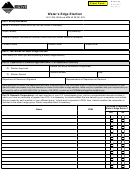

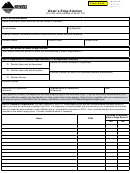

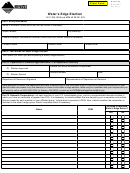

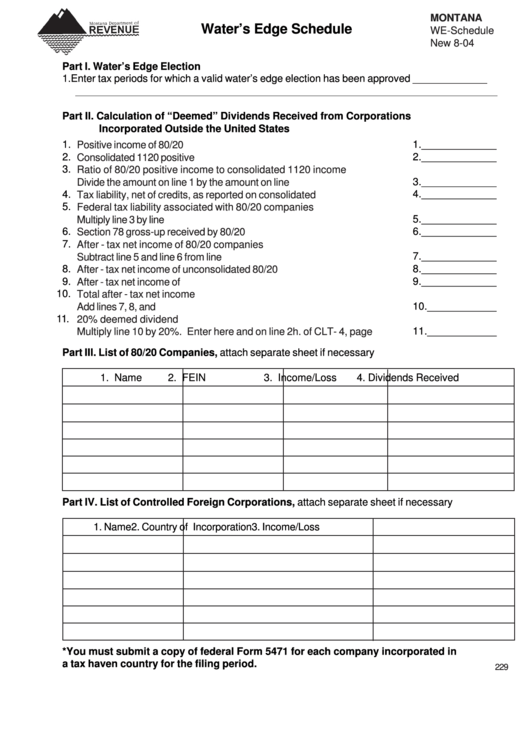

MONTANA

Water’s Edge Schedule

WE-Schedule

New 8-04

Part I. Water’s Edge Election

1. Enter tax periods for which a valid water’s edge election has been approved _____________

Part II. Calculation of “Deemed” Dividends Received from Corporations

Incorporated Outside the United States

1.

1._____________

Positive income of 80/20 companies.................................................................

2.

2._____________

Consolidated 1120 positive income...................................................................

3.

Ratio of 80/20 positive income to consolidated 1120 income

3._____________

Divide the amount on line 1 by the amount on line 2..........................................

4.

4._____________

Tax liability, net of credits, as reported on consolidated 1120.........................

5.

Federal tax liability associated with 80/20 companies

5._____________

Multiply line 3 by line 4..........................................................................................

6._____________

6.

Section 78 gross-up received by 80/20 companies.........................................

7.

After - tax net income of 80/20 companies

7._____________

Subtract line 5 and line 6 from line 1...................................................................

8.

8._____________

After - tax net income of unconsolidated 80/20 companies.............................

9.

9._____________

After - tax net income of U.S. possession companies......................................

10.

Total after - tax net income

10.____________

Add lines 7, 8, and 9.............................................................................................

11.

20% deemed dividend

11.____________

Multiply line 10 by 20%. Enter here and on line 2h. of CLT- 4, page 2.........

Part III. List of 80/20 Companies, attach separate sheet if necessary

1. Name

2. FEIN

3. Income/Loss

4. Dividends Received

Part IV. List of Controlled Foreign Corporations, attach separate sheet if necessary

1. Name

2. Country of Incorporation

3. Income/Loss

*You must submit a copy of federal Form 5471 for each company incorporated in

a tax haven country for the filing period.

229

1

1