Instructions For Form 207hcc - Health Care Center Tax Return

ADVERTISEMENT

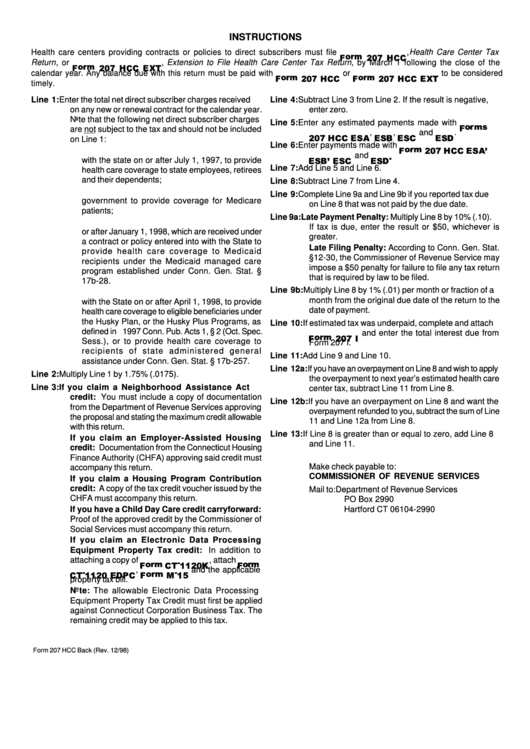

INSTRUCTIONS

Health care centers providing contracts or policies to direct subscribers must file

, Health Care Center Tax

Return , or

, Extension to File Health Care Center Tax Return , by March 1 following the close of the

calendar year. Any balance due with this return must be paid with

or

to be considered

timely.

Line 1:

Enter the total net direct subscriber charges received

Line 4:

Subtract Line 3 from Line 2. If the result is negative,

on any new or renewal contract for the calendar year.

enter zero.

Note that the following net direct subscriber charges

Line 5:

Enter any estimated payments made with

are not subject to the tax and should not be included

,

,

and

.

on Line 1:

Line 6:

Enter payments made with

1. Any new or renewal contract or policy entered into

and

with the state on or after July 1, 1997, to provide

Line 7:

Add Line 5 and Line 6.

health care coverage to state employees, retirees

and their dependents;

Line 8:

Subtract Line 7 from Line 4.

2. Any subscriber charges received from the federal

Line 9:

Complete Line 9a and Line 9b if you reported tax due

government to provide coverage for Medicare

on Line 8 that was not paid by the due date.

patients;

Line 9a: Late Payment Penalty: Multiply Line 8 by 10% (.10).

3. Any subscriber charges attributable to a period on

If tax is due, enter the result or $50, whichever is

or after January 1, 1998, which are received under

greater.

a contract or policy entered into with the State to

Late Filing Penalty: According to Conn. Gen. Stat.

provide health care coverage to Medicaid

§12-30, the Commissioner of Revenue Service may

recipients under the Medicaid managed care

impose a $50 penalty for failure to file any tax return

program established under Conn. Gen. Stat. §

that is required by law to be filed.

17b-28.

Line 9b: Multiply Line 8 by 1% (.01) per month or fraction of a

4. Any new or renewal contract or policy entered into

month from the original due date of the return to the

with the State on or after April 1, 1998, to provide

date of payment.

health care coverage to eligible beneficiaries under

the Husky Plan, or the Husky Plus Programs, as

Line 10: If estimated tax was underpaid, complete and attach

defined in 1997 Conn. Pub. Acts 1, § 2 (Oct. Spec.

and enter the total interest due from

Sess.), or to provide health care coverage to

Form 207 I.

recipients of state administered general

Line 11: Add Line 9 and Line 10.

assistance under Conn. Gen. Stat. § 17b-257.

Line 12a: If you have an overpayment on Line 8 and wish to apply

Line 2:

Multiply Line 1 by 1.75% (.0175).

the overpayment to next year’s estimated health care

Line 3:

If you claim a Neighborhood Assistance Act

center tax, subtract Line 11 from Line 8.

credit: You must include a copy of documentation

Line 12b: If you have an overpayment on Line 8 and want the

from the Department of Revenue Services approving

overpayment refunded to you, subtract the sum of Line

the proposal and stating the maximum credit allowable

11 and Line 12a from Line 8.

with this return.

Line 13: If Line 8 is greater than or equal to zero, add Line 8

If you claim an Employer-Assisted Housing

and Line 11.

credit: Documentation from the Connecticut Housing

Finance Authority (CHFA) approving said credit must

Make check payable to:

accompany this return.

COMMISSIONER OF REVENUE SERVICES

If you claim a Housing Program Contribution

credit: A copy of the tax credit voucher issued by the

Mail to: Department of Revenue Services

CHFA must accompany this return.

PO Box 2990

If you have a Child Day Care credit carryforward:

Hartford CT 06104-2990

Proof of the approved credit by the Commissioner of

Social Services must accompany this return.

If you claim an Electronic Data Processing

Equipment Property Tax credit: In addition to

attaching a copy of

, attach

,

and the applicable

property tax bill.

Note: The allowable Electronic Data Processing

Equipment Property Tax Credit must first be applied

against Connecticut Corporation Business Tax. The

remaining credit may be applied to this tax.

Form 207 HCC Back (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1