Form Boe-231 - Manufacturer'S Exemption Certificate And Use Tax Declaration Form

ADVERTISEMENT

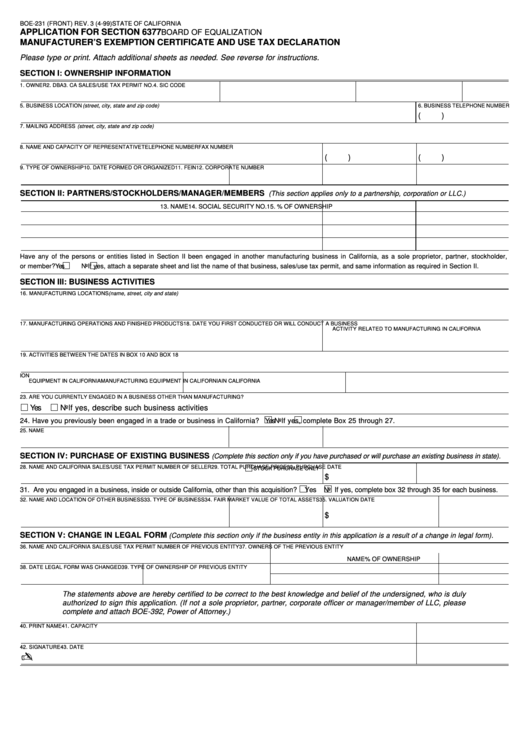

BOE-231 (FRONT) REV. 3 (4-99)

STATE OF CALIFORNIA

APPLICATION FOR SECTION 6377

BOARD OF EQUALIZATION

MANUFACTURER’S EXEMPTION CERTIFICATE AND USE TAX DECLARATION

Please type or print. Attach additional sheets as needed. See reverse for instructions.

SECTION I: OWNERSHIP INFORMATION

1. OWNER

2. DBA

3. CA SALES/USE TAX PERMIT NO.

4. SIC CODE

5. BUSINESS LOCATION (street, city, state and zip code)

6. BUSINESS TELEPHONE NUMBER

(

)

7. MAILING ADDRESS (street, city, state and zip code)

8. NAME AND CAPACITY OF REPRESENTATIVE

TELEPHONE NUMBER

FAX NUMBER

(

)

(

)

9. TYPE OF OWNERSHIP

10. DATE FORMED OR ORGANIZED 11. FEIN

12. CORPORATE NUMBER

SECTION II: PARTNERS/STOCKHOLDERS/MANAGER/MEMBERS

(This section applies only to a partnership, corporation or LLC.)

13. NAME

14. SOCIAL SECURITY NO.

15. % OF OWNERSHIP

Have any of the persons or entities listed in Section II been engaged in another manufacturing business in California, as a sole proprietor, partner, stockholder,

or member?

Yes

No If yes, attach a separate sheet and list the name of that business, sales/use tax permit, and same information as required in Section II.

SECTION III: BUSINESS ACTIVITIES

16. MANUFACTURING LOCATIONS (name, street, city and state)

17. MANUFACTURING OPERATIONS AND FINISHED PRODUCTS

18. DATE YOU FIRST CONDUCTED OR WILL CONDUCT A BUSINESS

ACTIVITY RELATED TO MANUFACTURING IN CALIFORNIA

19. ACTIVITIES BETWEEN THE DATES IN BOX 10 AND BOX 18

20.DATE OF FIRST PURCHASE OF MANUFACTURING

21. DATE OF INCEPTION OF FIRST LEASE OF

22. DATE YOU FIRST BEGAN OR WILL BEGIN PRODUCTION

EQUIPMENT IN CALIFORNIA

MANUFACTURING EQUIPMENT IN CALIFORNIA

IN CALIFORNIA

23. ARE YOU CURRENTLY ENGAGED IN A BUSINESS OTHER THAN MANUFACTURING?

Yes

No If yes, describe such business activities

24. Have you previously been engaged in a trade or business in California?

Yes

No If yes, complete Box 25 through 27.

25. NAME

26. CA SALES/USE TAX PERMIT NO. 27. TYPE OF BUSINESS AND SIC CODE

SECTION IV: PURCHASE OF EXISTING BUSINESS

(Complete this section only if you have purchased or will purchase an existing business in state).

28. NAME AND CALIFORNIA SALES/USE TAX PERMIT NUMBER OF SELLER

29. TOTAL PURCHASE PRICE

30. PURCHASE DATE

STOCK PURCHASE ONLY

$

31. Are you engaged in a business, inside or outside California, other than this acquisition?

Yes

No If yes, complete box 32 through 35 for each business.

32. NAME AND LOCATION OF OTHER BUSINESS

33. TYPE OF BUSINESS

34. FAIR MARKET VALUE OF TOTAL ASSETS 35. VALUATION DATE

$

SECTION V: CHANGE IN LEGAL FORM

(Complete this section only if the business entity in this application is a result of a change in legal form).

36. NAME AND CALIFORNIA SALES/USE TAX PERMIT NUMBER OF PREVIOUS ENTITY

37. OWNERS OF THE PREVIOUS ENTITY

NAME

% OF OWNERSHIP

38. DATE LEGAL FORM WAS CHANGED

39. TYPE OF OWNERSHIP OF PREVIOUS ENTITY

The statements above are hereby certified to be correct to the best knowledge and belief of the undersigned, who is duly

The statements above are hereby certified to be correct to the best knowledge and belief of the undersigned, who is duly

authorized to sign this application. (If not a sole proprietor, partner, corporate officer or manage/member of LLC, please

authorized to sign this application. (If not a sole proprietor, partner, corporate officer or manager/member of LLC, please

complete and attach BOE-392, Power of Attorney.)

complete and attach BOE-392, Power of Attorney.)

40. PRINT NAME

41. CAPACITY

42. SIGNATURE

43. DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2