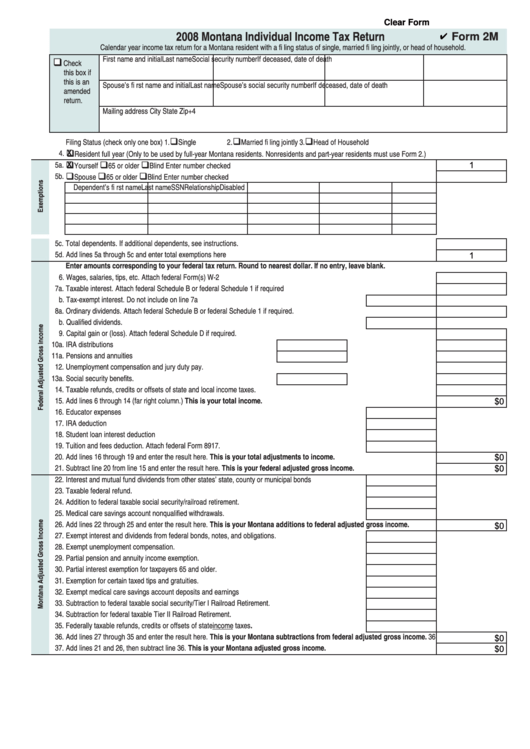

Clear Form

2008 Montana Individual Income Tax Return

Form 2M

Calendar year income tax return for a Montana resident with a fi ling status of single, married fi ling jointly, or head of household.

First name and initial

Last name

Social security number

If deceased, date of death

Check

this box if

this is an

Spouse’s fi rst name and initial

Last name

Spouse’s social security number If deceased, date of death

amended

return.

Mailing address

City

State

Zip+4

Filing Status (check only one box)

1.

Single

2.

Married fi ling jointly

3.

Head of Household

4.

Resident full year (Only to be used by full-year Montana residents. Nonresidents and part-year residents must use Form 2.)

X

1

5a.

Yourself

65 or older

Blind

Enter number checked ................................................ 5a.

X

5b.

Spouse

65 or older

Blind

Enter number checked ................................................ 5b.

Dependent’s fi rst name

Last name

SSN

Relationship

Disabled

5c. Total dependents. If additional dependents, see instructions. .......................................................................................................... 5c.

5d. Add lines 5a through 5c and enter total exemptions here ................................................................................................................ 5d.

1

Enter amounts corresponding to your federal tax return. Round to nearest dollar. If no entry, leave blank.

6. Wages, salaries, tips, etc. Attach federal Form(s) W-2 ...................................................................................................................... 6.

7a. Taxable interest. Attach federal Schedule B or federal Schedule 1 if required ................................................................................ 7a.

b. Tax-exempt interest. Do not include on line 7a .........................................................................................7b.

8a. Ordinary dividends. Attach federal Schedule B or federal Schedule 1 if required. ........................................................................... 8a.

b. Qualifi ed dividends. ...................................................................................................................................8b.

9. Capital gain or (loss). Attach federal Schedule D if required. ............................................................................................................. 9.

10a. IRA distributions ................................................................................... 10a.

Taxable amount. .............. 10b.

11a. Pensions and annuities ........................................................................ 11a.

Taxable amount. .............. 11b.

12. Unemployment compensation and jury duty pay. ............................................................................................................................. 12.

13a. Social security benefi ts. ........................................................................ 13a.

Taxable amount. .............. 13b.

14. Taxable refunds, credits or offsets of state and local income taxes. ................................................................................................ 14.

15. Add lines 6 through 14 (far right column.) This is your total income. ............................................................................................ 15.

$0

16. Educator expenses ....................................................................................................................................16.

17. IRA deduction ............................................................................................................................................17.

18. Student loan interest deduction .................................................................................................................18.

19. Tuition and fees deduction. Attach federal Form 8917. .............................................................................19.

$0

20. Add lines 16 through 19 and enter the result here. This is your total adjustments to income. ................................................... 20.

$0

21. Subtract line 20 from line 15 and enter the result here. This is your federal adjusted gross income. ........................................ 21.

22. Interest and mutual fund dividends from other states’ state, county or municipal bonds ..........................22.

23. Taxable federal refund. ..............................................................................................................................23.

24. Addition to federal taxable social security/railroad retirement. ..................................................................24.

25. Medical care savings account nonqualifi ed withdrawals. ..........................................................................25.

26. Add lines 22 through 25 and enter the result here. This is your Montana additions to federal adjusted gross income. .......... 26.

$0

27. Exempt interest and dividends from federal bonds, notes, and obligations. .............................................27.

28. Exempt unemployment compensation. .....................................................................................................28.

29. Partial pension and annuity income exemption. ........................................................................................29.

30. Partial interest exemption for taxpayers 65 and older. ..............................................................................30.

31. Exemption for certain taxed tips and gratuities. .........................................................................................31.

32. Exempt medical care savings account deposits and earnings ..................................................................32.

33. Subtraction to federal taxable social security/Tier I Railroad Retirement. .................................................33.

34. Subtraction for federal taxable Tier II Railroad Retirement. ......................................................................34.

35. Federally taxable refunds, credits or offsets of state income taxes. ..........................................................35.

36. Add lines 27 through 35 and enter the result here. This is your Montana subtractions from federal adjusted gross income. 36.

$0

$0

37. Add lines 21 and 26, then subtract line 36. This is your Montana adjusted gross income. ........................................................ 37.

1

1 2

2 3

3 4

4