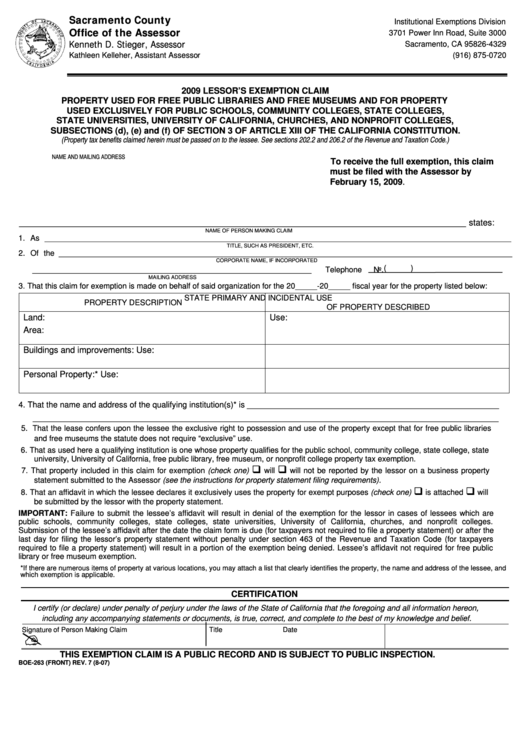

Form Boe-263 - Lessor'S Exemption Claim

ADVERTISEMENT

Sacramento County

Institutional Exemptions Division

Office of the Assessor

3701 Power Inn Road, Suite 3000

Kenneth D. Stieger, Assessor

Sacramento, CA 95826-4329

(916) 875-0720

Kathleen Kelleher

, Assistant Assessor

2009 LESSOR’S EXEMPTION CLAIM

PROPERTY USED FOR FREE PUBLIC LIBRARIES AND FREE MUSEUMS AND FOR PROPERTY

USED EXCLUSIVELY FOR PUBLIC SCHOOLS, COMMUNITY COLLEGES, STATE COLLEGES,

STATE UNIVERSITIES, UNIVERSITY OF CALIFORNIA, CHURCHES, AND NONPROFIT COLLEGES,

SUBSECTIONS (d), (e) and (f) OF SECTION 3 OF ARTICLE XIII OF THE CALIFORNIA CONSTITUTION.

(Property tax benefits claimed herein must be passed on to the lessee. See sections 202.2 and 206.2 of the Revenue and Taxation Code.)

NAME AND MAILING ADDRESS

To receive the full exemption, this claim

must be filed with the Assessor by

February 15, 2009.

______________________________________________________________________________________________ states:

NAME OF PERSON MAKING CLAIM

1. As ___________________________________________________________________________________________________________

TITLE, SUCH AS PRESIDENT, ETC.

2. Of the ________________________________________________________________________________________________________

CORPORATE NAME, IF INCORPORATED

________________________________________________________________ Telephone No. (

)

MAILING ADDRESS

3. That this claim for exemption is made on behalf of said organization for the 20_____-20_____ fiscal year for the property listed below:

STATE PRIMARY AND INCIDENTAL USE

PROPERTY DESCRIPTION

OF PROPERTY DESCRIBED

Land:

Use:

Area:

Buildings and improvements:

Use:

Personal Property:*

Use:

_____________________________________________________

4. That the name and address of the qualifying institution(s)* is

__________________________________________________________________________________________________

5. That the lease confers upon the lessee the exclusive right to possession and use of the property except that for free public libraries

and free museums the statute does not require “exclusive” use.

6. That as used here a qualifying institution is one whose property qualifies for the public school, community college, state college, state

university, University of California, free public library, free museum, or nonprofit college property tax exemption.

7. That property included in this claim for exemption (check one)

will

will not be reported by the lessor on a business property

statement submitted to the Assessor (see the instructions for property statement filing requirements).

8. That an affidavit in which the lessee declares it exclusively uses the property for exempt purposes (check one)

is attached

will

be submitted by the lessor with the property statement.

IMPORTANT: Failure to submit the lessee’s affidavit will result in denial of the exemption for the lessor in cases of lessees which are

public schools, community colleges, state colleges, state universities, University of California, churches, and nonprofit colleges.

Submission of the lessee’s affidavit after the date the claim form is due (for taxpayers not required to file a property statement) or after the

last day for filing the lessor’s property statement without penalty under section 463 of the Revenue and Taxation Code (for taxpayers

required to file a property statement) will result in a portion of the exemption being denied. Lessee’s affidavit not required for free public

library or free museum exemption.

*If there are numerous items of property at various locations, you may attach a list that clearly identifies the property, the name and address of the lessee, and

which exemption is applicable.

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

Signature of Person Making Claim

Title

Date

THIS EXEMPTION CLAIM IS A PUBLIC RECORD AND IS SUBJECT TO PUBLIC INSPECTION.

BOE-263 (FRONT) REV. 7 (8-07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2