Form Ct-Wh (Drs) - Connecticut Withholding Tax Payment Schedule December 2008

ADVERTISEMENT

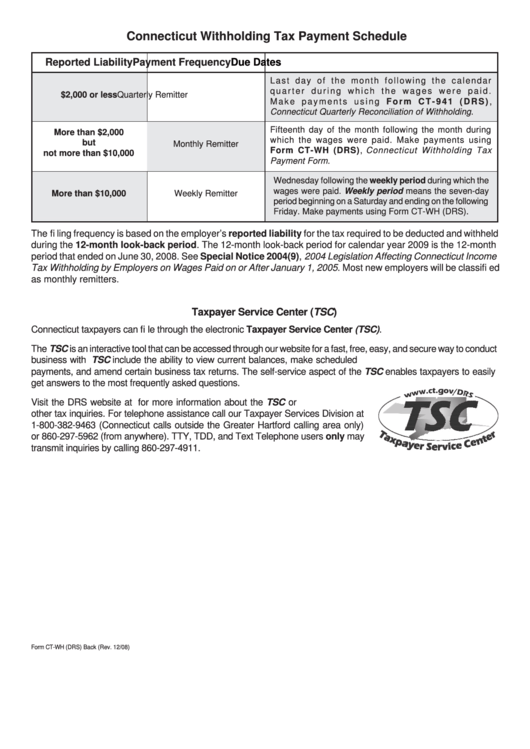

Connecticut Withholding Tax Payment Schedule

Reported Liability

Payment Frequency

Due Dates

L a s t d a y o f t h e m o n t h f o l l o w i n g t h e c a l e n d a r

q u a r t e r d u r i n g w h i c h t h e w a g e s w e r e p a i d .

$2,000 or less

Quarterly Remitter

M a k e p a y m e n t s u s i n g F o r m C T- 9 4 1 ( D R S ) ,

Connecticut Quarterly Reconciliation of Withholding.

Fifteenth day of the month following the month during

More than $2,000

which the wages were paid. Make payments using

but

Monthly Remitter

Form CT-WH (DRS), Connecticut Withholding Tax

not more than $10,000

Payment Form.

Wednesday following the weekly period during which the

wages were paid. Weekly period means the seven-day

More than $10,000

Weekly Remitter

period beginning on a Saturday and ending on the following

Friday. Make payments using Form CT-WH (DRS).

The fi ling frequency is based on the employer’s reported liability for the tax required to be deducted and withheld

during the 12-month look-back period. The 12-month look-back period for calendar year 2009 is the 12-month

period that ended on June 30, 2008. See Special Notice 2004(9), 2004 Legislation Affecting Connecticut Income

Tax Withholding by Employers on Wages Paid on or After January 1, 2005. Most new employers will be classifi ed

as monthly remitters.

Taxpayer Service Center (TSC)

Connecticut taxpayers can fi le through the electronic Taxpayer Service Center (TSC).

The TSC is an interactive tool that can be accessed through our website for a fast, free, easy, and secure way to conduct

business with DRS. Some of the features of the TSC include the ability to view current balances, make scheduled

payments, and amend certain business tax returns. The self-service aspect of the TSC enables taxpayers to easily

get answers to the most frequently asked questions.

Visit the DRS website at for more information about the TSC or

other tax inquiries. For telephone assistance call our Taxpayer Services Division at

1-800-382-9463 (Connecticut calls outside the Greater Hartford calling area only)

or 860-297-5962 (from anywhere). TTY, TDD, and Text Telephone users only may

transmit inquiries by calling 860-297-4911.

Form CT-WH (DRS) Back (Rev. 12/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1