Form 207hcc - Health Care Center Tax Return - 2003

ADVERTISEMENT

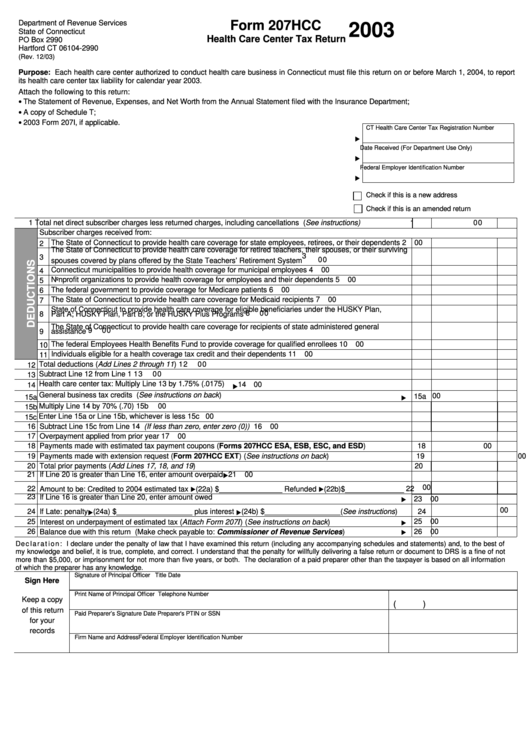

Department of Revenue Services

Form 207HCC

2003

State of Connecticut

Health Care Center Tax Return

PO Box 2990

Hartford CT 06104-2990

(Rev. 12/03)

Purpose: Each health care center authorized to conduct health care business in Connecticut must file this return on or before March 1, 2004, to report

its health care center tax liability for calendar year 2003.

Attach the following to this return:

•

The Statement of Revenue, Expenses, and Net Worth from the Annual Statement filed with the Insurance Department;

•

A copy of Schedule T;

•

2003 Form 207I, if applicable.

CT Health Care Center Tax Registration Number

Date Received (For Department Use Only)

Federal Employer Identification Number

Check if this is a new address

Check if this is an amended return

1 Total net direct subscriber charges less returned charges, including cancellations (See instructions)

1

00

Subscriber charges received from:

The State of Connecticut to provide health care coverage for state employees, retirees, or their dependents

2

00

2

The State of Connecticut to provide health care coverage for retired teachers, their spouses, or their surviving

3

3

00

spouses covered by plans offered by the State Teachers’ Retirement System

Connecticut municipalities to provide health coverage for municipal employees

4

00

4

Nonprofit organizations to provide health coverage for employees and their dependents

5

00

5

The federal government to provide coverage for Medicare patients

6

00

6

The State of Connecticut to provide health care coverage for Medicaid recipients

7

00

7

State of Connecticut to provide health care coverage for eligible beneficiaries under the HUSKY Plan,

8

8

00

Part A; HUSKY Plan, Part B; or the HUSKY Plus Programs

The State of Connecticut to provide health care coverage for recipients of state administered general

9

9

00

assistance

10 The federal Employees Health Benefits Fund to provide coverage for qualified enrollees

10

00

11 Individuals eligible for a health coverage tax credit and their dependents

11

00

12 Total deductions (Add Lines 2 through 11)

12

00

13 Subtract Line 12 from Line 1

13

00

14 Health care center tax: Multiply Line 13 by 1.75% (.0175)

14

00

15a General business tax credits (See instructions on back)

00

15a

15b Multiply Line 14 by 70% (.70)

15b

00

15c Enter Line 15a or Line 15b, whichever is less

15c

00

16 Subtract Line 15c from Line 14 (If less than zero, enter zero (0))

16

00

17 Overpayment applied from prior year

17

00

18 Payments made with estimated tax payment coupons (Forms 207HCC ESA, ESB, ESC, and ESD)

18

00

19 Payments made with extension request (Form 207HCC EXT) (See instructions on back)

19

00

20 Total prior payments (Add Lines 17, 18, and 19)

20

00

21 If Line 20 is greater than Line 16, enter amount overpaid

21

00

00

22 Amount to be: Credited to 2004 estimated tax (22a) $_______________ Refunded (22b)$______________

22

23 If Line 16 is greater than Line 20, enter amount owed

23

00

00

24 If Late: penalty (24a) $__________________ plus interest (24b) $__________________(See instructions)

24

25

00

25 Interest on underpayment of estimated tax (Attach Form 207

I

) (See instructions on back)

26 Balance due with this return (Make check payable to: Commissioner of Revenue Services)

26

00

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return or document to DRS is a fine of not

more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Signature of Principal Officer

Title

Date

Sign Here

Print Name of Principal Officer

Telephone Number

Keep a copy

(

)

of this return

Paid Preparer’s Signature

Date

Preparer's PTIN or SSN

for your

records

Firm Name and Address

Federal Employer Identification Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1