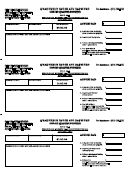

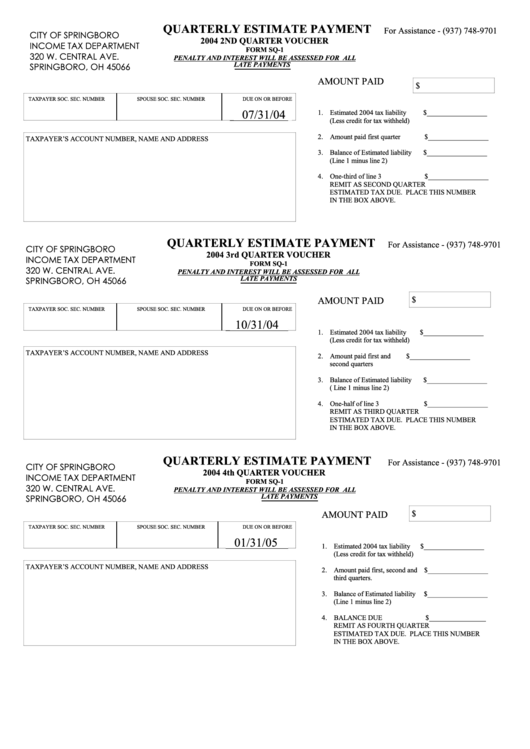

Form Sq-1 - Quarterly Estimate Payment Vouchers - 2004

ADVERTISEMENT

QUARTERLY ESTIMATE PAYMENT

For Assistance - (937) 748-9701

CITY OF SPRINGBORO

2004 2ND QUARTER VOUCHER

INCOME TAX DEPARTMENT

FORM SQ-1

320 W. CENTRAL AVE.

PENALTY AND INTEREST WILL BE ASSESSED FOR ALL

SPRINGBORO, OH 45066

LATE PAYMENTS

AMOUNT PAID

$

TAXPAYER SOC. SEC. NUMBER

SPOUSE SOC. SEC. NUMBER

DUE ON OR BEFORE

07/31/04

1. Estimated 2004 tax liability

$_________________

(Less credit for tax withheld)

2. Amount paid first quarter

$_________________

TAXPAYER’S ACCOUNT NUMBER, NAME AND ADDRESS

3. Balance of Estimated liability

$_________________

(Line 1 minus line 2)

4. One-third of line 3

$_________________

REMIT AS SECOND QUARTER

ESTIMATED TAX DUE. PLACE THIS NUMBER

IN THE BOX ABOVE.

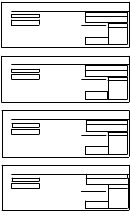

QUARTERLY ESTIMATE PAYMENT

For Assistance - (937) 748-9701

CITY OF SPRINGBORO

2004 3rd QUARTER VOUCHER

INCOME TAX DEPARTMENT

FORM SQ-1

320 W. CENTRAL AVE.

PENALTY AND INTEREST WILL BE ASSESSED FOR ALL

SPRINGBORO, OH 45066

LATE PAYMENTS

$

AMOUNT PAID

TAXPAYER SOC. SEC. NUMBER

SPOUSE SOC. SEC. NUMBER

DUE ON OR BEFORE

10/31/04

1. Estimated 2004 tax liability

$_________________

(Less credit for tax withheld)

TAXPAYER’S ACCOUNT NUMBER, NAME AND ADDRESS

2. Amount paid first and

$_________________

second quarters

3. Balance of Estimated liability

$_________________

( Line 1 minus line 2)

4. One-half of line 3

$_________________

REMIT AS THIRD QUARTER

ESTIMATED TAX DUE. PLACE THIS NUMBER

IN THE BOX ABOVE.

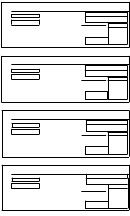

QUARTERLY ESTIMATE PAYMENT

For Assistance - (937) 748-9701

CITY OF SPRINGBORO

2004 4th QUARTER VOUCHER

INCOME TAX DEPARTMENT

FORM SQ-1

320 W. CENTRAL AVE.

PENALTY AND INTEREST WILL BE ASSESSED FOR ALL

SPRINGBORO, OH 45066

LATE PAYMENTS

$

AMOUNT PAID

TAXPAYER SOC. SEC. NUMBER

SPOUSE SOC. SEC. NUMBER

DUE ON OR BEFORE

01/31/05

1. Estimated 2004 tax liability

$_________________

(Less credit for tax withheld)

TAXPAYER’S ACCOUNT NUMBER, NAME AND ADDRESS

2. Amount paid first, second and $_________________

third quarters.

3. Balance of Estimated liability

$_________________

(Line 1 minus line 2)

4. BALANCE DUE

$________________

REMIT AS FOURTH QUARTER

ESTIMATED TAX DUE. PLACE THIS NUMBER

IN THE BOX ABOVE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1