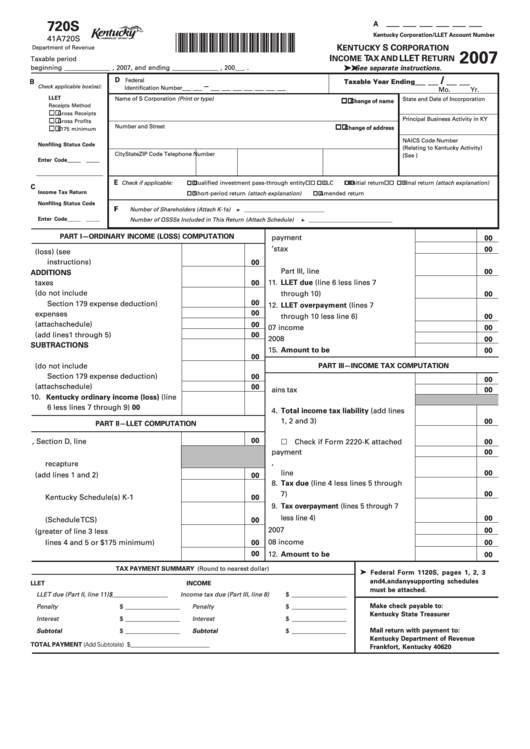

Form 720s - Kentucky S Corporation Income Tax And Llet Return - 2007

ADVERTISEMENT

__ __ __ __ __ __

720S

A

Kentucky Corporation/LLET Account Number

*0700020256*

41A720S

K

S C

ENTUCKY

ORPORATION

Department of Revenue

2007

I

T

LLET R

NCOME

AX AND

ETURN

Taxable period

➤ ➤ ➤ ➤ ➤

beginning ______________ , 2007, and ending ______________ , 200___ .

See separate instructions.

__ __ / __ __

D

Federal

B

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

Check applicable box(es):

Identification Number

Mo.

Yr.

LLET

Name of S Corporation (Print or type)

State and Date of Incorporation

Change of name

Receipts Method

Gross Receipts

Principal Business Activity in KY

Gross Profits

Number and Street

Change of address

$175 minimum

NAICS Code Number

Nonfiling Status Code

(Relating to Kentucky Activity)

City

State

ZIP Code

Telephone Number

(See )

Enter Code _____ _____

E

Check if applicable:

Qualified investment pass-through entity

LLC

Initial return

Final return (attach explanation)

C

Income Tax Return

Short-period return (attach explanation)

Amended return

Nonfiling Status Code

F

Number of Shareholders (Attach K-1s)

➤

_________________________________________

Enter Code _____ _____

Number of QSSSs Included in This Return (Attach Schedule)

➤ ___________________________________________

PART I—ORDINARY INCOME (LOSS) COMPUTATION

8. Extension payment .............................

00

9. Prior year’s tax credit .........................

00

1. Federal ordinary income (loss) (see

10. Income tax overpayment from

instructions) ..........................................

00

Part III, line 10 .....................................

00

ADDITIONS

00

11. LLET due (line 6 less lines 7

2. State taxes ............................................

3. Federal depreciation (do not include

through 10) ..........................................

00

00

Section 179 expense deduction) .........

12. LLET overpayment (lines 7

00

4. Related party expenses ........................

through 10 less line 6) ........................

00

5. Other (attach schedule) .......................

00

13. Credited to 2007 income tax ..............

00

6. Total (add lines 1 through 5) ...............

00

14. Credited to 2008 LLET ........................

00

SUBTRACTIONS

15. Amount to be refunded ......................

00

7. Federal work opportunity credit .........

00

8. Kentucky depreciation (do not include

PART III—INCOME TAX COMPUTATION

Section 179 expense deduction) .........

00

1. Excess net passive income tax ..........

00

9. Other (attach schedule) .......................

00

2. Built-in gains tax ....................................

00

10. Kentucky ordinary income (loss) (line

3. Tax installment on LIFO recapture ....

6 less lines 7 through 9) .......................

00

4. Total income tax liability (add lines

1, 2 and 3) ............................................

00

PART II—LLET COMPUTATION

5. Estimated tax payments

00

1. Schedule LLET, Section D, line 1 ...........

Check if Form 2220-K attached

00

6. Extension payment .............................

00

2. Recycling/composting equipment

7. LLET overpayment from Part II,

recapture ................................................

line 13 ..................................................

00

3. Total (add lines 1 and 2) ........................

00

8. Tax due (line 4 less lines 5 through

4. Nonrefundable LLET credit from

7) ..........................................................

00

Kentucky Schedule(s) K-1 ......................

00

9. Tax overpayment (lines 5 through 7

5. Nonrefundable tax credits

less line 4) ...............................................

00

(Schedule TCS) .......................................

00

10. Credited to 2007 LLET ........................

00

6. LLET liability (greater of line 3 less

lines 4 and 5 or $175 minimum) ...........

11. Credited to 2008 income tax ..............

00

00

7. Estimated tax payments .......................

00

12. Amount to be refunded ......................

00

TAX PAYMENT SUMMARY (Round to nearest dollar)

➤

Federal Form 1120S, pages 1, 2, 3

and 4, and any supporting schedules

LLET

INCOME

must be attached.

LLET due (Part II, line 11)

$ __________________

Income tax due (Part III, line 8) $ __________________

Make check payable to:

Penalty

$ __________________

Penalty

$ __________________

Kentucky State Treasurer

Interest

$ __________________

Interest

$ __________________

Mail return with payment to:

Subtotal

$ __________________

Subtotal

$ __________________

Kentucky Department of Revenue

TOTAL PAYMENT (Add Subtotals) ............................................................................. $ __________________________

Frankfort, Kentucky 40620

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4