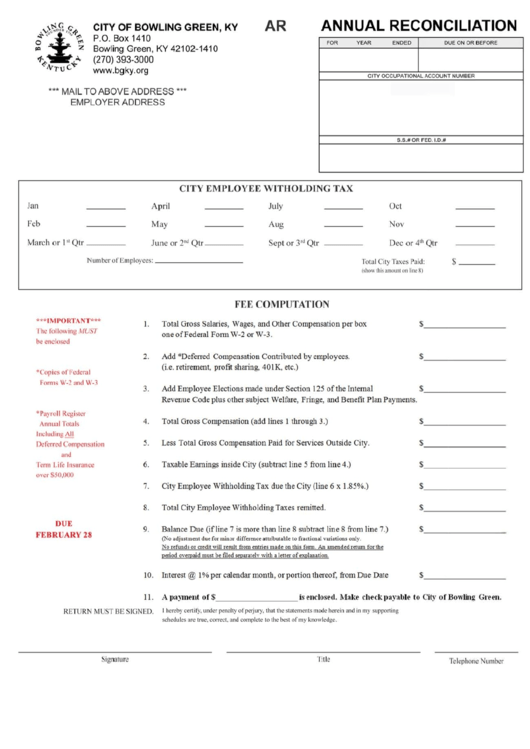

CITY OF BOWLING GREEN

,

KY

AR

ANNUAL RECONCILIATION

~

~

~

o

"

P.O.

Box

141

0

'OR

'EAR

ENDED

oue

ON

OR

B€FORE

~

z

Bowling

Green,

KY 42 102-14

10

1-

..

~.t\rTUC<t-

(270) 393-3000

C

ITY

OCCUPATIONAL

ACCOUNT NUMBER

••• MAIL TO ABOVE ADDRESS

•••

EMPLOYER ADDRESS

S.S., OR FEO. 1.0./11

C

IT

Y EM I'LOYEE

WITHOLDING

TAX

lao

April

July

Oc1

Feb

May

A

ug

Nov

March

or

I"

Qlr

June o

r

20<1

Qtr

Sept

or

3rd

Qtr

Dec

or

4th

Qlf

NllInbcr of Employees:

Total

City

Ta.~cs

Paid:

$

***

IM

I'OI{TANT·**

The follo\\ing

MUST

be

enclosed

'Copies of

FcdcrJI

Fonns W-2

and

W-J

•

Payroll

Registcr

Anl1uul TOlals

Includi ng All

Deferred

Compcns.1tion

and

Term Life

Insuran

ce

over

$50.000

DUE

FEBRUARY 28

(oho"

,hi,

"""""'''flli""

&)

FEE COM

P

UTAT ION

I

.

Tolal

Gross

Salaries, Wages,

and

OIlier

Compensation

per

box

one of Federal

Form

\V-2

or

W-3.

$,- - - - - -

2.

Add

·Deferred Compensation

Contributed

by

employees.

$,

_ _ _ _ _ _ _ _ _

(i.e. retirement,

profit

sharing,

401K,

etc.)

3.

Add Employee Elections made under

Section

125 of the Internal

$,

_ _ _ _ _ _ _ _ _

Revenue Code

plus other

subject

Welfare, Fringe,

and Benefit Plan Payments .

4

.

Total Gross Compemation

(add

lines

I

through

3.)

5.

Less

Total Gross Compensation

Paid

fo

r

Services Outside

City.

6.

Ta.xable Earnings

inside

City

(subtract line

5

from line

4.)

7.

City

Employee WithholdingTa.x

due

the

City

(line

6

x

1.85%.)

8.

Total City

Employee

Withholding Taxes remitted.

9.

Balance Due (if line

7

is more than

line

8

subtract line

8 from

line 7.)

(No

adjullmml due for min)!" differmce IlIribullble

10

ffactiWlal

,·&rillionl

only.

No ufund.9£ qsdi!

"iP

"tuh from

mlrie! mldr

on

lhi,

Conn

An

amrndM [([Urn for,he

Rtriod

o'·np.!jd

mu!1

bf

filM

!SPlntrly

wilh,

l<1!q

ohxpl,nltjon.

$,- - - - -

$ , - - - - - -

$

,

- - - - - -

$,- - - - - -

$,- - - - -

$,- - - - - -

10.

Interest

@

l

%

percalendarmonth

,

orponionthereof,fromDue

Date

$,

_ _ _ _ _ _ _ _ _

II

.

A

I):l)1nt

nl

of

$

_ _ _ _ _ _ _ _ _

h t

ndostd.

~I:lkt

chtck

))ayablt to

City of Bowling

Grttn.

RETURN

MUST BE

SIGNED.

1

hereby certi fy,

IlIIdcr

penally Qfperjury,

Ihal

the

S1a1emeniS

mu,jc

here in

and

in

my

supporting

schedulc. are

truc.

e<llTec!. 3nd romplc!e

to

the

beS!

of my

knowledge.

Signaturc

T:l

le

Telephone Number

1

1