Application For Resale Certificate (S) - 2004

ADVERTISEMENT

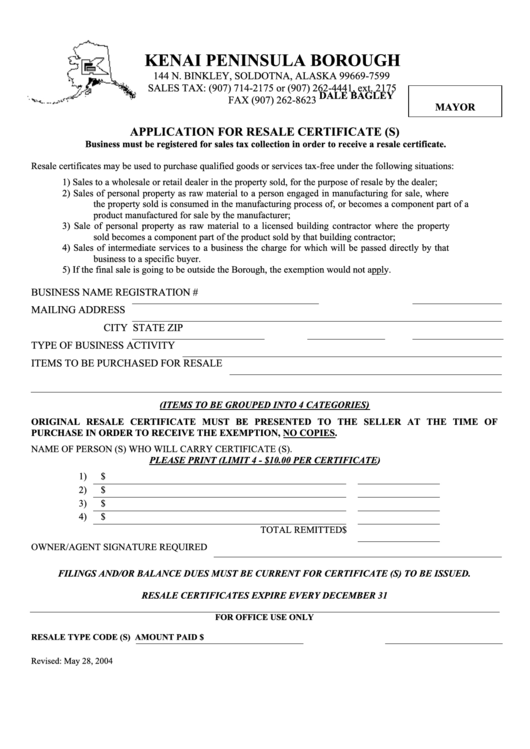

KENAI PENINSULA BOROUGH

144 N. BINKLEY, SOLDOTNA, ALASKA 99669-7599

SALES TAX: (907) 714-2175 or (907) 262-4441, ext. 2175

DALE BAGLEY

FAX (907) 262-8623

MAYOR

APPLICATION FOR RESALE CERTIFICATE (S)

Business must be registered for sales tax collection in order to receive a resale certificate.

Resale certificates may be used to purchase qualified goods or services tax-free under the following situations:

1)

Sales to a wholesale or retail dealer in the property sold, for the purpose of resale by the dealer;

2)

Sales of personal property as raw material to a person engaged in manufacturing for sale, where

the property sold is consumed in the manufacturing process of, or becomes a component part of a

product manufactured for sale by the manufacturer;

3)

Sale of personal property as raw material to a licensed building contractor where the property

sold becomes a component part of the product sold by that building contractor;

4)

Sales of intermediate services to a business the charge for which will be passed directly by that

business to a specific buyer.

5)

If the final sale is going to be outside the Borough, the exemption would not apply.

BUSINESS NAME

REGISTRATION #

MAILING ADDRESS

CITY

STATE

ZIP

TYPE OF BUSINESS ACTIVITY

ITEMS TO BE PURCHASED FOR RESALE

)

(ITEMS TO BE GROUPED INTO 4 CATEGORIES

ORIGINAL RESALE CERTIFICATE MUST BE PRESENTED TO THE SELLER AT THE TIME OF

PURCHASE IN ORDER TO RECEIVE THE EXEMPTION, NO COPIES.

NAME OF PERSON (S) WHO WILL CARRY CERTIFICATE (S).

PLEASE PRINT (LIMIT 4 - $10.00 PER CERTIFICATE)

1)

$

2)

$

3)

$

4)

$

TOTAL REMITTED $

OWNER/AGENT SIGNATURE REQUIRED

FILINGS AND/OR BALANCE DUES MUST BE CURRENT FOR CERTIFICATE (S) TO BE ISSUED.

RESALE CERTIFICATES EXPIRE EVERY DECEMBER 31

FOR OFFICE USE ONLY

RESALE TYPE CODE (S)

AMOUNT PAID $

Revised: May 28, 2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1