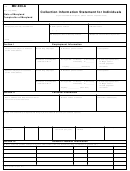

Form 433-F - How To Prepare A Collection Information Statement

ADVERTISEMENT

How to Prepare a

Collection Information Statement (Form 433-F)

Section F – Monthly Expenses

Please complete all of the blocks except for the shaded ones.

Write N/A (Not Applicable) for those blocks which don't apply to

Rent – Please enter your monthly rent payment. Write N/A (not

you. We need you to complete this form so we can establish the

applicable) if you own your home and pay mortgage expenses.

best method for you to pay the amount due.

National Standard Expenses (see National Standard Expenses

We've explained below some areas of the form which people have

Chart) – This category includes clothing and services, food,

found the most confusing to understand.

housekeeping supplies, personal care products and services, and

miscellaneous expenses. The chart allows you a certain amount

If any section is too small for the information you need to supply,

based on your total gross monthly income and the size of your

please use a separate sheet.

family.

Section A –

You may want to claim a higher amount if you have special

circumstances. If you do so, please explain the special

Accounts

circumstances and provide proof of your expenses.

Please include all accounts in Banks, Savings & Loan Institutions,

Certificates of Deposits, Individual Retirement Arrangements

Transportation – Please enter your average monthly transportation

(IRAs), Roth Individual Retirement Arrangements (IRAs), Keogh

expense. You may include costs such as insurance, registration

Plans, Simplified Employee Pensions, Mutual Funds, Stock

fees, maintenance, fuel, parking fees and tolls, and public

Brokerage Accounts, etc. Make a totally comprehensive listing of

transportation fares.

your accounts and enter all accounts, even it they currently have

no balance. However, do not enter bank loans in this section.

Medical – Please show only reoccurring medical expenses here.

Don't include a one time only medical expense.

Section B – Real Estate

Child Care/Dependent Care – Please enter the monthly amount

Please list all the real estate you own or are purchasing. This

you pay for the care of a dependent child or adult. Someone is your

listing should include your home and any other real estate you

dependent when you pay for more than half of their support.

own. Include the address and county description of any property

Quarterly Estimated Tax Payments (Form 1040ES) – Enter the

you list along with its current market value and amount you owe on

monthly amount you pay on your estimated tax.

it.

In order to determine a property's equity, please subtract the

Life Insurance – Please show the expenses you pay for term life

amount owed on it from its current market value.

insurance or any other insurance you have not listed in Section C.

Section C – Other Assets

Add up all of the monthly expenses listed in Section F to get

the figure for Total Expenses.

Please list any cars, boats, recreational vehicles, whole life

policies, or other assets that you own.

Section G – Additional Information

Complete this section the same way you completed section B:

Please show the total number of dependents in your family. Include

subtract any loans you owe on an asset from its market value.

yourself and your spouse.

The amount remaining after you do this is your equity in the asset.

Enter the maximum amount you would like to pay each month

on your account.

Section D – Credit Cards

Please enter all the credit cards for which you have an account.

Certification

Enter credit cards issued by a bank, credit union, or savings and

loan institution (MasterCard, Visa, Discover, overdraft protection,

Both yourself and your spouse need to sign the Collection

etc.). List all other charge accounts such as department stores

Information Statement when the tax liability is joint. When both of

and oil companies.

you have signed the same tax return, and both of you agree that

Section E – Monthly Income

you owe the money, you should both sign the statement.

Please enter the total amount of your monthly wages or salary

(your gross pay) - do not subtract taxes paid. (Include all income

from those living in your household who are not qualified

dependents.)

You can list the taxes withheld from your paycheck on the lines

under the Gross Pay line.

Subtract the taxes withheld from your gross pay and you'll get the

correct amount for your Net Pay.

Please also include the amount from all other sources of income

and add it to your net income to get your available income. Do the

same for your spouse, if you have one. List these expenses in

Section C and Section F.

Form 433-F (Rev. 08-2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2