Form Molt-2 - Marshall County Occupational License Tax Return For Schools - 2010

ADVERTISEMENT

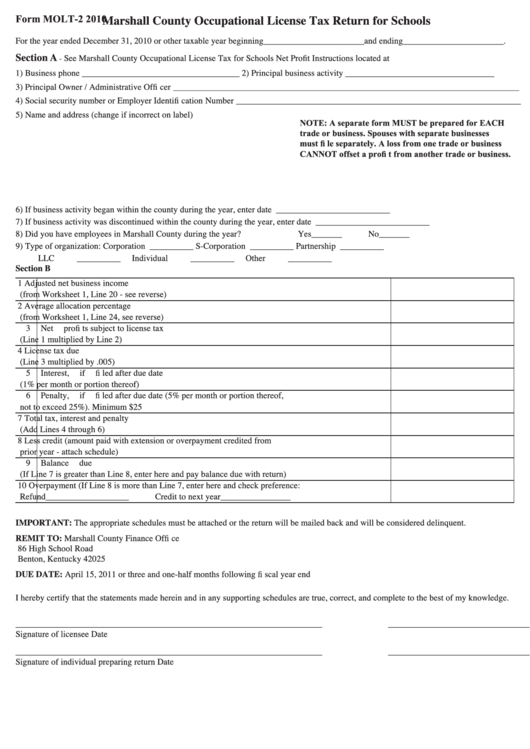

Form MOLT-2

2010

Marshall County Occupational License Tax Return for Schools

For the year ended December 31, 2010 or other taxable year beginning_______________________and ending_______________________.

Section A

See Marshall County Occupational License Tax for Schools Net Profi t Instructions located at

-

1) Business phone ____________________________________

2) Principal business activity __________________________________

3) Principal Owner / Administrative Offi cer _______________________________________________________________________________

4) Social security number or Employer Identifi cation Number _________________________________________________________________

5) Name and address (change if incorrect on label)

NOTE: A separate form MUST be prepared for EACH

trade or business. Spouses with separate businesses

must fi le separately. A loss from one trade or business

CANNOT offset a profi t from another trade or business.

6) If business activity began within the county during the year, enter date

__________________________

7) If business activity was discontinued within the county during the year, enter date

__________________________

8) Did you have employees in Marshall County during the year?

Yes_______

No_______

9) Type of organization:

Corporation __________

S-Corporation __________

Partnership

__________

LLC

__________

Individual

__________

Other

__________

Section B

1

Adjusted net business income

(from Worksheet 1, Line 20 - see reverse)

2

Average allocation percentage

(from Worksheet 1, Line 24, see reverse)

3

Net profi ts subject to license tax

(Line 1 multiplied by Line 2)

4

License tax due

(Line 3 multiplied by .005)

5

Interest, if fi led after due date

(1% per month or portion thereof)

6

Penalty, if fi led after due date (5% per month or portion thereof,

not to exceed 25%). Minimum $25

7

Total tax, interest and penalty

(Add Lines 4 through 6)

8

Less credit (amount paid with extension or overpayment credited from

prior year - attach schedule)

9

Balance due

(If Line 7 is greater than Line 8, enter here and pay balance due with return)

10

Overpayment (If Line 8 is more than Line 7, enter here and check preference:

Refund___________________

Credit to next year________________

IMPORTANT:

The appropriate schedules must be attached or the return will be mailed back and will be considered delinquent.

REMIT TO:

Marshall County Finance Offi ce

86 High School Road

Benton, Kentucky 42025

DUE DATE:

April 15, 2011 or three and one-half months following fi scal year end

I hereby certify that the statements made herein and in any supporting schedules are true, correct, and complete to the best of my knowledge.

______________________________________________________________________

____________________________________

Signature of licensee

Date

______________________________________________________________________

____________________________________

Signature of individual preparing return

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2