Form Ct-706ext - Application For Extension Of Time To File And/or Pay Estate Tax Instructions

ADVERTISEMENT

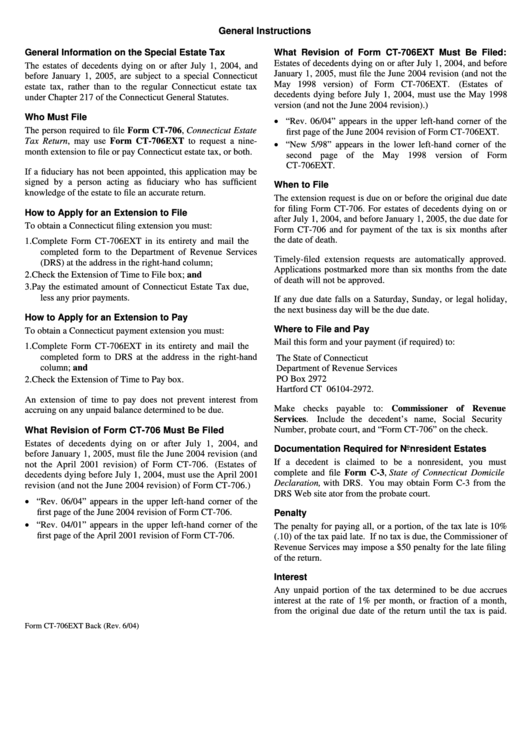

General Instructions

General Information on the Special Estate Tax

What Revision of Form CT-706EXT Must Be Filed:

Estates of decedents dying on or after July 1, 2004, and before

The estates of decedents dying on or after July 1, 2004, and

January 1, 2005, must file the June 2004 revision (and not the

before January 1, 2005, are subject to a special Connecticut

May 1998 version) of Form CT-706EXT.

(Estates of

estate tax, rather than to the regular Connecticut estate tax

decedents dying before July 1, 2004, must use the May 1998

under Chapter 217 of the Connecticut General Statutes.

version (and not the June 2004 revision).)

Who Must File

• “Rev. 06/04” appears in the upper left-hand corner of the

The person required to file Form CT-706, Connecticut Estate

first page of the June 2004 revision of Form CT-706EXT.

Tax Return, may use Form CT-706EXT to request a nine-

• “New 5/98” appears in the lower left-hand corner of the

month extension to file or pay Connecticut estate tax, or both.

second page of the May 1998 version of Form

CT-706EXT.

If a fiduciary has not been appointed, this application may be

signed by a person acting as fiduciary who has sufficient

When to File

knowledge of the estate to file an accurate return.

The extension request is due on or before the original due date

for filing Form CT-706. For estates of decedents dying on or

How to Apply for an Extension to File

after July 1, 2004, and before January 1, 2005, the due date for

To obtain a Connecticut filing extension you must:

Form CT-706 and for payment of the tax is six months after

the date of death.

1. Complete Form CT-706EXT in its entirety and mail the

completed form to the Department of Revenue Services

Timely-filed extension requests are automatically approved.

(DRS) at the address in the right-hand column;

Applications postmarked more than six months from the date

2. Check the Extension of Time to File box; and

of death will not be approved.

3. Pay the estimated amount of Connecticut Estate Tax due,

less any prior payments.

If any due date falls on a Saturday, Sunday, or legal holiday,

the next business day will be the due date.

How to Apply for an Extension to Pay

Where to File and Pay

To obtain a Connecticut payment extension you must:

Mail this form and your payment (if required) to:

1. Complete Form CT-706EXT in its entirety and mail the

completed form to DRS at the address in the right-hand

The State of Connecticut

column; and

Department of Revenue Services

PO Box 2972

2. Check the Extension of Time to Pay box.

Hartford CT 06104-2972.

An extension of time to pay does not prevent interest from

Make checks payable to: Commissioner of Revenue

accruing on any unpaid balance determined to be due.

Services.

Include the decedent’s name, Social Security

Number, probate court, and “Form CT-706” on the check.

What Revision of Form CT-706 Must Be Filed

Estates of decedents dying on or after July 1, 2004, and

Documentation Required for Nonresident Estates

before January 1, 2005, must file the June 2004 revision (and

If a decedent is claimed to be a nonresident, you must

not the April 2001 revision) of Form CT-706. (Estates of

complete and file Form C-3, State of Connecticut Domicile

decedents dying before July 1, 2004, must use the April 2001

Declaration, with DRS. You may obtain Form C-3 from the

revision (and not the June 2004 revision) of Form CT-706.)

DRS Web site at or from the probate court.

• “Rev. 06/04” appears in the upper left-hand corner of the

first page of the June 2004 revision of Form CT-706.

Penalty

• “Rev. 04/01” appears in the upper left-hand corner of the

The penalty for paying all, or a portion, of the tax late is 10%

first page of the April 2001 revision of Form CT-706.

(.10) of the tax paid late. If no tax is due, the Commissioner of

Revenue Services may impose a $50 penalty for the late filing

of the return.

Interest

Any unpaid portion of the tax determined to be due accrues

interest at the rate of 1% per month, or fraction of a month,

from the original due date of the return until the tax is paid.

Form CT-706EXT Back (Rev. 6/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1