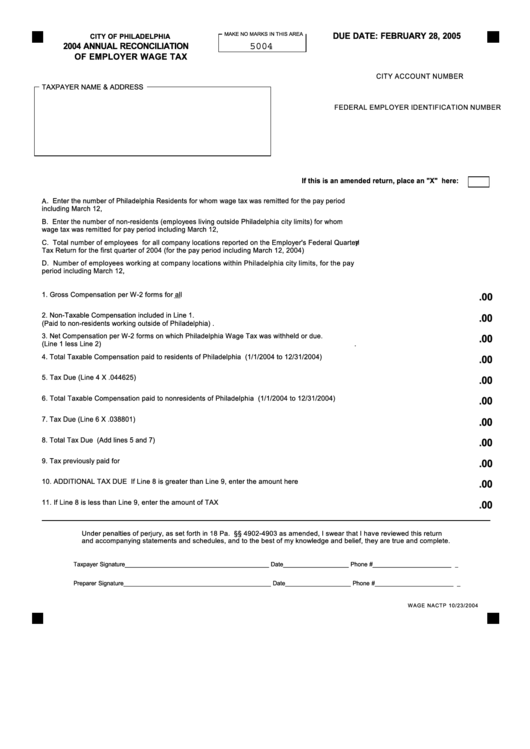

Annual Reconciliation Of Employer Wage Tax Form October 2004

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

DUE DATE: FEBRUARY 28, 2005

CITY OF PHILADELPHIA

2004 ANNUAL RECONCILIATION

5004

OF EMPLOYER WAGE TAX

CITY ACCOUNT NUMBER

TAXPAYER NAME & ADDRESS

FEDERAL EMPLOYER IDENTIFICA TION NUMBER

If this is an amended return, place an "X" here:

A . Enter the number of Philadelphia Residents for whom wage tax was remitted for the pay period

including March 12, 2004.......................... ............... ............... .............................. ............... ............... ............... .......A .

B. Enter the number of non-residents (employees living outside Philadelphia city lim its) for whom

wage tax was remitted f or pay period including March 12, 2004....................... ............... ..........................................B .

C. Total number of employees for all company locations reported on the Employer's Federal Quarterly

Tax Return f or the first quarter of 2004 (for the pay period including March 12, 2004)................................... ............C.

D. Number of employees working at company locations within Philadelphia city limits, f or the pay

period including March 12, 2004............... ............... ............... ............... ............... .............................. ............... .......D.

1. Gross Compensation per W-2 forms for all employees.......................... ............... ............... ............1.

.00

2. Non-Taxable Compensation included in Line 1.

.00

(Paid to non-residents working outside of Philadelphia)................ ............... ............... ............... ......2.

3. Net Compensation per W-2 forms on which Philadelphia W age Tax was withheld or due.

.00

(Line 1 less Line 2)............................ ............... ............... ............... ............................................. ....3.

4. Total Taxable Compensation paid to residents of Philadelphia (1/1/2004 to 12/31/2004)................4.

.00

5. Tax Due (Line 4 X .044625).......................... ............... ............... ............... .............................. ........5.

.00

6. Total Taxable Compensation paid to nonresidents of Philadelphia (1/1/2004 to 12/31/2004)..........6.

.00

7. Tax Due (Line 6 X .038801).......................... ............... ............... ............... .............................. ........7.

.00

8. Total Tax Due (A dd lines 5 and 7)...................... ............... ............... ............... ............... ............... .8.

.00

9. Tax previously paid f or 2004....................... ............... ............... .............................. ............... ..........9.

.00

10. A DDITIONA L TA X DUE If Line 8 is greater than Line 9, enter the amount here ............ .............10.

.00

11. If Line 8 is less than Line 9, enter the amount of TA X OVERPA ID.... .............................. .............11.

.00

Under penalties of perjury, as set forth in 18 Pa. C.S . §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief , they are true and complete.

Taxpayer Signature____________________________________ _______ _ Date____________________ Phone #________________________ _

Preparer Signature______________________ _______ ________ _______ _ Date____________________ Phone #________________________ _

WAGE NACTP 10/23/2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1