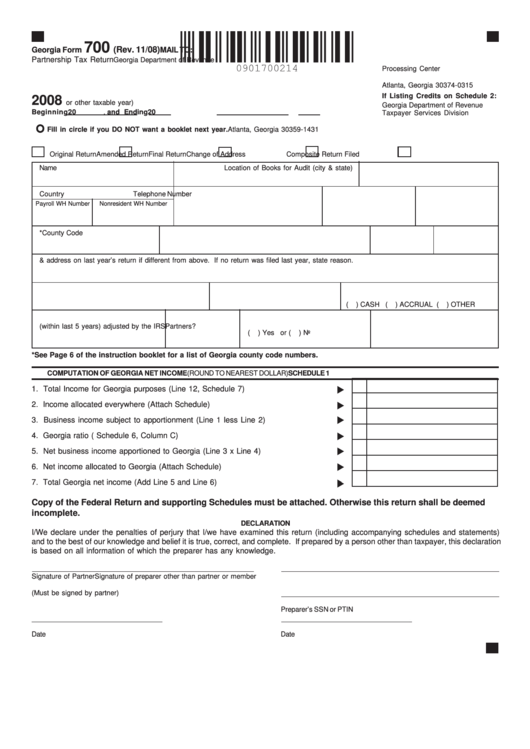

Georgia Form 700 - Partnership Tax Return - 2008

ADVERTISEMENT

700

(Rev. 11/08)

Georgia Form

MAIL TO:

Partnership Tax Return

Georgia Department of Revenue

Processing Center

P.O. Box 740315

Atlanta, Georgia 30374-0315

If Listing Credits on Schedule 2:

2008

or other taxable year)

Georgia Department of Revenue

Beginning

20

, and Ending

20

Taxpayer Services Division

P.O. Box 49431

Fill in circle if you DO NOT want a booklet next year.

Atlanta, Georgia 30359-1431

Original Return

Amended Return

Final Return

Change of Address

Composite Return Filed

A. FEI Number

Name

Location of Books for Audit (city & state)

B. GA. Withholding Tax Numbers

Number and Street

Country

Telephone Number

Payroll WH Number

Nonresident WH Number

C. GA. Sales Tax Reg. No.

City or Town

State

County

*County Code No. Zip Code

D. Name & address on last year’s return if different from above. If no return was filed last year, state reason.

E. Business Code No. shown on Federal Return

F. Kind of Business

G. Basis of this return

(

) CASH (

) ACCRUAL (

) OTHER

H. Indicate latest taxable year

I. Number of Partners

J. Do you have Nonresident

K. Number of Nonresident Partners

(within last 5 years) adjusted by the IRS

Partners?

(

) Yes or (

) No

*See Page 6 of the instruction booklet for a list of Georgia county code numbers.

COMPUTATION OF GEORGIA NET INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1. Total Income for Georgia purposes (Line 12, Schedule 7) ............................................

1.

2. Income allocated everywhere (Attach Schedule) ............................................................

2.

3. Business income subject to apportionment (Line 1 less Line 2) ..................................

3.

4. Georgia ratio ( Schedule 6, Column C) ...........................................................................

4.

5. Net business income apportioned to Georgia (Line 3 x Line 4) ....................................

5.

6. Net income allocated to Georgia (Attach Schedule) .......................................................

6.

7. Total Georgia net income (Add Line 5 and Line 6) .........................................................

7.

Copy of the Federal Return and supporting Schedules must be attached. Otherwise this return shall be deemed

incomplete.

DECLARATION

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements)

and to the best of our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration

is based on all information of which the preparer has any knowledge.

Signature of Partner

Signature of preparer other than partner or member

(Must be signed by partner)

Preparer’s SSN or PTIN

Date

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3