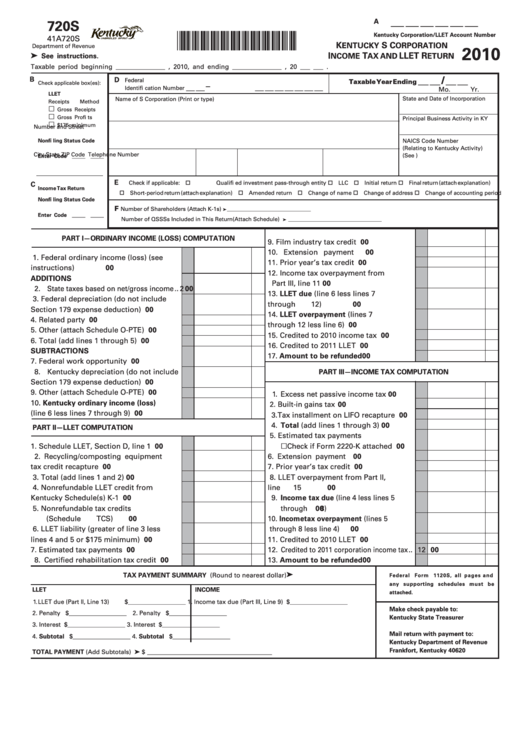

Form 720s - Kentucky S Corporation Income Tax And Llet Return - 2010

ADVERTISEMENT

__ __ __ __ __ __

A

720S

*1000020256*

Kentucky Corporation/LLET Account Number

41A720S

K

S C

ENTUCKY

ORPORATION

Department of Revenue

2010

➤

I

T

LLET R

See instructions.

NCOME

AX AND

ETURN

Taxable period beginning _______________ , 2010, and ending _______________ , 20 ___ ___ .

__ __ / __ __

B

D

Federal

Taxable Year Ending

Check applicable box(es):

__ __ – __ __ __ __ __ __ __

Identifi cation Number

Mo.

Yr.

LLET

State and Date of Incorporation

Name of S Corporation (Print or type)

Receipts Method

Gross Receipts

Gross Profi ts

Principal Business Activity in KY

$175 minimum

Number and Street

Nonfi ling Status Code

NAICS Code Number

(Relating to Kentucky Activity)

City

State

ZIP Code

Telephone Number

(See )

Enter Code _____ _____

E

Check if applicable:

Qualifi ed investment pass-through entity

LLC

Initial return

Final return (attach explanation)

C

Income Tax Return

Short-period return (attach explanation)

Amended return

Change of name

Change of address

Change of accounting period

Nonfi ling Status Code

F

Number of Shareholders (Attach K-1s)

➤ ___________________________________________

Enter Code _____ _____

Number of QSSSs Included in This Return (Attach Schedule)

➤ ________________________________________________

PART I—ORDINARY INCOME (LOSS) COMPUTATION

9. Film industry tax credit ........................

9

00

10. Extension payment ............................. 10

00

1. Federal ordinary income (loss) (see

11. Prior year’s tax credit ..........................

11

00

instructions) ...........................................

1

00

12. Income tax overpayment from

ADDITIONS

Part III, line 11 ...................................... 12

00

2. State taxes based on net/gross income ..

2

00

13. LLET due (line 6 less lines 7

3. Federal depreciation (do not include

through 12) .......................................... 13

00

Section 179 expense deduction) ..........

3

00

14. LLET overpayment (lines 7

4. Related party expenses.........................

4

00

through 12 less line 6) ........................ 14

00

5. Other (attach Schedule O-PTE) .............

5

00

15. Credited to 2010 income tax ............... 15

00

6. Total (add lines 1 through 5) ................

6

00

16. Credited to 2011 LLET ......................... 16

00

SUBTRACTIONS

17. Amount to be refunded ...................... 17

00

7. Federal work opportunity credit...........

7

00

8. Kentucky depreciation (do not include

PART III—INCOME TAX COMPUTATION

Section 179 expense deduction) ..........

8

00

9. Other (attach Schedule O-PTE) .............

9

00

1. Excess net passive income tax ............

1

00

10. Kentucky ordinary income (loss)

2. Built-in gains tax ...................................

2

00

(line 6 less lines 7 through 9) ............... 10

00

3. Tax installment on LIFO recapture ......

3

00

4. Total (add lines 1 through 3) ................

4

00

PART II—LLET COMPUTATION

5. Estimated tax payments

1. Schedule LLET, Section D, line 1 .........

1

00

Check if Form 2220-K attached .....

5

00

2. Recycling/composting equipment

6. Extension payment ..............................

6

00

tax credit recapture ..............................

2

00

7. Prior year’s tax credit ...........................

7

00

3. Total (add lines 1 and 2) .......................

3

00

8. LLET overpayment from Part II,

4. Nonrefundable LLET credit from

line 15 ....................................................

8

00

Kentucky Schedule(s) K-1 ....................

4

00

9. Income tax due (line 4 less lines 5

5. Nonrefundable tax credits

through 8) ..............................................

9

00

(Schedule TCS) ......................................

5

00

10. Income tax overpayment (lines 5

6. LLET liability (greater of line 3 less

through 8 less line 4) ............................. 10

00

lines 4 and 5 or $175 minimum) .........

6

00

11. Credited to 2010 LLET .......................... 11

00

7. Estimated tax payments ......................

7

00

12. Credited to 2011 corporation income tax .. 12

00

8. Certifi ed rehabilitation tax credit ........

8

00

13. Amount to be refunded ....................... 13

00

➤

TAX PAYMENT SUMMARY (Round to nearest dollar)

Federal

Form

1120S, all pages and

any supporting schedules must be

LLET

INCOME

attached.

1. LLET due (Part II, Line 13)

$___________________

1. Income tax due (Part III, Line 9)

$___________________

Make check payable to:

2. Penalty

$___________________

2. Penalty

$___________________

Kentucky State Treasurer

3. Interest

$___________________

3. Interest

$___________________

Mail return with payment to:

4. Subtotal

$___________________

4. Subtotal

$___________________

Kentucky Department of Revenue

Frankfort, Kentucky 40620

TOTAL PAYMENT (Add Subtotals) ..............................................................➤ $ _________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4