Form Rmft-5-Sfb Instructions

ADVERTISEMENT

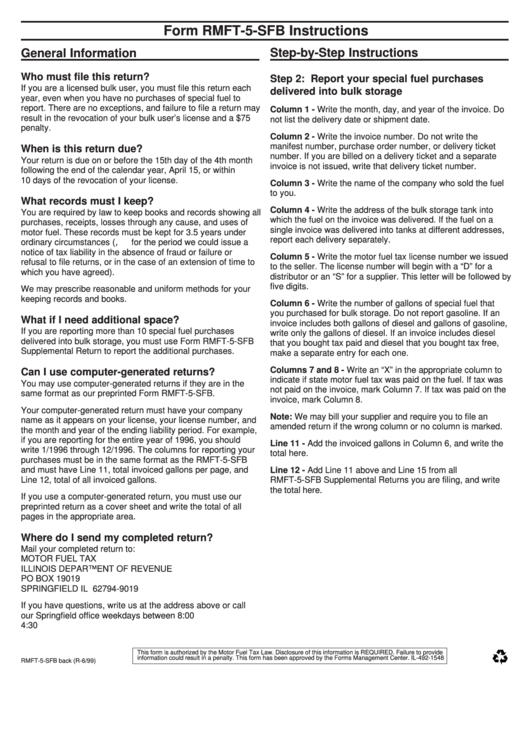

Form RMFT-5-SFB Instructions

Step-by-Step Instructions

General Information

Who must file this return?

Step 2: Report your special fuel purchases

If you are a licensed bulk user, you must file this return each

delivered into bulk storage

year, even when you have no purchases of special fuel to

report. There are no exceptions, and failure to file a return may

Column 1 - Write the month, day, and year of the invoice. Do

result in the revocation of your bulk user’s license and a $75

not list the delivery date or shipment date.

penalty.

Column 2 - Write the invoice number. Do not write the

manifest number, purchase order number, or delivery ticket

When is this return due?

number. If you are billed on a delivery ticket and a separate

Your return is due on or before the 15th day of the 4th month

invoice is not issued, write that delivery ticket number.

following the end of the calendar year, April 15, or within

10 days of the revocation of your license.

Column 3 - Write the name of the company who sold the fuel

to you.

What records must I keep?

Column 4 - Write the address of the bulk storage tank into

You are required by law to keep books and records showing all

which the fuel on the invoice was delivered. If the fuel on a

purchases, receipts, losses through any cause, and uses of

single invoice was delivered into tanks at different addresses,

motor fuel. These records must be kept for 3.5 years under

report each delivery separately.

ordinary circumstances ( i.e., for the period we could issue a

notice of tax liability in the absence of fraud or failure or

Column 5 - Write the motor fuel tax license number we issued

refusal to file returns, or in the case of an extension of time to

to the seller. The license number will begin with a “D” for a

which you have agreed).

distributor or an “S” for a supplier. This letter will be followed by

five digits.

We may prescribe reasonable and uniform methods for your

keeping records and books.

Column 6 - Write the number of gallons of special fuel that

you purchased for bulk storage. Do not report gasoline. If an

What if I need additional space?

invoice includes both gallons of diesel and gallons of gasoline,

If you are reporting more than 10 special fuel purchases

write only the gallons of diesel. If an invoice includes diesel

delivered into bulk storage, you must use Form RMFT-5-SFB

that you bought tax paid and diesel that you bought tax free,

Supplemental Return to report the additional purchases.

make a separate entry for each one.

Columns 7 and 8 - Write an “X” in the appropriate column to

Can I use computer-generated returns?

indicate if state motor fuel tax was paid on the fuel. If tax was

You may use computer-generated returns if they are in the

not paid on the invoice, mark Column 7. If tax was paid on the

same format as our preprinted Form RMFT-5-SFB.

invoice, mark Column 8.

Your computer-generated return must have your company

Note: We may bill your supplier and require you to file an

name as it appears on your license, your license number, and

amended return if the wrong column or no column is marked.

the month and year of the ending liability period. For example,

if you are reporting for the entire year of 1996, you should

Line 11 - Add the invoiced gallons in Column 6, and write the

write 1/1996 through 12/1996. The columns for reporting your

total here.

purchases must be in the same format as the RMFT-5-SFB

and must have Line 11, total invoiced gallons per page, and

Line 12 - Add Line 11 above and Line 15 from all

Line 12, total of all invoiced gallons.

RMFT-5-SFB Supplemental Returns you are filing, and write

the total here.

If you use a computer-generated return, you must use our

preprinted return as a cover sheet and write the total of all

pages in the appropriate area.

Where do I send my completed return?

Mail your completed return to:

MOTOR FUEL TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

If you have questions, write us at the address above or call

our Springfield office weekdays between 8:00 a.m. and

4:30 p.m. at 217 782-2291.

This form is authorized by the Motor Fuel Tax Law. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-1548

RMFT-5-SFB back (R-6/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1