Form Ct-941x Instructions - Amended Connecticut Quarterly Reconciliation Of Withholding - 2000

ADVERTISEMENT

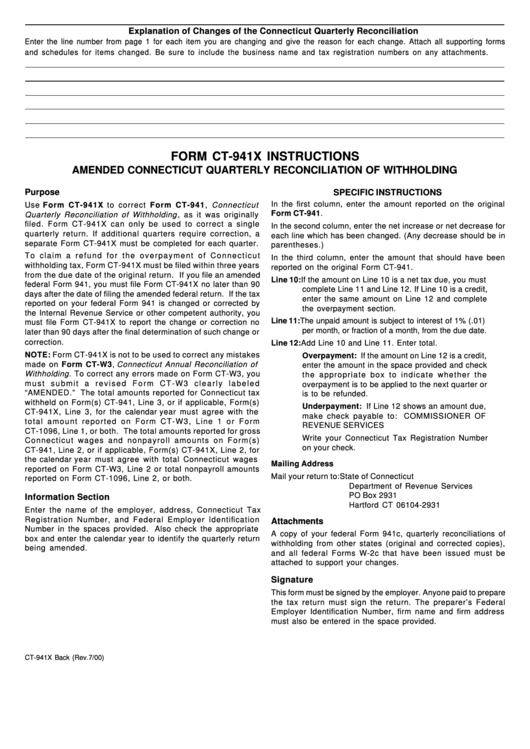

Explanation of Changes of the Connecticut Quarterly Reconciliation

Enter the line number from page 1 for each item you are changing and give the reason for each change. Attach all supporting forms

and schedules for items changed. Be sure to include the business name and tax registration numbers on any attachments.

FORM CT-941X INSTRUCTIONS

AMENDED CONNECTICUT QUARTERLY RECONCILIATION OF WITHHOLDING

Purpose

SPECIFIC INSTRUCTIONS

In the first column, enter the amount reported on the original

Use Form CT-941X to correct Form CT-941, Connecticut

Form CT-941.

Quarterly Reconciliation of Withholding , as it was originally

filed. Form CT-941X can only be used to correct a single

In the second column, enter the net increase or net decrease for

quarterly return. If additional quarters require correction, a

each line which has been changed. (Any decrease should be in

separate Form CT-941X must be completed for each quarter.

parentheses.)

To c l a i m a r e f u n d f o r t h e o v e r p a y m e n t o f C o n n e c t i c u t

In the third column, enter the amount that should have been

withholding tax, Form CT-941X must be filed within three years

reported on the original Form CT-941.

from the due date of the original return. If you file an amended

Line 10: If the amount on Line 10 is a net tax due, you must

federal Form 941, you must file Form CT-941X no later than 90

complete Line 11 and Line 12. If Line 10 is a credit,

days after the date of filing the amended federal return. If the tax

enter the same amount on Line 12 and complete

reported on your federal Form 941 is changed or corrected by

the overpayment section.

the Internal Revenue Service or other competent authority, you

Line 11: The unpaid amount is subject to interest of 1% (.01)

must file Form CT-941X to report the change or correction no

per month, or fraction of a month, from the due date.

later than 90 days after the final determination of such change or

correction.

Line 12: Add Line 10 and Line 11. Enter total.

NOTE: Form CT-941X is not to be used to correct any mistakes

Overpayment: If the amount on Line 12 is a credit,

made on Form CT-W3, Connecticut Annual Reconciliation of

enter the amount in the space provided and check

Withholding . To correct any errors made on Form CT-W3, you

the appropriate box to indicate whether the

m u s t s u b m i t a r e v i s e d F o r m C T - W 3 c l e a r l y l a b e l e d

overpayment is to be applied to the next quarter or

“AMENDED.” The total amounts reported for Connecticut tax

is to be refunded.

withheld on Form(s) CT-941, Line 3, or if applicable, Form(s)

Underpayment: If Line 12 shows an amount due,

CT-941X, Line 3, for the calendar year must agree with the

make check payable to: COMMISSIONER OF

total amount reported on Form CT-W3, Line 1 or Form

REVENUE SERVICES

CT-1096, Line 1, or both. The total amounts reported for gross

Write your Connecticut Tax Registration Number

Connecticut wages and nonpayroll amounts on Form(s)

on your check.

CT-941, Line 2, or if applicable, Form(s) CT-941X, Line 2, for

the calendar year must agree with total Connecticut wages

Mailing Address

reported on Form CT-W3, Line 2 or total nonpayroll amounts

Mail your return to:

State of Connecticut

reported on Form CT-1096, Line 2, or both.

Department of Revenue Services

PO Box 2931

Information Section

Hartford CT 06104-2931

Enter the name of the employer, address, Connecticut Tax

Registration Number, and Federal Employer Identification

Attachments

Number in the spaces provided. Also check the appropriate

A copy of your federal Form 941c, quarterly reconciliations of

box and enter the calendar year to identify the quarterly return

withholding from other states (original and corrected copies),

being amended.

and all federal Forms W-2c that have been issued must be

attached to support your changes.

Signature

This form must be signed by the employer. Anyone paid to prepare

the tax return must sign the return. The preparer’s Federal

Employer Identification Number, firm name and firm address

must also be entered in the space provided.

CT-941X Back (Rev.7/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1