Form Ct-706ext - Application For Extension Of Time To File And/or Pay Estate Tax - 2004

ADVERTISEMENT

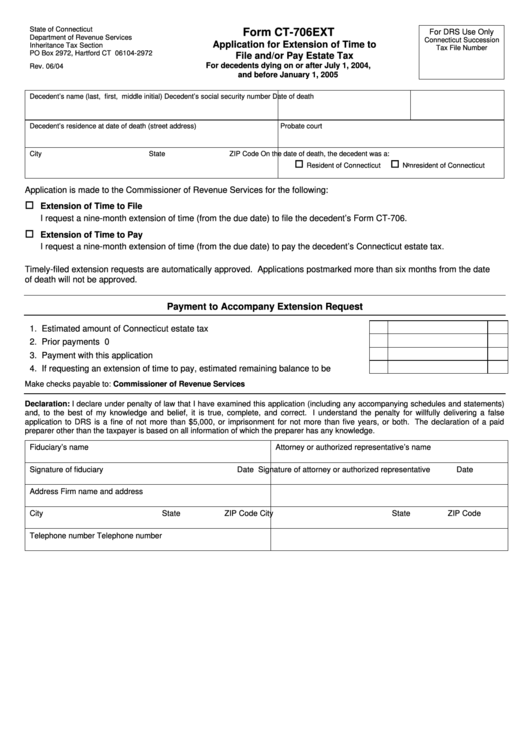

State of Connecticut

Form CT-706EXT

For DRS Use Only

Department of Revenue Services

Connecticut Succession

Application for Extension of Time to

Inheritance Tax Section

Tax File Number

PO Box 2972, Hartford CT 06104-2972

File and/or Pay Estate Tax

For decedents dying on or after July 1, 2004,

Rev. 06/04

and before January 1, 2005

Decedent’s name (last, first, middle initial)

Decedent’s social security number

Date of death

Decedent’s residence at date of death (street address)

Probate court

City

State

ZIP Code

On the date of death, the decedent was a:

Resident of Connecticut

Nonresident of Connecticut

Application is made to the Commissioner of Revenue Services for the following:

Extension of Time to File

I request a nine-month extension of time (from the due date) to file the decedent’s Form CT-706.

Extension of Time to Pay

I request a nine-month extension of time (from the due date) to pay the decedent’s Connecticut estate tax.

Timely-filed extension requests are automatically approved. Applications postmarked more than six months from the date

of death will not be approved.

Payment to Accompany Extension Request

1. Estimated amount of Connecticut estate tax due.....................................................

1.

00

2. Prior payments made..................................................................................................

2.

00

3. Payment with this application......................................................................................

3.

00

4. If requesting an extension of time to pay, estimated remaining balance to be paid...

4.

00

Make checks payable to: Commissioner of Revenue Services

Declaration: I declare under penalty of law that I have examined this application (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false

application to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid

preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Fiduciary’s name

Attorney or authorized representative’s name

Signature of fiduciary

Date

Signature of attorney or authorized representative

Date

Address

Firm name and address

City

State

ZIP Code

City

State

ZIP Code

Telephone number

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1