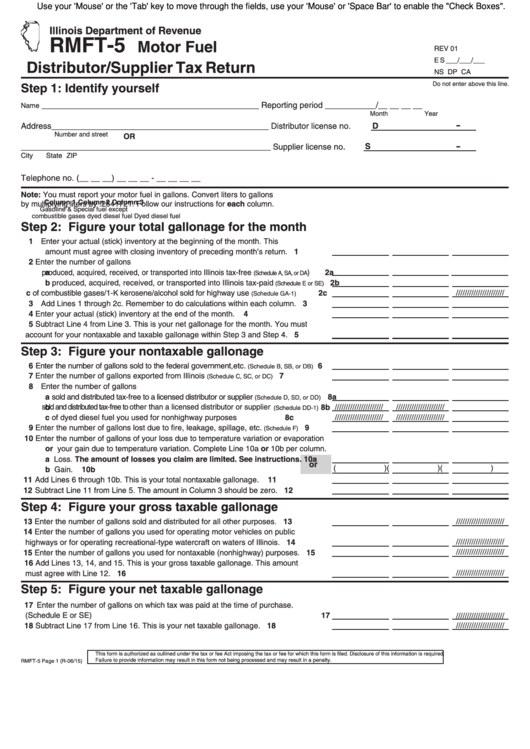

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

RMFT-5

Motor Fuel

REV 01

E S ___/___/___

Distributor/Supplier Tax Return

NS DP CA

Step 1: Identify yourself

Do not enter above this line.

_______________________________________________

Reporting period ___________/__ __ __ __

Name

Month

Year

-

D

Address_______________________________________________

Distributor license no.

Number and street

OR

S

-

______________________________________________________

Supplier license no.

City

State

ZIP

Telephone no. (__ __ __) __ __ __ - __ __ __ __

Note: You must report your motor fuel in gallons. Convert liters to gallons

Column 1

Column 2

Column 3

by multiplying liters by .2641721. Follow our instructions for each column.

Gasoline &

Special fuel except

combustible gases

dyed diesel fuel

Dyed diesel fuel

Step 2: Figure your total gallonage for the month

1 Enter your actual (stick) inventory at the beginning of the month. This

amount must agree with closing inventory of preceding month’s return.

1

2 Enter the number of gallons

a produced, acquired, received, or transported into Illinois tax-free

)

2a

(Schedule A, SA, or DA

b produced, acquired, received, or transported into Illinois tax-paid

2b

(Schedule E or SE)

c of combustible gases/1-K kerosene/alcohol sold for highway use

2c

//////////////////////

(Schedule GA-1)

3 Add Lines 1 through 2c. Remember to do calculations within each column.

3

4 Enter your actual (stick) inventory at the end of the month.

4

5 Subtract Line 4 from Line 3. This is your net gallonage for the month. You must

account for your nontaxable and taxable gallonage within Step 3 and Step 4.

5

Step 3: Figure your nontaxable gallonage

6 Enter the number of gallons sold to the federal government,etc.

6

(Schedule B, SB, or DB)

7 Enter the number of gallons exported from Illinois

7

(Schedule C, SC, or DC)

8 Enter the number of gallons

a sold and distributed tax-free to a licensed distributor or supplier

8a

(Schedule D, SD, or DD)

b sold and distributed tax-free to other than a licensed distributor or supplier

8b

//////////////////////

//////////////////////

(Schedule DD-1)

c of dyed diesel fuel you used for nonhighway purposes

8c

//////////////////////

//////////////////////

9 Enter the number of gallons lost due to fire, leakage, spillage, etc.

9

(Schedule F)

10 Enter the number of gallons of your loss due to temperature variation or evaporation

or your gain due to temperature variation. Complete Line 10a or 10b per column.

a Loss. The amount of losses you claim are limited. See instructions.

10a

or

(

) (

) (

)

b Gain.

10b

11 Add Lines 6 through 10b. This is your total nontaxable gallonage.

11

12 Subtract Line 11 from Line 5. The amount in Column 3 should be zero.

12

Step 4: Figure your gross taxable gallonage

13 Enter the number of gallons sold and distributed for all other purposes.

13

//////////////////////

14 Enter the number of gallons you used for operating motor vehicles on public

//////////////////////

highways or for operating recreational-type watercraft on waters of Illinois.

14

15 Enter the number of gallons you used for nontaxable (nonhighway) purposes.

15

//////////////////////

16 Add Lines 13, 14, and 15. This is your gross taxable gallonage. This amount

//////////////////////

must agree with Line 12.

16

Step 5: Figure your net taxable gallonage

17 Enter the number of gallons on which tax was paid at the time of purchase.

(Schedule E or SE)

17

//////////////////////

18 Subtract Line 17 from Line 16. This is your net taxable gallonage.

18

//////////////////////

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

RMFT-5 Page 1 (R-06/15)

1

1 2

2