Form A-3730 - Computation Of Refund Business Personal Property/refund Cigarette Tax

ADVERTISEMENT

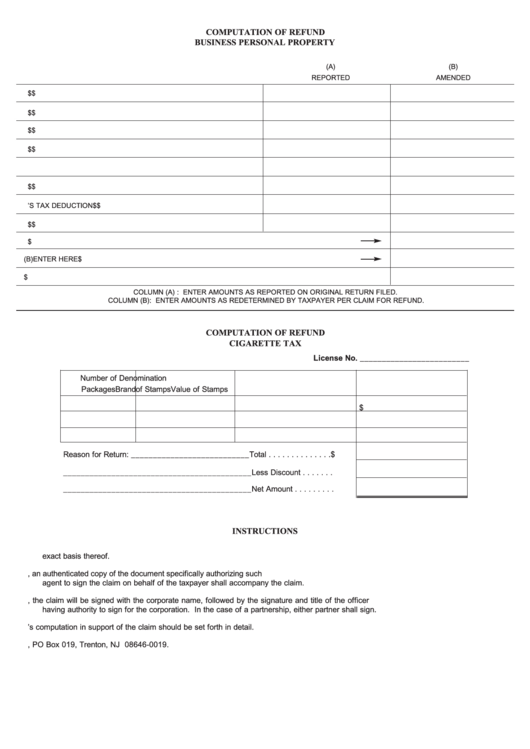

COMPUTATION OF REFUND

BUSINESS PERSONAL PROPERTY

(A)

(B)

REPORTED

AMENDED

1.

ORIGINAL COST

$

$

2.

POLLUTION ABATEMENT EQUIPMENT

$

$

3.

TAXABLE PROPERTY

$

$

4.

TAXABLE VALUE

$

$

5.

TAX RATE

.013

.013

6.

TAX LIABILITY

$

$

7.

VETERAN’S TAX DEDUCTION

$

$

8.

TAX LIABILITY FOR ENTIRE YEAR

$

$

9.

AMOUNT PAID

ENTER HERE

$

10.

TAX LIABILITY - FROM LINE 8 COLUMN (B)

ENTER HERE

$

11.

AMOUNT OF OVERPAYMENT - LINE 9 MINUS LINE 10

$

COLUMN (A) : ENTER AMOUNTS AS REPORTED ON ORIGINAL RETURN FILED.

COLUMN (B): ENTER AMOUNTS AS REDETERMINED BY TAXPAYER PER CLAIM FOR REFUND.

COMPUTATION OF REFUND

CIGARETTE TAX

License No. _________________________

Number of

Denomination

Packages

Brand

of Stamps

Value of Stamps

$

Reason for Return: ___________________________

Total . . . . . . . . . . . . . .

$

___________________________________________

Less Discount . . . . . . .

___________________________________________

Net Amount . . . . . . . . .

INSTRUCTIONS

1. The claim must clearly set forth in detail each ground upon which the claim is based and sufficient facts to apprise the Division of the

exact basis thereof.

2. Whenever a claim is executed by an agent on behalf of the taxpayer, an authenticated copy of the document specifically authorizing such

agent to sign the claim on behalf of the taxpayer shall accompany the claim.

3. Where the taxpayer is a corporation, the claim will be signed with the corporate name, followed by the signature and title of the officer

having authority to sign for the corporation. In the case of a partnership, either partner shall sign.

4. Taxpayer’s computation in support of the claim should be set forth in detail.

5. Claims for refund should be filed with the Division of Taxation, PO Box 019, Trenton, NJ 08646-0019.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1