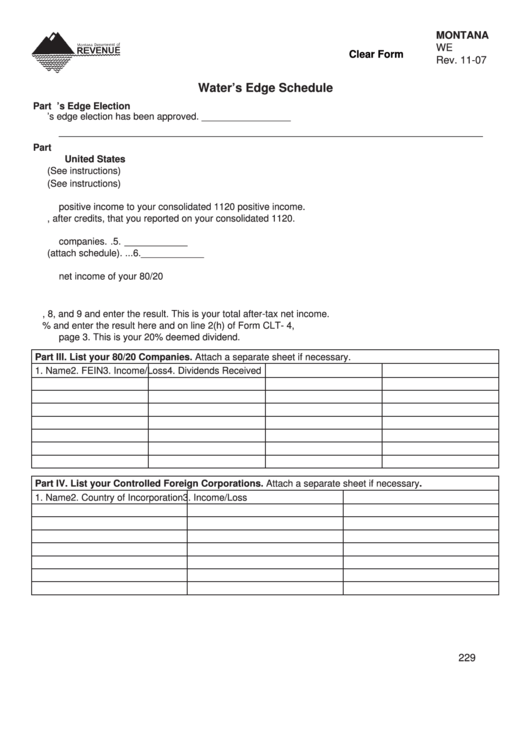

MONTANA

WE

Clear Form

Rev. 11-07

Water’s Edge Schedule

Part I. Water’s Edge Election

1. Enter the tax periods for which a valid water’s edge election has been approved. _________________

_________________________________________________________________________________

Part II. Calculation of Deemed Dividends Received from Corporations Incorporated Outside of the

United States

1. Enter the positive income of your 80/20 companies. (See instructions) .........................1. ____________

2. Enter your consolidated 1120 positive income. (See instructions) .................................2. ____________

3. Divide the amount on line 1 by the amount on line 2. This is the ratio of your 80/20

positive income to your consolidated 1120 positive income. ..........................................3. ____________

4. Enter the tax liability, after credits, that you reported on your consolidated 1120. ..........4. ____________

5. Multiply line 3 by line 4. This is the federal tax liability associated with your 80/20

companies. .....................................................................................................................5. ____________

6. Enter the section 78 gross-up received by your 80/20 companies (attach schedule). ...6. ____________

7. Subtract the total of lines 5 and 6 from line 1 and enter the result. This is the after-tax

net income of your 80/20 companies..............................................................................7. ____________

8. Enter the after-tax net income of all unconsolidated 80/20 companies. .........................8. ____________

9. Enter the after-tax net income of your U.S. possession companies. ..............................9. ____________

10. Add lines 7, 8, and 9 and enter the result. This is your total after-tax net income. .......10. ____________

11. Multiply line 10 by 20% and enter the result here and on line 2(h) of Form CLT- 4,

page 3. This is your 20% deemed dividend. .................................................................11. ____________

Part III. List your 80/20 Companies. Attach a separate sheet if necessary.

1. Name

2. FEIN

3. Income/Loss

4. Dividends Received

Part IV. List your Controlled Foreign Corporations. Attach a separate sheet if necessary.

1. Name

2. Country of Incorporation

3. Income/Loss

229

1

1