Form Ir - Income Tax Return 2003

ADVERTISEMENT

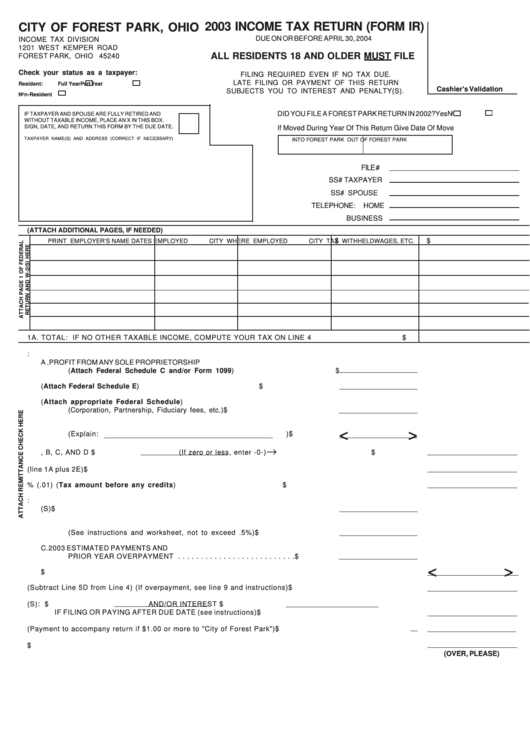

2003 INCOME TAX RETURN (FORM IR)

CITY OF FOREST PARK, OHIO

DUE ON OR BEFORE APRIL 30, 2004

INCOME TAX DIVISION

1201 WEST KEMPER ROAD

ALL RESIDENTS 18 AND OLDER MUST FILE

FOREST PARK, OHIO 45240

Check your status as a taxpayer:

FILING REQUIRED EVEN IF NO TAX DUE.

LATE FILING OR PAYMENT OF THIS RETURN

Resident:

Full Year

Part Year

Cashier's Validation

SUBJECTS YOU TO INTEREST AND PENALTY(S).

Non-Resident

DID YOU FILE A FOREST PARK RETURN IN 2002?

Yes

No

IF TAXPAYER AND SPOUSE ARE FULLY RETIRED AND

WITHOUT TAXABLE INCOME, PLACE AN X IN THIS BOX.

SIGN, DATE, AND RETURN THIS FORM BY THE DUE DATE.

If Moved During Year Of This Return Give Date Of Move

TAXPAYER NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

INTO FOREST PARK

OUT OF FOREST PARK

FILE #

SS# TAXPAYER

SS# SPOUSE

TELEPHONE: HOME

BUSINESS

1.

ENTER TOTAL COMPENSATION/WAGES BEFORE ANY PAYROLL DEDUCTIONS (ATTACH ADDITIONAL PAGES, IF NEEDED)

PRINT EMPLOYER'S NAME

DATES EMPLOYED

CITY WHERE EMPLOYED

$

CITY TAX WITHHELD

$

WAGES, ETC.

1A. TOTAL: IF NO OTHER TAXABLE INCOME, COMPUTE YOUR TAX ON LINE 4

$

2. TOTAL PROFIT FROM INCOME OTHER THAN WAGES:

A . PROFIT FROM ANY SOLE PROPRIETORSHIP

(Attach Federal Schedule C and/or Form 1099)

$

B.

RENTAL INCOME (Attach Federal Schedule E)

$

C. OTHER INCOME (Attach appropriate Federal Schedule)

(Corporation, Partnership, Fiduciary fees, etc.)

$

D. DEDUCTIBLE INCOME/NON-TAXABLE INCOME

<

>

(Explain:

)

$

→

E. TOTAL A, B, C, AND D $

(If zero or less, enter -0-)

$

3. TOTAL TAXABLE INCOME (line 1A plus 2E)

$

4. MULTIPLY TAXABLE INCOME BY 1% (.01) (Tax amount before any credits)

$

5.

LESS PAYMENTS AND CREDITS:

A . FOREST PARK TAX WITHHELD BY EMPLOYER(S)

$

B. ALLOWABLE CREDIT ON INCOME TAXED BY ANOTHER CITY/COUNTY

(See instructions and worksheet, not to exceed .5%)

$

C. 2003 ESTIMATED PAYMENTS AND

PRIOR YEAR OVERPAYMENT . . . . . . . . . . . . . . . . . . . . . . . . . .

$

<

>

D. TOTAL PAYMENTS AND CREDITS

$

6. TAX LESS CREDITS (Subtract Line 5D from Line 4) (If overpayment, see line 9 and instructions)

$

7. ADD PENALTY(S): $

AND/OR INTEREST $

IF FILING OR PAYING AFTER DUE DATE (see instructions)

$

8. TOTAL AMOUNT DUE FOR 2003. (Payment to accompany return if $1.00 or more to "City of Forest Park")

$

9. OVERPAYMENT FOR 2003 - RECORD HERE AND CARRY TO LINE 14

$

(OVER, PLEASE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3