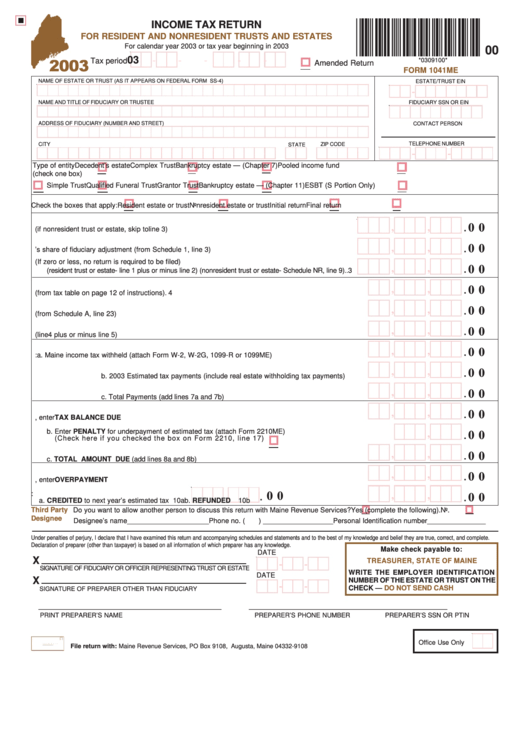

Form 1041me - Income Tax Return For Resident And Nonresident Trusts And Estates - 2003

ADVERTISEMENT

*0309100*

INCOME TAX RETURN

FOR RESIDENT AND NONRESIDENT TRUSTS AND ESTATES

For calendar year 2003 or tax year beginning in 2003

00

-

-

03

-

-

-

*0309100*

Tax period

2003

Amended Return

FORM 1041ME

NAME OF ESTATE OR TRUST (AS IT APPEARS ON FEDERAL FORM SS-4)

ESTATE/TRUST EIN

-

NAME AND TITLE OF FIDUCIARY OR TRUSTEE

FIDUCIARY SSN OR EIN

ADDRESS OF FIDUCIARY (NUMBER AND STREET)

CONTACT PERSON

TELEPHONE NUMBER

CITY

ZIP CODE

STATE

-

-

Type of entity

Decedent’s estate

Complex Trust

Bankruptcy estate — (Chapter 7)

Pooled income fund

(check one box)

Simple Trust

Qualified Funeral Trust

Grantor Trust

Bankruptcy estate — (Chapter 11)

ESBT (S Portion Only)

Check the boxes that apply:

Resident estate or trust

Nonresident estate or trust

Initial return

Final return

0 0

,

,

.

1. Federal taxable income (if nonresident trust or estate, skip to line 3) ................................................ 1

0 0

,

,

.

2. Trust/estate’s share of fiduciary adjustment (from Schedule 1, line 3) ............................................... 2

3. Maine taxable income (If zero or less, no return is required to be filed)

,

,

0 0

.

(resident trust or estate- line 1 plus or minus line 2) (nonresident trust or estate- Schedule NR, line 9) .. 3

,

,

0 0

.

4. Maine income tax (from tax table on page 12 of instructions) .................................................................. 4

,

,

0 0

.

5. Adjustments to tax (from Schedule A, line 23) ......................................................................................... 5

,

,

0 0

.

6. Adjusted Maine income tax (line 4 plus or minus line 5) .......................................................................... 6

,

,

0 0

.

7. Tax payments:

a. Maine income tax withheld (attach Form W-2, W-2G, 1099-R or 1099ME) .......... 7a

,

,

0 0

.

b. 2003 Estimated tax payments (include real estate withholding tax payments) ..... 7b

,

,

0 0

.

c. Total Payments (add lines 7a and 7b) .................................................................... 7c

,

,

0 0

.

8. a. If line 6 is greater than line 7c, enter TAX BALANCE DUE ............................................................... 8a

b. Enter PENALTY for underpayment of estimated tax (attach Form 2210ME)

,

0 0

.

(Check here if you checked the box on Form 2210, line 17)

................................................... 8b

,

,

0 0

.

c. TOTAL AMOUNT DUE (add lines 8a and 8b) ................................................................................... 8c

,

,

0 0

.

9. If line 7c is greater than line 6, enter OVERPAYMENT ............................................................................ 9

10. Overpayment to be:

0 0

,

,

,

0 0

.

.

a. CREDITED to next year’s estimated tax 10a

b. REFUNDED

10b

Third Party

Do you want to allow another person to discuss this return with Maine Revenue Services?

Yes (complete the following).

No.

Designee

Designee’s name _____________________ Phone no. (

) __________________ Personal Identification number _______________

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they are true, correct, and complete.

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Make check payable to:

DATE

X

TREASURER, STATE OF MAINE

-

-

SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING TRUST OR ESTATE

WRITE THE EMPLOYER IDENTIFICATION

DATE

X

NUMBER OF THE ESTATE OR TRUST ON THE

-

-

CHECK —

DO NOT SEND CASH

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY

_______________________________________________

___________________________

________________________

PRINT PREPARER’S NAME

PREPARER’S PHONE NUMBER

PREPARER’S SSN OR PTIN

Office Use Only

File return with: Maine Revenue Services, PO Box 9108, Augusta, Maine 04332-9108

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2