Print

Clear

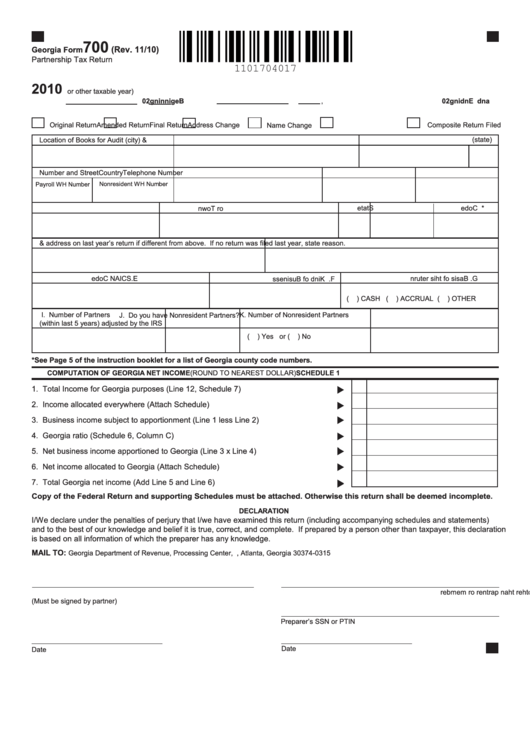

700

(Rev. 11/10)

Georgia Form

Partnership Tax Return

2010

or other taxable year)

B

e

g

n i

n

n i

g

2

0

,

a

n

d

E

n

d

n i

g

2

0

Original Return

Amended Return

Final Return

Name Change

Address Change

Composite Return Filed

Location of Books for Audit (city) & (state)

A. FEI Number

Name

B. GA. Withholding Tax Numbers

Number and Street

Country

Telephone Number

Payroll WH Number

Nonresident WH Number

S

a t

e t

*

C

o

u

n

y t

C

o

d

e

N

. o

Z

p i

C

o

d

e

. C

G

. A

S

a

e l

s

T

a

x

R

e

. g

N

. o

C

y t i

r o

T

o

w

n

D. Name & address on last year’s return if different from above.

If no return was filed last year, state reason.

. E

NAICS

C

o

d

e

. G

B

a

s

s i

f o

h t

s i

e r

u t

n r

. F

K

n i

d

f o

B

u

s

n i

e

s s

(

) CASH (

) ACCRUAL (

) OTHER

H. Indicate latest taxable year

I. Number of Partners

K. Number of Nonresident Partners

J. Do you have Nonresident Partners?

(within last 5 years) adjusted by the IRS

(

) Yes or (

) No

*See Page 5 of the instruction booklet for a list of Georgia county code numbers.

COMPUTATION OF GEORGIA NET INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1. Total Income for Georgia purposes (Line 12, Schedule 7) ............................................

1.

2. Income allocated everywhere (Attach Schedule) ............................................................

2.

3. Business income subject to apportionment (Line 1 less Line 2) ..................................

3.

4. Georgia ratio (Schedule 6, Column C) ...........................................................................

4.

5. Net business income apportioned to Georgia (Line 3 x Line 4) ....................................

5.

6. Net income allocated to Georgia (Attach Schedule) .......................................................

6.

7. Total Georgia net income (Add Line 5 and Line 6) .........................................................

7.

Copy of the Federal Return and supporting Schedules must be attached. Otherwise this return shall be deemed incomplete.

DECLARATION

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements)

and to the best of our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration

is based on all information of which the preparer has any knowledge.

MAIL TO:

Georgia Department of Revenue, Processing Center, P.O. Box 740315, Atlanta, Georgia 30374-0315

S

g i

n

a

u t

e r

f o

P

r a

n t

r e

S

g i

n

a

u t

e r

f o

p

e r

p

r a

r e

o

h t

r e

h t

a

n

p

r a

n t

r e

r o

m

e

m

b

r e

(Must be signed by partner)

Preparer’s SSN or PTIN

Date

Date

1

1 2

2 3

3