Form De 999c - How To Prepare The Offer In Compromise Financial Statement (De 999b) - State Of California

ADVERTISEMENT

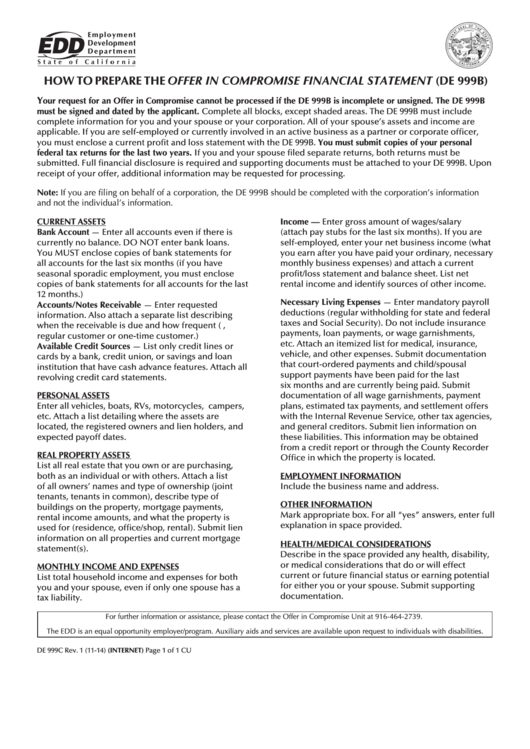

HOW TO PREPARE THE OFFER IN COMPROMISE FINANCIAL STATEMENT (DE 999B)

Y

our request for an Offer in Compromise cannot be processed if the DE 999B is incomplete or unsigned. The DE 999B

must be signed and dated by the applicant. Complete all blocks, except shaded areas. The DE 999B must include

complete information for you and your spouse or your corporation. All of your spouse’s assets and income are

applicable. If you are self‑employed or currently involved in an active business as a partner or corporate officer,

you must enclose a current profit and loss statement with the DE 999B. You must submit copies of your personal

federal tax returns for the last two years. If you and your spouse filed separate returns, both returns must be

submitted. Full financial disclosure is required and supporting documents must be attached to your DE 999B. Upon

receipt of your offer, additional information may be requested for processing.

Note: If you are filing on behalf of a corporation, the DE 999B should be completed with the corporation’s information

and not the individual’s information.

CURRENT ASSETS

Income — Enter gross amount of wages/salary

Bank Account — Enter all accounts even if there is

(attach pay stubs for the last six months). If you are

currently no balance. DO NOT enter bank loans.

self‑employed, enter your net business income (what

You MUST enclose copies of bank statements for

you earn after you have paid your ordinary, necessary

all accounts for the last six months (if you have

monthly business expenses) and attach a current

seasonal sporadic employment, you must enclose

profit/loss statement and balance sheet. List net

copies of bank statements for all accounts for the last

rental income and identify sources of other income.

12 months.)

Necessary Living Expenses — Enter mandatory payroll

Accounts/Notes Receivable — Enter requested

deductions (regular withholding for state and federal

information. Also attach a separate list describing

taxes and Social Security). Do not include insurance

when the receivable is due and how frequent (i.e.,

payments, loan payments, or wage garnishments,

regular customer or one‑time customer.)

etc. Attach an itemized list for medical, insurance,

Available Credit Sources — List only credit lines or

vehicle, and other expenses. Submit documentation

cards by a bank, credit union, or savings and loan

that court‑ordered payments and child/spousal

institution that have cash advance features. Attach all

support payments have been paid for the last

revolving credit card statements.

six months and are currently being paid. Submit

PERSONAL ASSETS

documentation of all wage garnishments, payment

Enter all vehicles, boats, RVs, motorcycles, campers,

plans, estimated tax payments, and settlement offers

etc. Attach a list detailing where the assets are

with the Internal Revenue Service, other tax agencies,

located, the registered owners and lien holders, and

and general creditors. Submit lien information on

expected payoff dates.

these liabilities. This information may be obtained

from a credit report or through the County Recorder

REAL PROPERTY ASSETS

Office in which the property is located.

List all real estate that you own or are purchasing,

EMPLOYMENT INFORMATION

both as an individual or with others. Attach a list

of all owners’ names and type of ownership (joint

Include the business name and address.

tenants, tenants in common), describe type of

OTHER INFORMATION

buildings on the property, mortgage payments,

Mark appropriate box. For all “yes” answers, enter full

rental income amounts, and what the property is

explanation in space provided.

used for (residence, office/shop, rental). Submit lien

information on all properties and current mortgage

HEALTH/MEDICAL CONSIDERATIONS

statement(s).

Describe in the space provided any health, disability,

or medical considerations that do or will effect

MONTHLY INCOME AND EXPENSES

current or future financial status or earning potential

List total household income and expenses for both

for either you or your spouse. Submit supporting

you and your spouse, even if only one spouse has a

documentation.

tax liability.

For further information or assistance, please contact the Offer in Compromise Unit at 916-464-2739.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities.

DE 999C Rev. 1 (11‑14) (INTERNET)

Page 1 of 1

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1