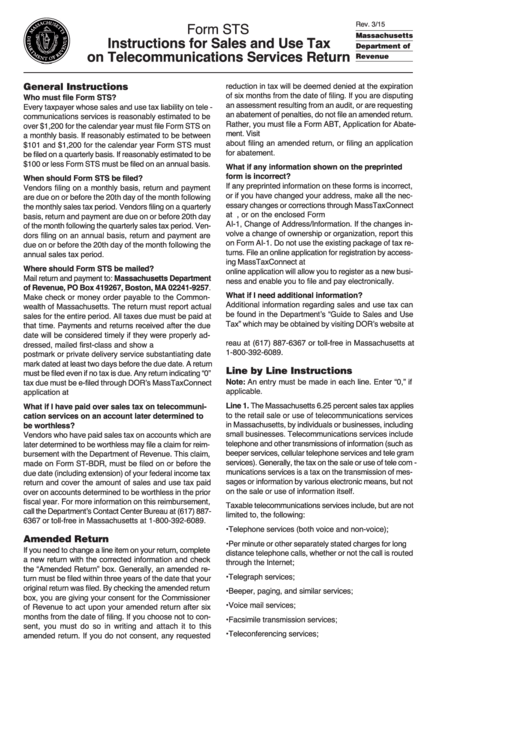

Form Sts - Instructions For Sales And Use Tax On Telecommunications Services Return

ADVERTISEMENT

Rev. 3/15

Form STS

Massachusetts

Instructions for Sales and Use Tax

Department of

on Telecommunications Services Return

Revenue

General Instructions

reduction in tax will be deemed denied at the expiration

of six months from the date of filing. If you are disputing

Who must file Form STS?

an assessment resulting from an audit, or are requesting

Every taxpayer whose sales and use tax liability on tele -

an abatement of penalties, do not file an amended return.

communications services is reasonably estimated to be

Rather, you must file a Form ABT, Application for Abate-

over $1,200 for the calendar year must file Form STS on

ment. Visit mass.gov/dor/amend for additional information

a monthly basis. If reasonably estimated to be between

about filing an amended return, or filing an application

$101 and $1,200 for the calendar year Form STS must

for abatement.

be filed on a quarterly basis. If reasonably estimated to be

$100 or less Form STS must be filed on an annual basis.

What if any information shown on the preprinted

form is incorrect?

When should Form STS be filed?

If any preprinted information on these forms is incorrect,

Vendors filing on a monthly basis, return and payment

or if you have changed your address, make all the nec-

are due on or before the 20th day of the month following

essary changes or corrections through MassTaxConnect

the monthly sales tax period. Vendors filing on a quarterly

at mass.gov/masstaxconnect, or on the enclosed Form

basis, return and payment are due on or before 20th day

AI-1, Change of Address/Information. If the changes in-

of the month following the quarterly sales tax period. Ven-

volve a change of ownership or organization, report this

dors filing on an annual basis, return and payment are

on Form AI-1. Do not use the existing package of tax re-

due on or before the 20th day of the month following the

turns. File an online application for registration by access-

annual sales tax period.

ing MassTaxConnect at mass.gov/masstaxconnect. The

Where should Form STS be mailed?

online application will allow you to register as a new busi-

Mail return and payment to: Massachusetts Department

ness and enable you to file and pay electronically.

of Revenue, PO Box 419267, Boston, MA 02241-9257.

What if I need additional information?

Make check or money order payable to the Common-

Additional information regarding sales and use tax can

wealth of Massachusetts. The return must report actual

be found in the Department’s “Guide to Sales and Use

sales for the entire period. All taxes due must be paid at

Tax” which may be obtained by visiting DOR’s website at

that time. Payments and returns received after the due

or by calling the Contact Center Bu-

date will be considered timely if they were properly ad-

reau at (617) 887-6367 or toll-free in Massachusetts at

dressed, mailed first-class and show a U.S. Post Office

1-800-392-6089.

postmark or private delivery service substantiating date

mark dated at least two days before the due date. A return

Line by Line Instructions

must be filed even if no tax is due. Any return indicating “0”

Note: An entry must be made in each line. Enter “0,” if

tax due must be e-filed through DOR’s MassTaxConnect

applicable.

application at mass.gov/masstaxconnect.

Line 1. The Massachusetts 6.25 percent sales tax applies

What if I have paid over sales tax on telecommuni-

to the retail sale or use of telecommunications services

cation services on an account later determined to

in Massachusetts, by individuals or businesses, including

be worthless?

small businesses. Telecommunications services include

Vendors who have paid sales tax on accounts which are

telephone and other transmissions of information (such as

later determined to be worthless may file a claim for reim-

beeper services, cellular telephone services and tele gram

bursement with the Department of Revenue. This claim,

services). Generally, the tax on the sale or use of tele com -

made on Form ST-BDR, must be filed on or before the

munications services is a tax on the transmission of mes-

due date (including extension) of your federal income tax

sages or information by various electronic means, but not

return and cover the amount of sales and use tax paid

on the sale or use of information itself.

over on accounts determined to be worthless in the prior

fiscal year. For more information on this reimbursement,

Taxable telecommunications services include, but are not

call the Department’s Contact Center Bureau at (617) 887-

limited to, the following:

6367 or toll-free in Massachusetts at 1-800-392-6089.

• Telephone services (both voice and non-voice);

Amended Return

• Per minute or other separately stated charges for long

If you need to change a line item on your return, complete

distance telephone calls, whether or not the call is routed

a new return with the corrected information and check

through the Internet;

the “Amended Return” box. Generally, an amended re-

• Telegraph services;

turn must be filed within three years of the date that your

original return was filed. By checking the amended return

• Beeper, paging, and similar services;

box, you are giving your consent for the Commissioner

• Voice mail services;

of Revenue to act upon your amended return after six

months from the date of filing. If you choose not to con-

• Facsimile transmission services;

sent, you must do so in writing and attach it to this

• Teleconferencing services;

amended return. If you do not consent, any requested

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2