Form Pit-1 - New Mexico Personal Income Tax - 2007

ADVERTISEMENT

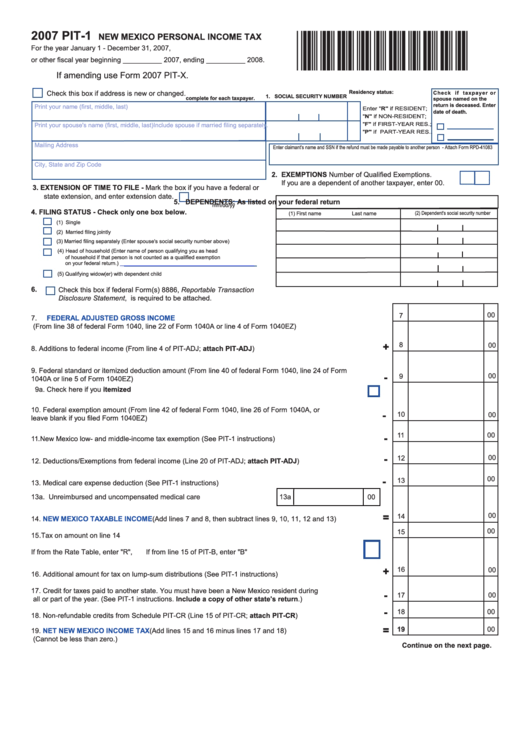

2007 PIT-1

*70180200*

NEW MEXICO PERSONAL INCOME TAX

For the year January 1 - December 31, 2007,

or other fiscal year beginning __________ 2007, ending __________ 2008.

If amending use Form 2007 PIT-X.

Residency status:

Check this box if address is new or changed.

Check if taxpayer or

1. SOCIAL SECURITy NUMBER

complete for each taxpayer.

spouse named on the

return is deceased. Enter

Print your name (first, middle, last)

Enter "R" if RESIDENT;

date of death.

"N" if NON-RESIDENT;

"F" if FIRST-YEAR RES.;

Print your spouse's name (first, middle, last)Include spouse if married filing separately.

"P" if PART-YEAR RES..

Mailing Address

Enter claimant's name and SSN if the refund must be made payable to another person - Attach Form RPD-41083

City, State and Zip Code

2. EXEMPTIONS Number of Qualified Exemptions.

If you are a dependent of another taxpayer, enter 00.

3. EXTENSION OF TIME TO FILE - Mark the box if you have a federal or

state extension, and enter extension date.

5. DEPENDENTS: As listed on your federal return

mm/dd/yy

4. FILING STATUS - Check only one box below.

(2) Dependent's social security number

(1) First name

Last name

(1) Single

(2) Married filing jointly

(3) Married filing separately (Enter spouse's social security number above)

(4) Head of household (Enter name of person qualifying you as head

of household if that person is not counted as a qualified exemption

on your federal return.)

______________________________________________

(5) Qualifying widow(er) with dependent child

6.

Check this box if federal Form(s) 8886, Reportable Transaction

Disclosure Statement, is required to be attached.

00

7

7.

FEDERAL ADJUSTED GROSS INCOME

..........................................................................................................

(From line 38 of federal Form 1040, line 22 of Form 1040A or line 4 of Form 1040EZ)

+

8

00

8.

Additions to federal income (From line 4 of PIT-ADJ; attach PIT-ADJ) ...............................................................

9.

Federal standard or itemized deduction amount (From line 40 of federal Form 1040, line 24 of Form

-

00

9

1040A or line 5 of Form 1040EZ) ........................................................................................................................

9a. Check here if you itemized ......................................................................................................................

10. Federal exemption amount (From line 42 of federal Form 1040, line 26 of Form 1040A, or

-

10

00

leave blank if you filed Form 1040EZ) ..................................................................................................................

00

-

11

.

11

New Mexico low- and middle-income tax exemption (See PIT-1 instructions) .....................................................

-

12

00

12. Deductions/Exemptions from federal income (Line 20 of PIT-ADJ; attach PIT-ADJ) ..........................................

-

00

13

13. Medical care expense deduction (See PIT-1 instructions) ....................................................................................

13a. Unreimbursed and uncompensated medical care expenses....................

13a

00

=

00

14

14.

NEW MEXICO TAXABLE INCOME

(Add lines 7 and 8, then subtract lines 9, 10, 11, 12 and 13) ......................

00

15

.

15

Tax on amount on line 14 .....................................................................................................................................

If from the Rate Table, enter "R",

If from line 15 of PIT-B, enter "B" ........................................

+

16

00

16. Additional amount for tax on lump-sum distributions (See PIT-1 instructions) .....................................................

17. Credit for taxes paid to another state. You must have been a New Mexico resident during

-

00

17

all or part of the year. (See PIT-1 instructions. Include a copy of other state's return.) ...................................

-

18

00

18. Non-refundable credits from Schedule PIT-CR (Line 15 of PIT-CR; attach PIT-CR) ...........................................

=

19

00

19.

NET NEW MEXICO INCOME TAX

(Add lines 15 and 16 minus lines 17 and 18) ...............................................

(Cannot be less than zero.)

Continue on the next page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3