Form Dr 1089 - Colorado Tax Amnesty Application And Request For Agreement To Pay Installment Plan - 2003

ADVERTISEMENT

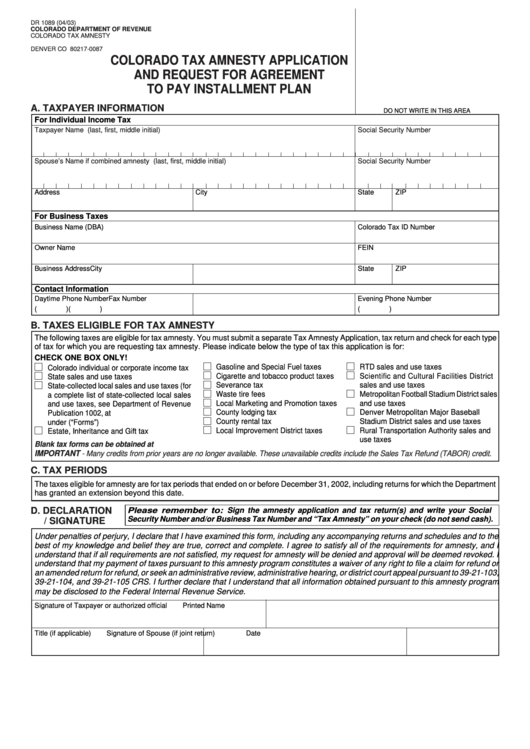

DR 1089 (04/03)

COLORADO DEPARTMENT OF REVENUE

COLORADO TAX AMNESTY

P.O. BOX 17087

DENVER CO 80217-0087

COLORADO TAX AMNESTY APPLICATION

AND REQUEST FOR AGREEMENT

TO PAY INSTALLMENT PLAN

A. TAXPAYER INFORMATION

DO NOT WRITE IN THIS AREA

For Individual Income Tax

Taxpayer Name (last, first, middle initial)

Social Security Number

Spouse’s Name if combined amnesty (last, first, middle initial)

Social Security Number

Address

City

State

ZIP

For Business Taxes

Business Name (DBA)

Colorado Tax ID Number

Owner Name

FEIN

Business Address

City

State

ZIP

Contact Information

Daytime Phone Number

Fax Number

Evening Phone Number

(

)

(

)

(

)

B. TAXES ELIGIBLE FOR TAX AMNESTY

The following taxes are eligible for tax amnesty. You must submit a separate Tax Amnesty Application, tax return and check for each type

of tax for which you are requesting tax amnesty. Please indicate below the type of tax this application is for:

CHECK ONE BOX ONLY!

Gasoline and Special Fuel taxes

RTD sales and use taxes

Colorado individual or corporate income tax

Cigarette and tobacco product taxes

Scientific and Cultural Facilities District

State sales and use taxes

Severance tax

sales and use taxes

State-collected local sales and use taxes (for

Waste tire fees

Metropolitan Football Stadium District sales

a complete list of state-collected local sales

Local Marketing and Promotion taxes

and use taxes

and use taxes, see Department of Revenue

County lodging tax

Denver Metropolitan Major Baseball

Publication 1002, at

County rental tax

Stadium District sales and use taxes

under (“Forms”)

Local Improvement District taxes

Rural Transportation Authority sales and

Estate, Inheritance and Gift tax

use taxes

Blank tax forms can be obtained at

IMPORTANT

- Many credits from prior years are no longer available. These unavailable credits include the Sales Tax Refund (TABOR) credit.

C. TAX PERIODS

The taxes eligible for amnesty are for tax periods that ended on or before December 31, 2002, including returns for which the Department

has granted an extension beyond this date.

D. DECLARATION

Please remember to: Sign the amnesty application and tax return(s) and write your Social

Security Number and/or Business Tax Number and “Tax Amnesty” on your check (do not send cash).

/ SIGNATURE

Under penalties of perjury, I declare that I have examined this form, including any accompanying returns and schedules and to the

best of my knowledge and belief they are true, correct and complete. I agree to satisfy all of the requirements for amnesty, and I

understand that if all requirements are not satisfied, my request for amnesty will be denied and approval will be deemed revoked. I

understand that my payment of taxes pursuant to this amnesty program constitutes a waiver of any right to file a claim for refund or

an amended return for refund, or seek an administrative review, administrative hearing, or district court appeal pursuant to 39-21-103,

39-21-104, and 39-21-105 CRS. I further declare that I understand that all information obtained pursuant to this amnesty program

may be disclosed to the Federal Internal Revenue Service.

Signature of Taxpayer or authorized official

Printed Name

Title (if applicable)

Signature of Spouse (if joint return)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2