FOR THE YEAR (LINE 8 MINUS LINES 9 AND 10)________________

12. QUARTERLY PAYMENT DUE (MULTIPLY LINE 11 BY .25) ____________________

13. TOTAL DUE WITH THIS RETURN (ADD LINES 6 AND 12) $____________________

(ATTACH W-2’S AND MAIL TO: City of Hamilton, 345 HIGH ST SUITE 410, HAMILTON OH 45011)

DATE _________________

_________________________SIGNATURE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1