Instructions For Form Dtf-804

ADVERTISEMENT

DTF-804 (9/98) (back)

Instructions

Use this form to compute and claim the credit allowed for sales

Line 10 – Enter the amount from line 4 or the amount from

tax paid to another state for motor vehicles, all terrain vehicles

line 7, whichever is less.

(ATV), vessels (boats), or snowmobiles.

Line 11 – Subtract the amount on line 10 from the amount on

A New York State resident who purchases a motor vehicle

line 9 and enter the result; this is the amount of tax owed to

outside the state becomes liable for a use tax when the vehicle

New York State after applying the credit for tax paid to the

is brought into the state. However, if the buyer paid a sales tax

other state.

to the state where the vehicle was purchased, and that state

has a reciprocal tax agreement with New York State, and the

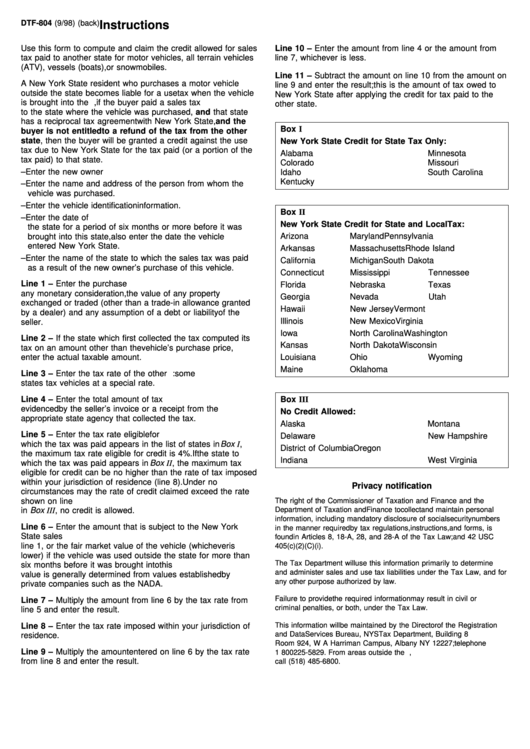

Box I

buyer is not entitled to a refund of the tax from the other

state, then the buyer will be granted a credit against the use

New York State Credit for State Tax Only:

tax due to New York State for the tax paid (or a portion of the

Alabama

Minnesota

tax paid) to that state.

Colorado

Missouri

– Enter the new owner information. Complete all entries.

Idaho

South Carolina

Kentucky

– Enter the name and address of the person from whom the

vehicle was purchased.

– Enter the vehicle identification information.

Box II

– Enter the date of purchase. If the vehicle was used outside

New York State Credit for State and Local Tax:

the state for a period of six months or more before it was

brought into this state, also enter the date the vehicle

Arizona

Maryland

Pennsylvania

entered New York State.

Arkansas

Massachusetts

Rhode Island

– Enter the name of the state to which the sales tax was paid

California

Michigan

South Dakota

as a result of the new owner’s purchase of this vehicle.

Connecticut

Mississippi

Tennessee

Line 1 – Enter the purchase price. Purchase price includes

Florida

Nebraska

Texas

any monetary consideration, the value of any property

Georgia

Nevada

Utah

exchanged or traded (other than a trade-in allowance granted

Hawaii

New Jersey

Vermont

by a dealer) and any assumption of a debt or liability of the

Illinois

New Mexico

Virginia

seller.

Iowa

North Carolina

Washington

Line 2 – If the state which first collected the tax computed its

Kansas

North Dakota

Wisconsin

tax on an amount other than the vehicle’s purchase price,

enter the actual taxable amount.

Louisiana

Ohio

Wyoming

Maine

Oklahoma

Line 3 – Enter the tax rate of the other state. Note: some

states tax vehicles at a special rate.

Line 4 – Enter the total amount of tax paid. This must be

Box III

evidenced by the seller’s invoice or a receipt from the

No Credit Allowed:

appropriate state agency that collected the tax.

Alaska

Montana

Line 5 – Enter the tax rate eligible for credit. If the state to

Delaware

New Hampshire

which the tax was paid appears in the list of states in Box I,

District of Columbia

Oregon

the maximum tax rate eligible for credit is 4%. If the state to

Indiana

West Virginia

which the tax was paid appears in Box II, the maximum tax

eligible for credit can be no higher than the rate of tax imposed

within your jurisdiction of residence (line 8). Under no

Privacy notification

circumstances may the rate of credit claimed exceed the rate

shown on line 3. If the state to which the tax was paid appears

The right of the Commissioner of Taxation and Finance and the

in Box III, no credit is allowed.

Department of Taxation and Finance to collect and maintain personal

information, including mandatory disclosure of social security numbers

Line 6 – Enter the amount that is subject to the New York

in the manner required by tax regulations, instructions, and forms, is

State sales tax. This will be the same amount as entered on

found in Articles 8, 18-A, 28, and 28-A of the Tax Law; and 42 USC

line 1, or the fair market value of the vehicle (whichever is

405(c)(2)(C)(i).

lower) if the vehicle was used outside the state for more than

The Tax Department will use this information primarily to determine

six months before it was brought into this state. Fair market

and administer sales and use tax liabilities under the Tax Law, and for

value is generally determined from values established by

any other purpose authorized by law.

private companies such as the NADA.

Failure to provide the required information may result in civil or

Line 7 – Multiply the amount from line 6 by the tax rate from

criminal penalties, or both, under the Tax Law.

line 5 and enter the result.

This information will be maintained by the Director of the Registration

Line 8 – Enter the tax rate imposed within your jurisdiction of

and Data Services Bureau, NYS Tax Department, Building 8

residence.

Room 924, W A Harriman Campus, Albany NY 12227; telephone

Line 9 – Multiply the amount entered on line 6 by the tax rate

1 800 225-5829. From areas outside the U.S. and outside Canada,

from line 8 and enter the result.

call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1